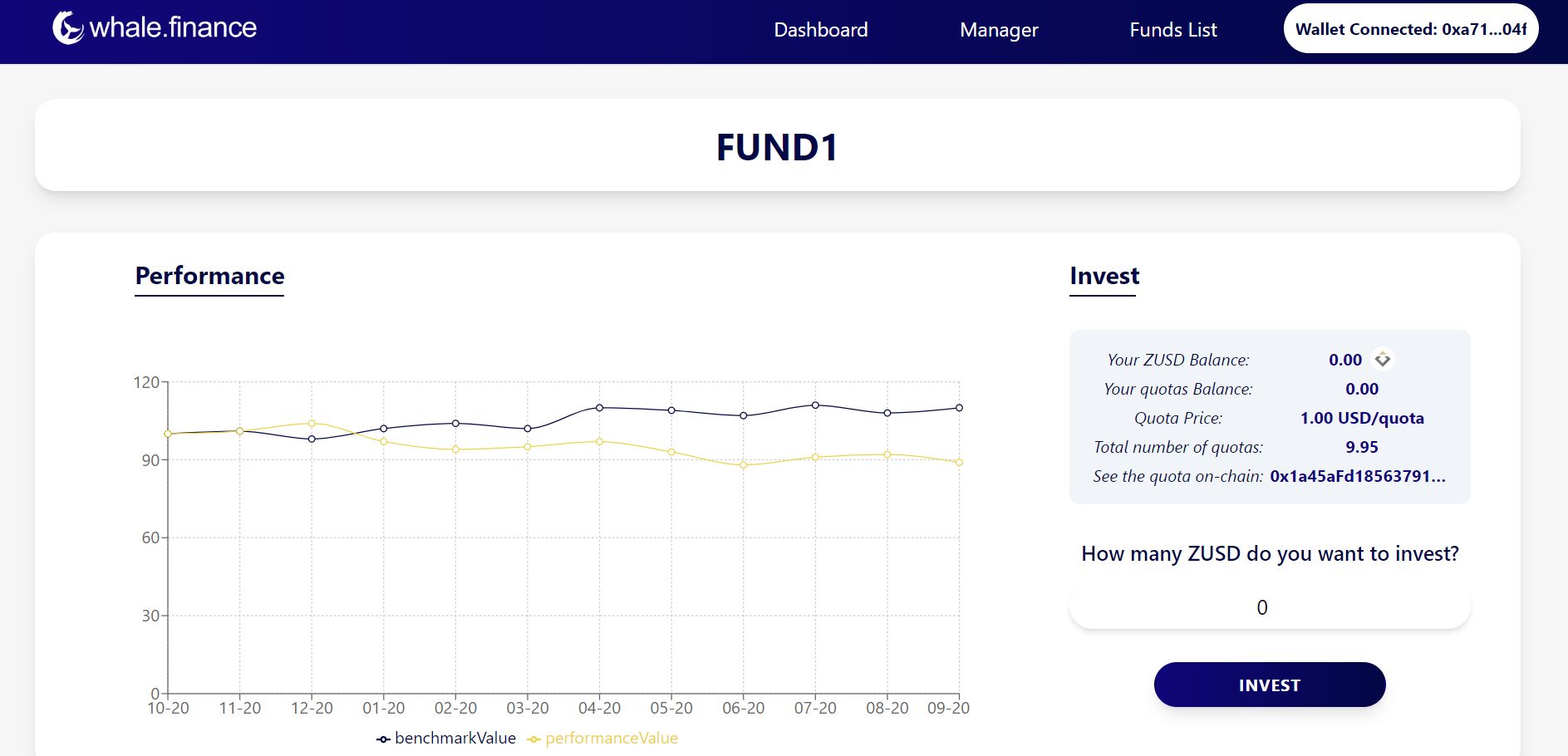

whale.finance

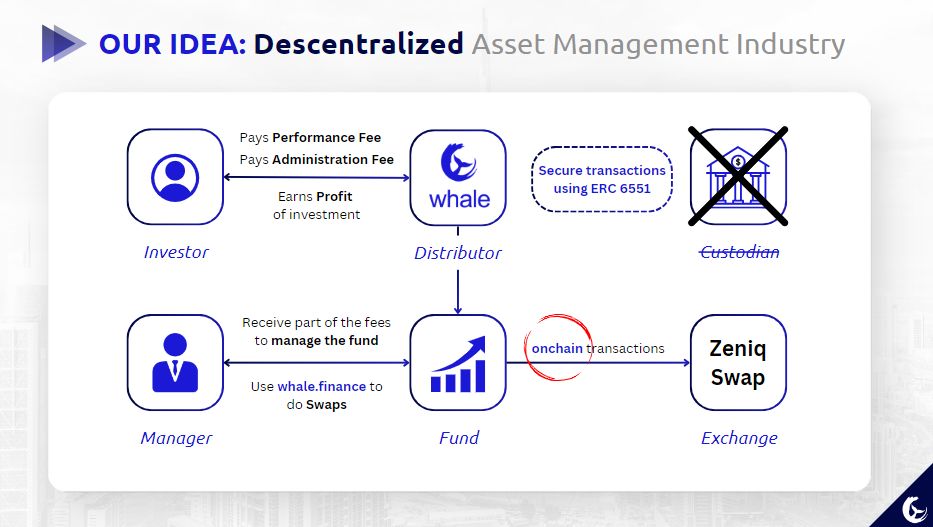

whale.finance basically implements Decentralized Asset Management with ERC 6551. We want to give the opportunity to investors sees their money been managed with full security and auditability.

Project Description

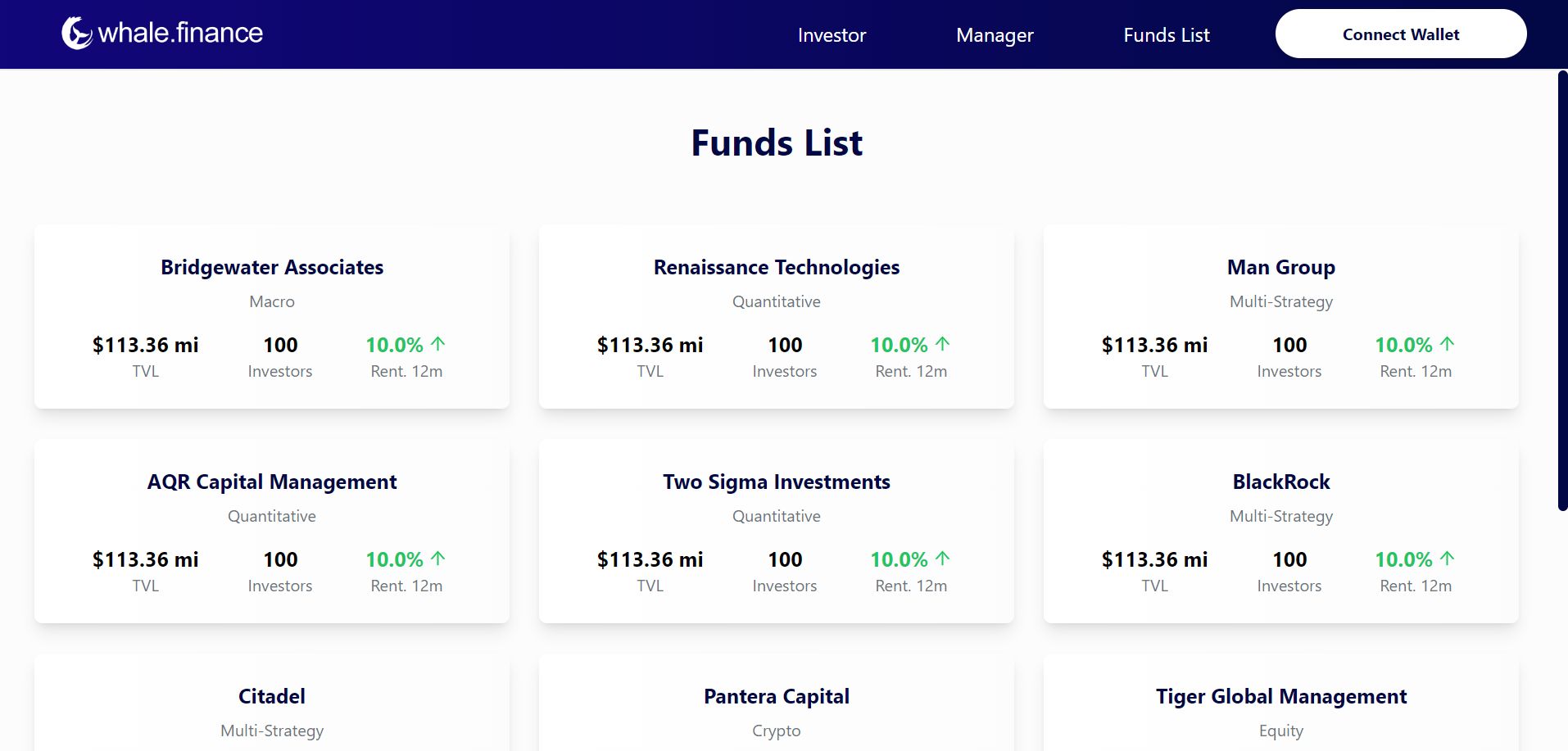

This project uses ERC 6551 to allow managers to hold assets from investors. In this way, we can basically make a descentralized asset management using EVM. The platform is designed for the two publics: The investors, who will be able to invest their tokens in really great funds around the work in a safe way, and the managers, who will be able to manage and hold investor tokens and can have a profit to themselves.

