Find a Project

Check out the projects created at past events

YieldSeeker

AI Agent that will find and execute the best yield options for you, automatically

YieldSage

We are building an AI-powered DeFi platform that analyzes various protocols (like Uniswap, Aave) and pools within them. It compares key parameters like returns, fees, liquidity, and risks to suggest the best investment or trading opportunities.

YieldMax AI

An AI-powered yield maximizer for stablecoins on Base. The AI agent automatically selects optimal lending strategies across protocols, while users maintain control through their dedicated AI-Agent powered wallets.

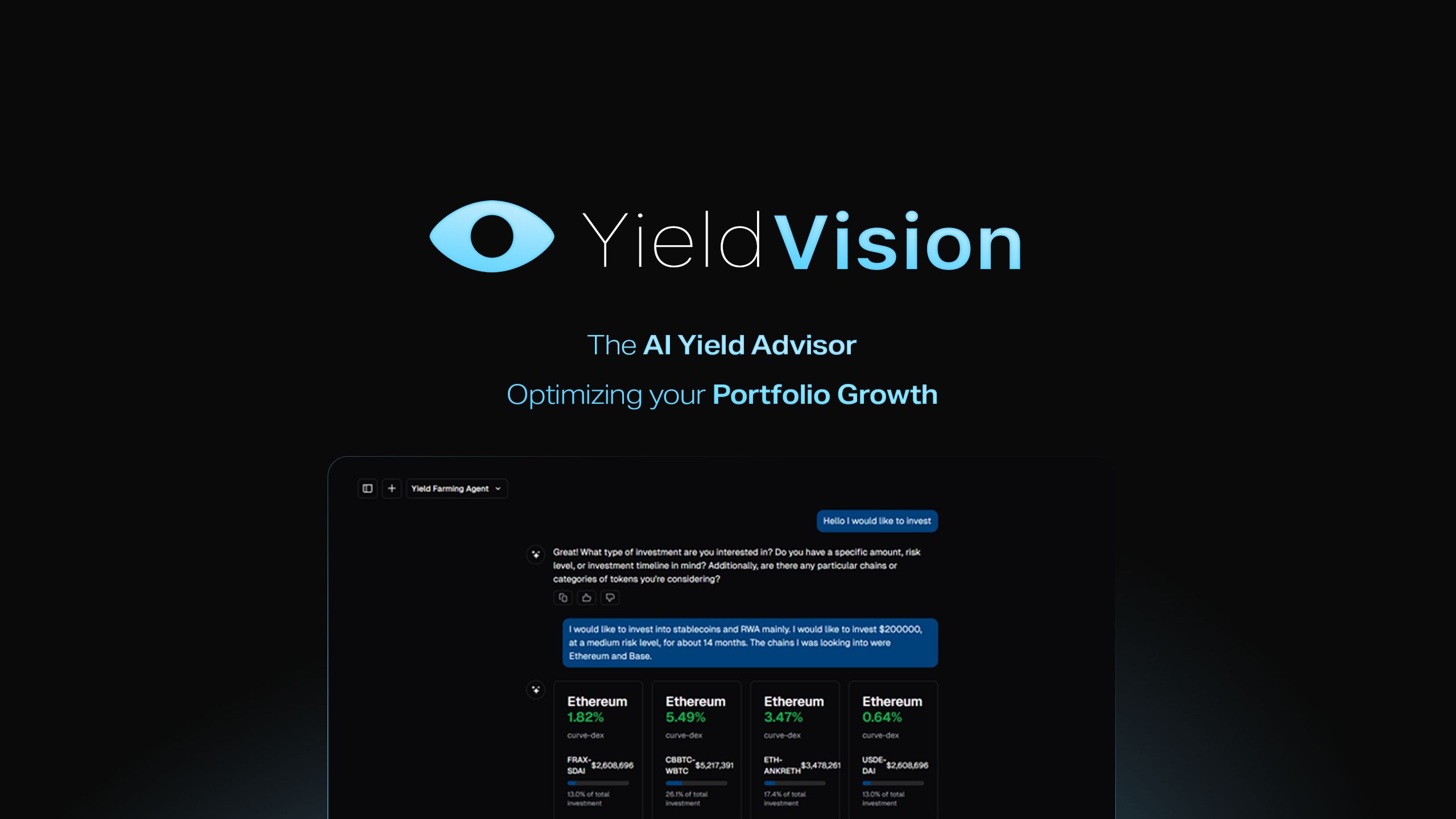

YieldVision

Yield Vision intelligently utilizes the power of AI to match users with the most lucrative yield opportunities, streamlining and simplifying the complicated yield investment research process down to just one prompt.

