Find a Project

Check out the projects created at past events

Crypto Portfolio Defi Token

Using the Aave platform to list our token and enable portfolio positions to be updated, Chainlink oracles to stream live data into the portfolio app, our token will allow users to own an index fund of the top 5 crypto tokens according to Coin Market Cap.

Levered.finance

Decentralized margin trading protocol for opening long and short positions on any tokens listed on Aave with up to 5x leverage

SIGH Finance

SIGH Finance consists of an on-chain lending protocol designed to farm 'Volatility-Risk' of the supported instruments and an off-chain network intelligence infrastructure to study, develop and optimize crypto-econometric models supported by Digital Curation Markets (DCM).

DefiPing

Alert system for trades made by pool managers on DHedge

Governor Alpha Vote Splitter

Vote Splitter lets users 'rent out' their votes for Governor Alpha (Compound-style) governances.

SimpleDeFi

A simple project to make deposits on the best available offer in DeFi

Claimable

Airdrops are great, but did you miss any? How about POAPs? Now you'll know. Has been used to claim over $50,000USD already.

coinfu.io

Workflow automation for cryptocurrency investors

Immortal Hearing Aid

Allow people with hearing loss really owned their audiogram

Credit3

Unsecured lending vaults using Bloom, Molecule, and Aave

AAVE-Leverage

You can leverage on your aave position by utilizing FlashLoan and 1Inch Swap

Aave V2 User Retention Dashboard

Aave V2 User Retention Dashboard and Funnel Analysis

ENS Analytics

Anaytics Dashboard to Track ENS Domain lifecycle

ZEUS

sports prediction market + flash loan credit delegation

CAT

CAT allows you to observe the historical price margins of ERC20 tokens between Ethereum Mainnet and Matic chain (and QuickSwap). This is going to be the port of similar project I did for Mainnet-xDAI at https://github.com/makoto/xdai-arb-graph a

Deer FlashLoan Protocol

A decentralized flash loan marketplace that enables flash loan for any token

Revert

Actionable analytics for DeFi liquidity providers

Islamic Aave

This is an attempt to implement a Shariah-compliant version of the Aave protocol that could be used through The Islamic Endowment and the Islamic loan Hassan.

aDebt

A marketplace for loans from aave credit delegation where aave holders can vote on lending proposals

Leverager

Leverage on AAVE using Flashloan and 1inch swap

refi-loan

Allows to refinance loan in DeFi space by leveraging credit delegation.

Shelter

peer to peer coverage protocol on Layer 2

UniScan by Graph

Build an application to show live activities such as transactions, gas, fee ... and do analytics as well such as trending coin based on transactions.

Gov10

Gov10 is GovTech that aims to solve the problem of routing digital attention to physical matter. Done through AAVE loans on land and biology, by building a credit network of attracting funds for builders with developments and users with well being contributions as NFTs from BCIs.