How it's Made

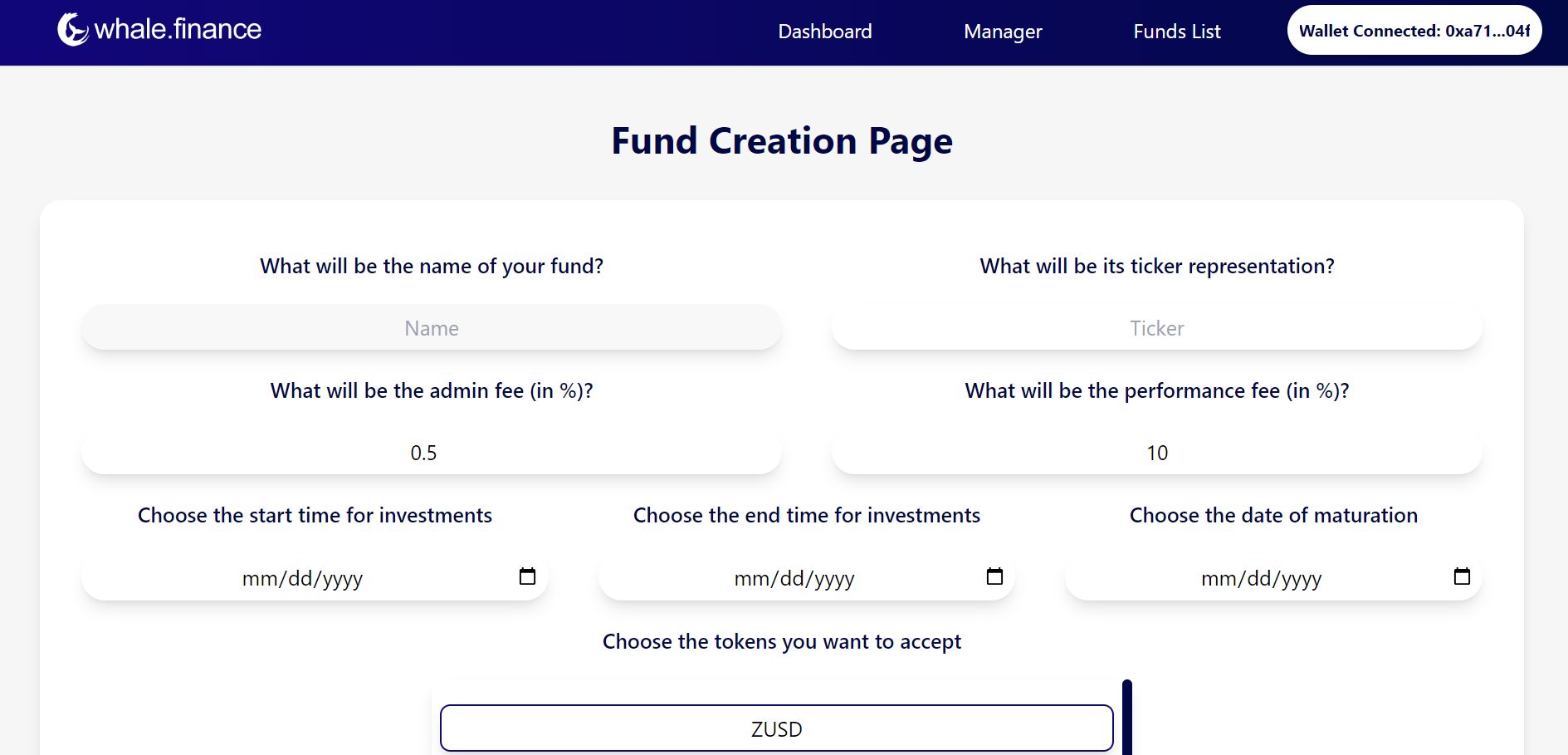

Frontend: We used typescrit + tailwind css + vite.js to deploy more fast and be adjusted to our web3 project, that does not have backend Contracts: We use ERC 6551 to allow managers to control assets from investor at the same time that the assets are safe in a different address.