Yield

Find the best, AI-optimized, interest rates in one click! Yield is the robinhood of finance, it permits everyone (even your grandmother) to easily profit from the best interest rates in DeFi.

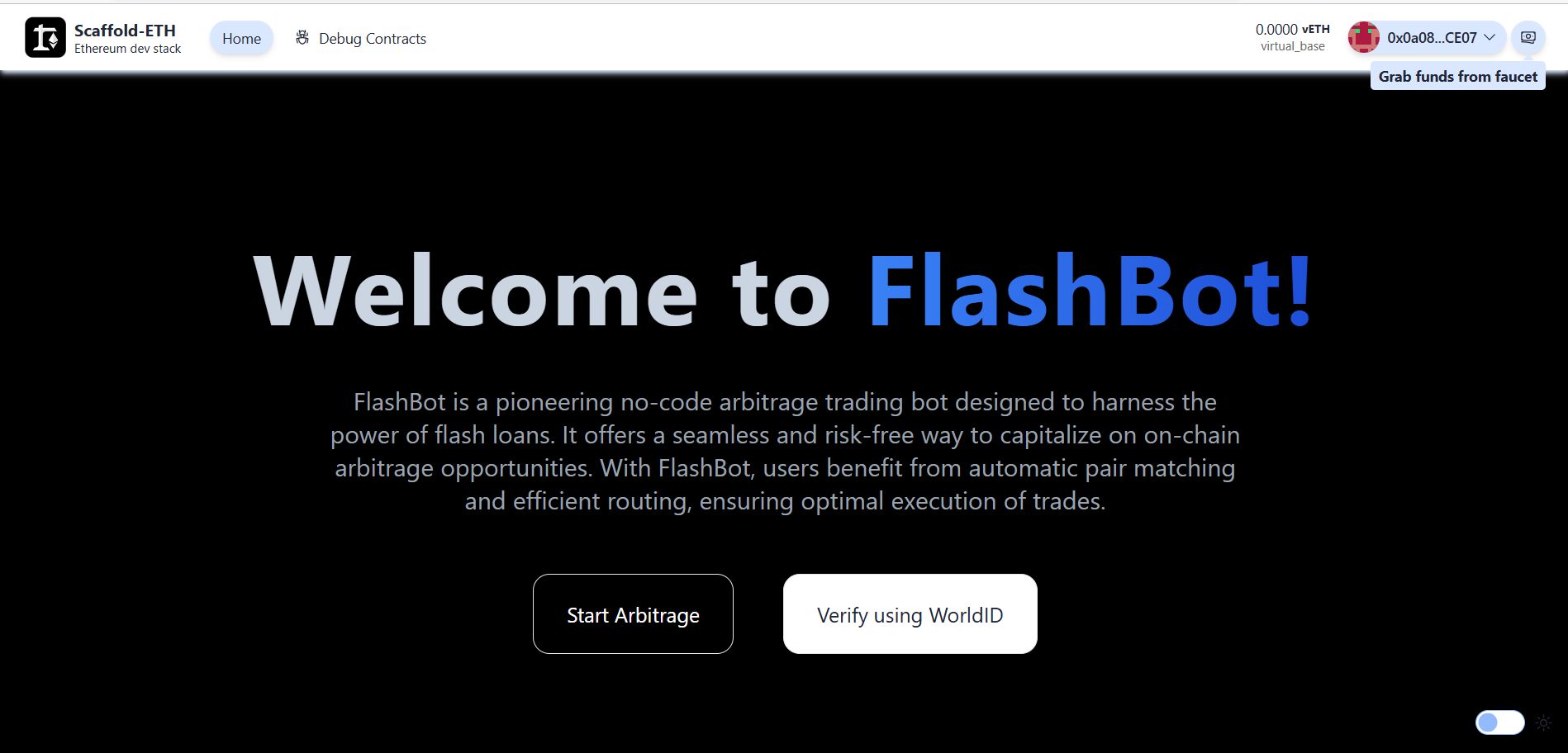

SwiftYield

We deploy our bot on Tenderly for real-time monitoring and management of smart contracts, ensuring accurate and efficient arbitrage trading.