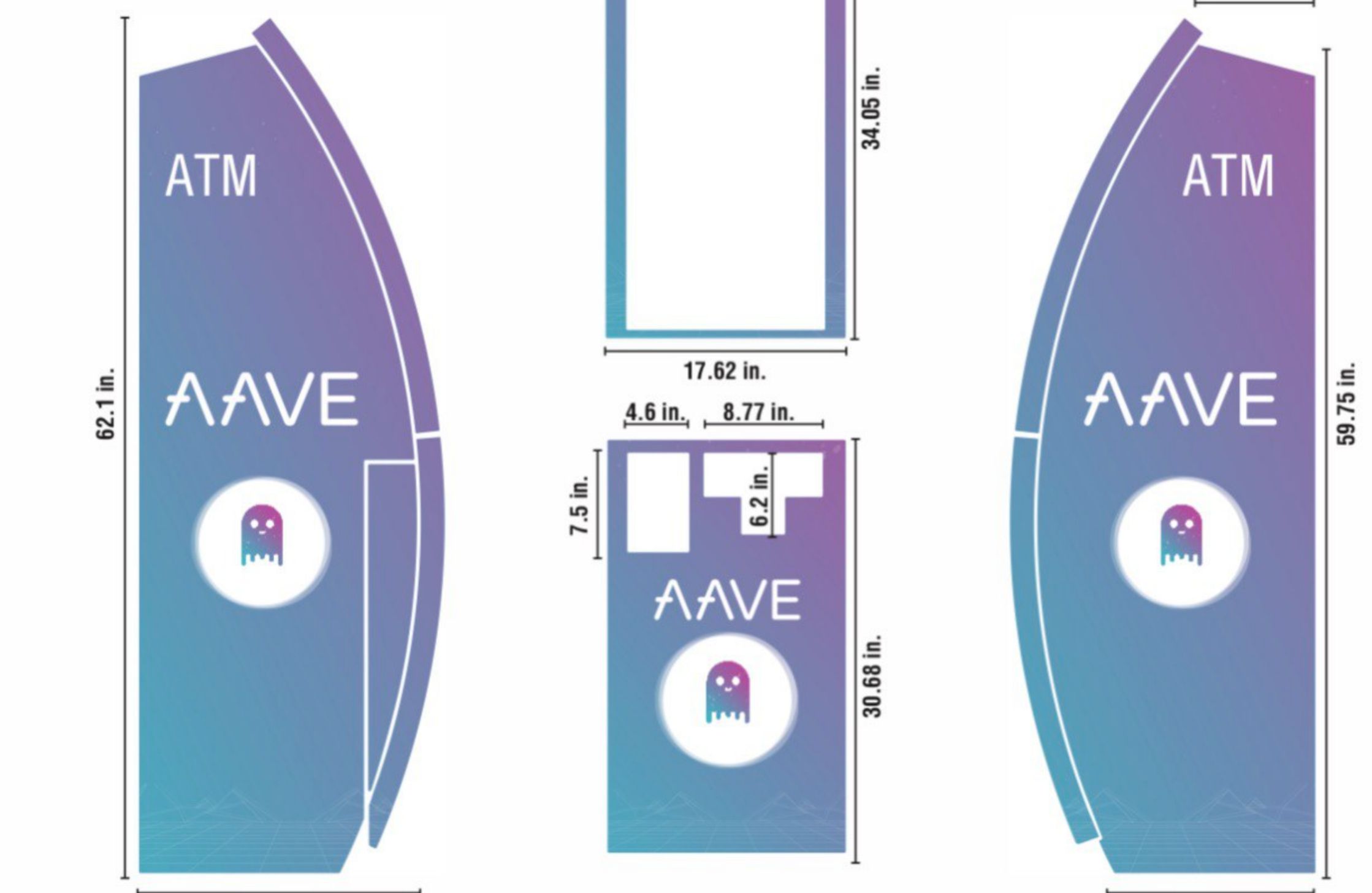

AAVE-Teller-Machine

The aave teller machine is a physical cash liquidity provider.