This ERC allows an nft owner to have control over an account, but with customizable features, such as limitations to the possible transactions made. The WhaleFinance contract implements the ERC721 tokens (NFT) and creates the controllable addresses, which we call Safe Accounts. Also, every fund has a quota (or share), which is an ERC20 token, also deployed when the NFT is created. With these features, the investors are able to invest with a stablecoin (say ZUSD) and get 1:1 quotas in exchange.

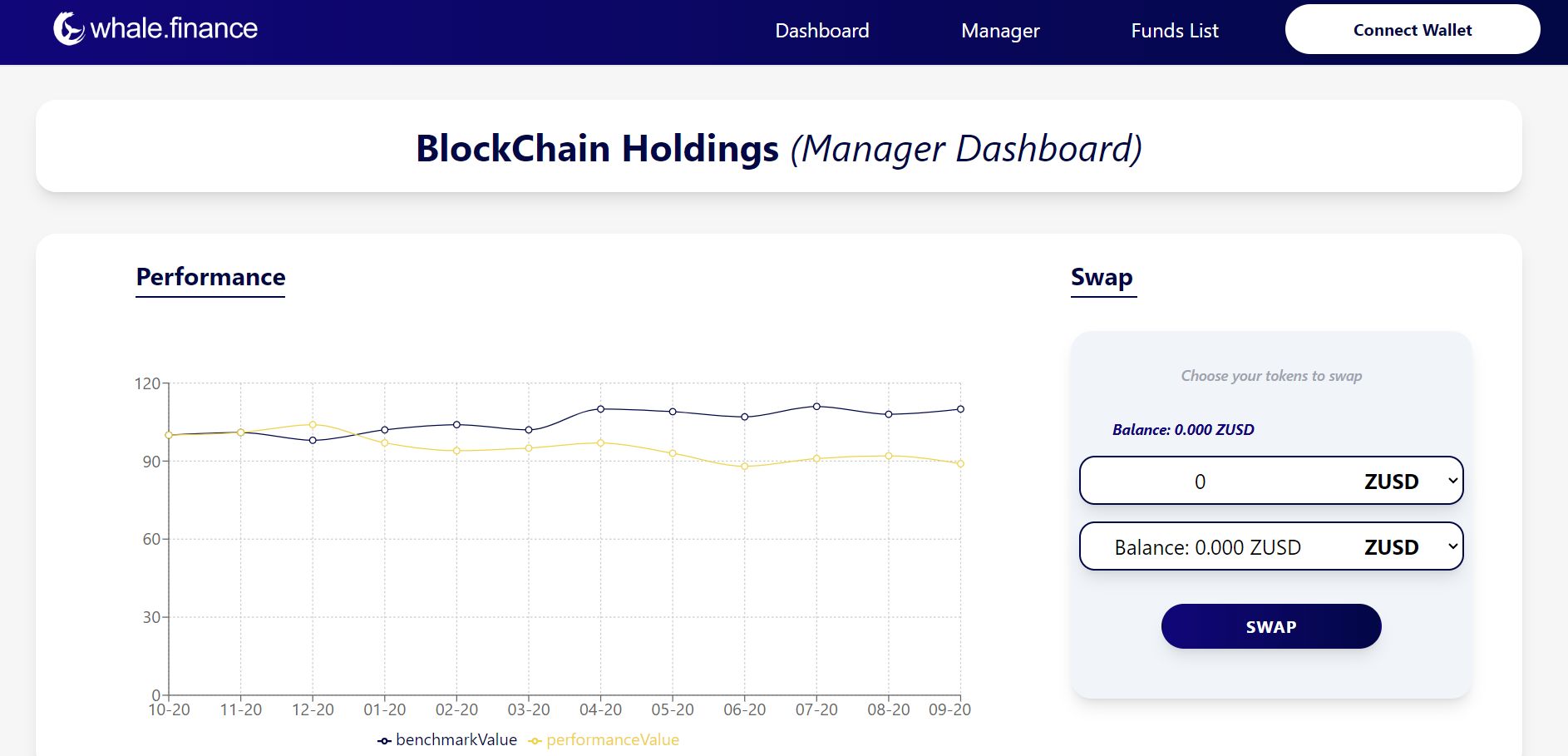

When the fund is open to trades, the manager can interact with his prefered Swap to make profits, using the assets available in the Safe Account. After maturation time, the investor can redeem their yields, with profits or loss.