BestUSDC yield Vault

ERC-4626 USDC yield optimizer on Base chain, maximizing returns across ExtraFi, Aave, Seamless, and Moonwell. Efficiently handles deposits, withdrawals, rebalancing, and reward tokens.

Yieldhive

Yieldhive is the home for cross-chain and native yield strategy vaults of OP chains.

Yield-bearing Wallet

Interest-bearing wallet infrastructure. Enables Native Yield wherever smart accounts exist, including EVM, Cosmos, and Solana.

GnosispayYieldCard

Yield Bearing Tokens Integration with Gnosis Pay to power yield for crypto debit cards

Yield.me

Yield.me is a mobile app which aims to give people the whole picture of cross-chain DeFi options and their security implication to earn yield on their crypto in a very understandable way, while allowing to access those in one click from a single chain and a single wallet.

"./yieldGhoVault"

Yield strategies vault of gho overcolateralized stablecoin to produce up to three different yield revenues from the same supplied investment..

Yield-Catalyst

We're adding a functionality to existing Collateral based protocols to take advantage of the staked collateral, when the collateral increases in price, with an aim of keeping the collateral intact.

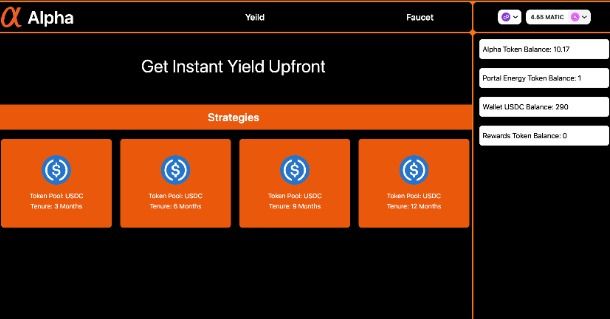

Alpha- Instant Yield Protocol

Alpha is a unique yield protocol that provides instant yield in the form of Yield or protocol Alpha tokens. It deposts users funds to procotols like balancer and curve to generate yield for users.

Yield for Good

A Philanthropic Yield Farming Platform that allows users to turn their crypto farming rewards into donations for good causes.

YieldNest

YieldNest streamlines decentralized finance (DeFi) with a unified GUI, offering account abstraction, self-custody, and modularity.

GreenYield

PWA on-ramp/off-ramp using using a payment processor and account abstraction to boost Defi mass-adoption.

Yield Ape

YieldApe is your one-stop shop to access any yield strategy on any network with any starting token position.

LevYieldX

Cross-chain leveraged yield farming strategies based on your risk tolerance and portfolio.

RWA Yield

Unlock the potential of blockchain for real-world assets! Our project seamlessly integrates with Maker SubDAOs to enable on-chain borrowing to fund investments in real world assets.

Moonyield

Cross-chain gasless USDC deposit on Moonbeam from 5+ L2 chains

Decentralized Yield Data Collector

We made a proof of concept of decentralized yield data aggregator. It gets the pool data, does calculation on it and shows the best APY value of the reserve to the user with push notification.

YieldGranter

A transparent donation app with subscriptions. Stake funds, donate a percent of yields to projects

Yieldify

Cryptocurrency holders can earn interest and pay for subscriptions by staking their tokens on a SAAS platform that accepts cryptocurrency payments.

YIELD BEARING STABLECOIN BACKED BY LANDÐ

NFTD STABLECOIN - YIELD BEARING STABLECOIN BACKED BY VIRTUAL LAND AND STAKED ETH .

Yield.Share

Support your creators by staking crypto allowing them to receive the interests and receive an NFT as a proof of support

Yieldgate

Yieldgate is a tool to receive donations, or to support projects and creators, with yield. No NFTs or tokens, just good old MATIC! Built with ❤️ on top of Aave, Polygon, Coinbase, and WalletConnect

Yieldboard

Yield Farming Dashboard for DeFi Degens to tract their earnings.

EYELN - Play To Yield NFT Game

A Play to Yield NFT Crypto Game. Own and claim your EYELN Tokens.

YieldWell

Lend your ETH to yield pools for funding microenterprises. Yield farmers funding real farmers.

Better Yield

Explore different strategies to achieve better yield for crypto assets

EthicHub: Yield Farmers to Actual Farmers

Fixed interest stable coin NFT Bonds connecting DeFi and real world coffee farmers.

G Yield

A project to provide stable quick turn around yields on your DeFi Protocol investements