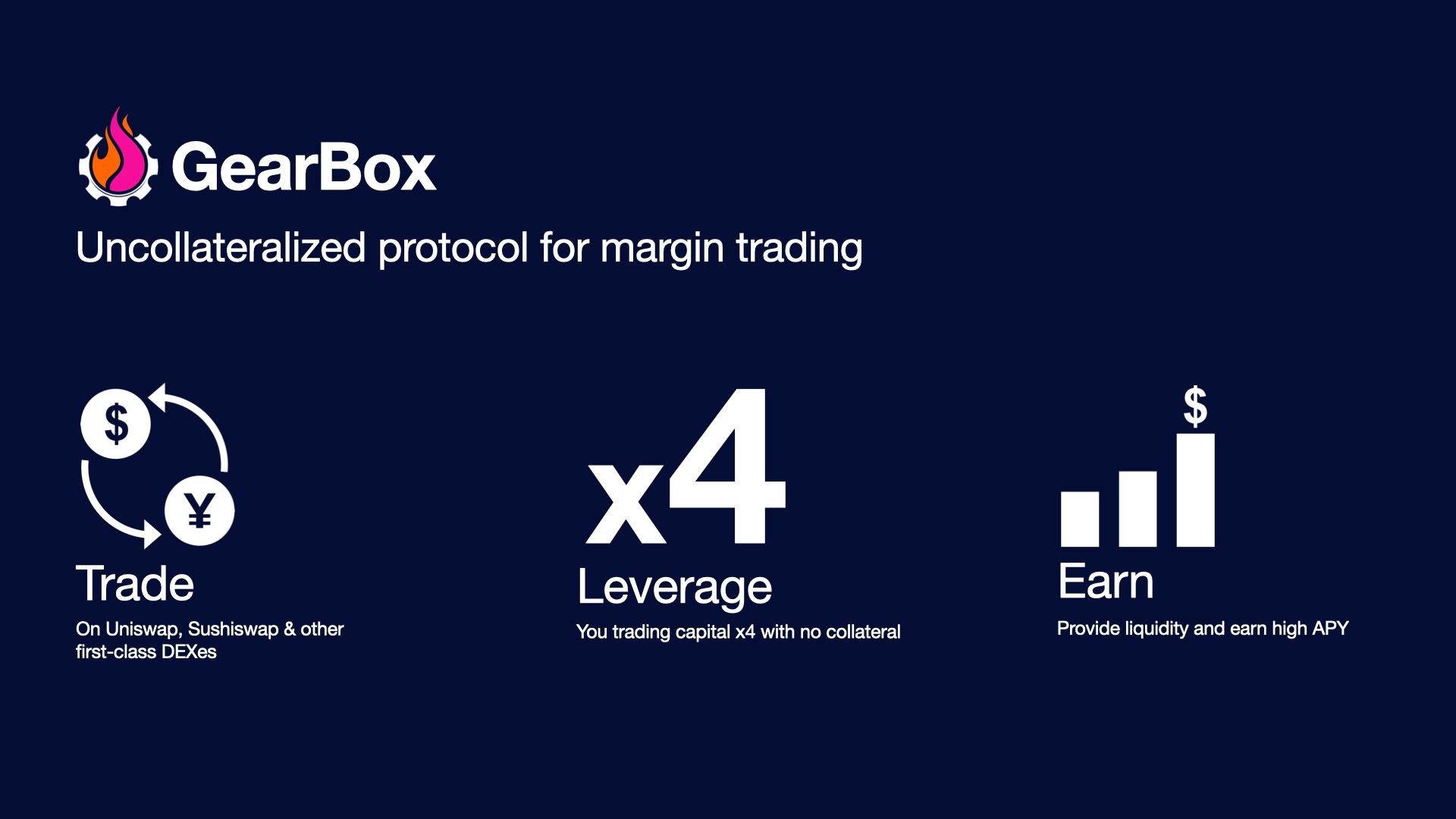

Gearbox protocol

Uncollateralized protocol for margin trading

dVIX

A protocol for making decentralized volatility index feeds for synthetic tokens.

ALKEMY

Create a way to recover access to wallets via a secure , decentralized, and anonymous way in the Ethereum ecosystem.

AAVE Liquidation Protection

AAVE Liquidation Protection Bot. Avoid liquidation penalties and take precise control over thresholds where repayment occurs.

STONK Master

An easy to use contract enabling the use of Aave flashloans to leverage a position in any supported token

TheraId

Attempt to create a goverment Id using erc 721 and hack in a voting system with ERC 721.

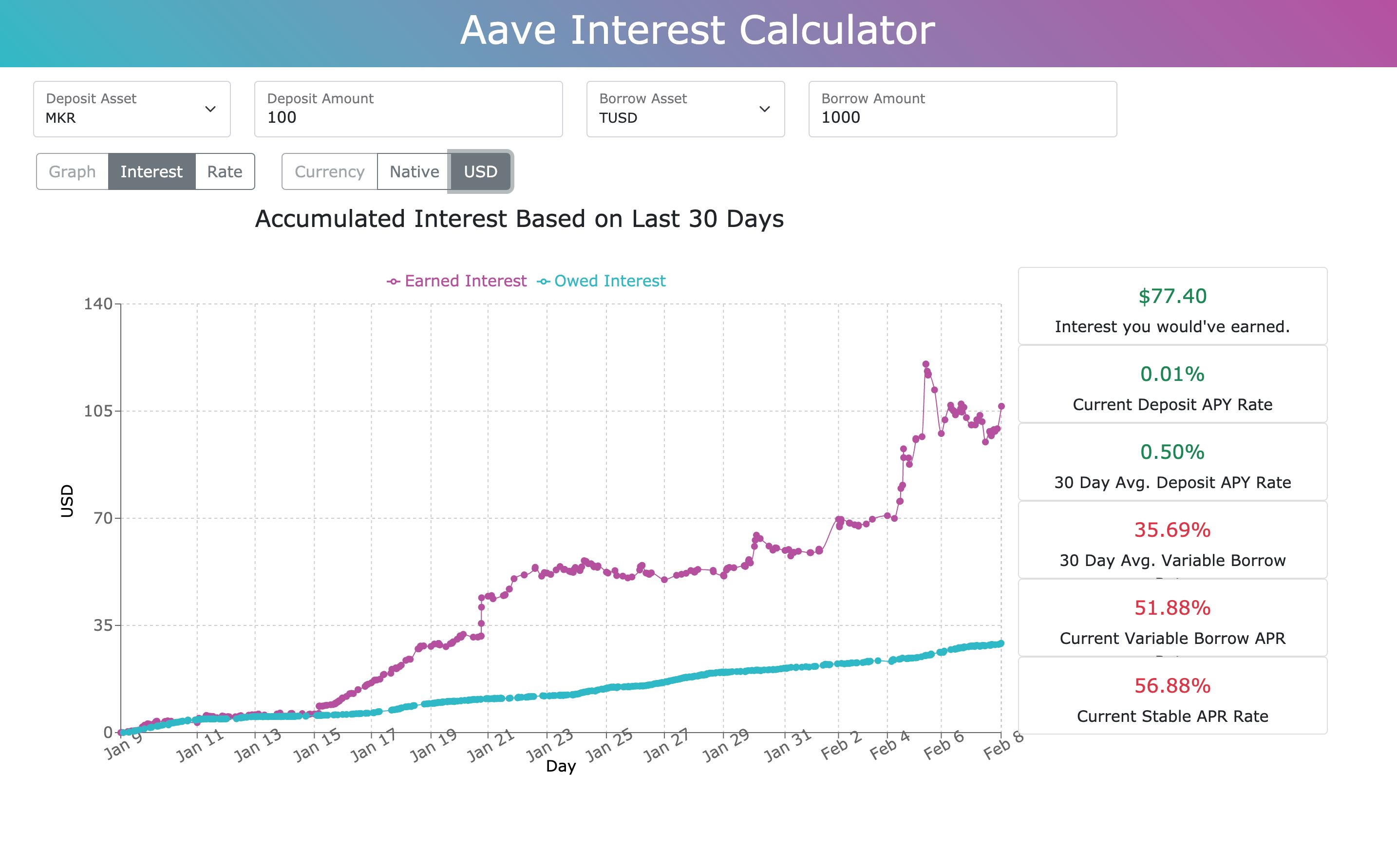

InterestSimulator

An interest earned simulator for the Aave deposits and borrows.

V-Cred

Enabling short-selling in DeFi using Aave credit delegation and One inch