WAGBI

Future of On-Chain Lending

Project Description

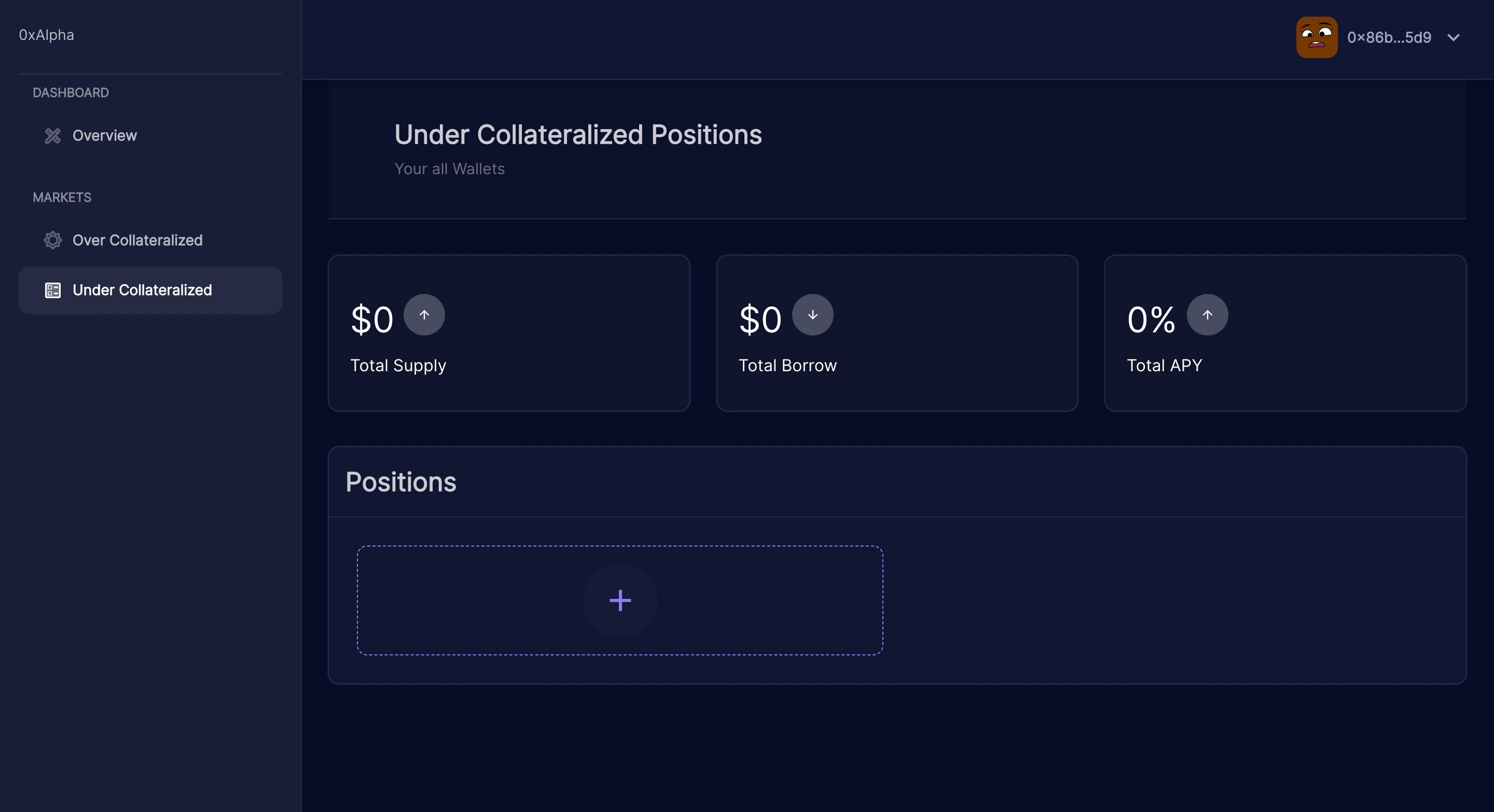

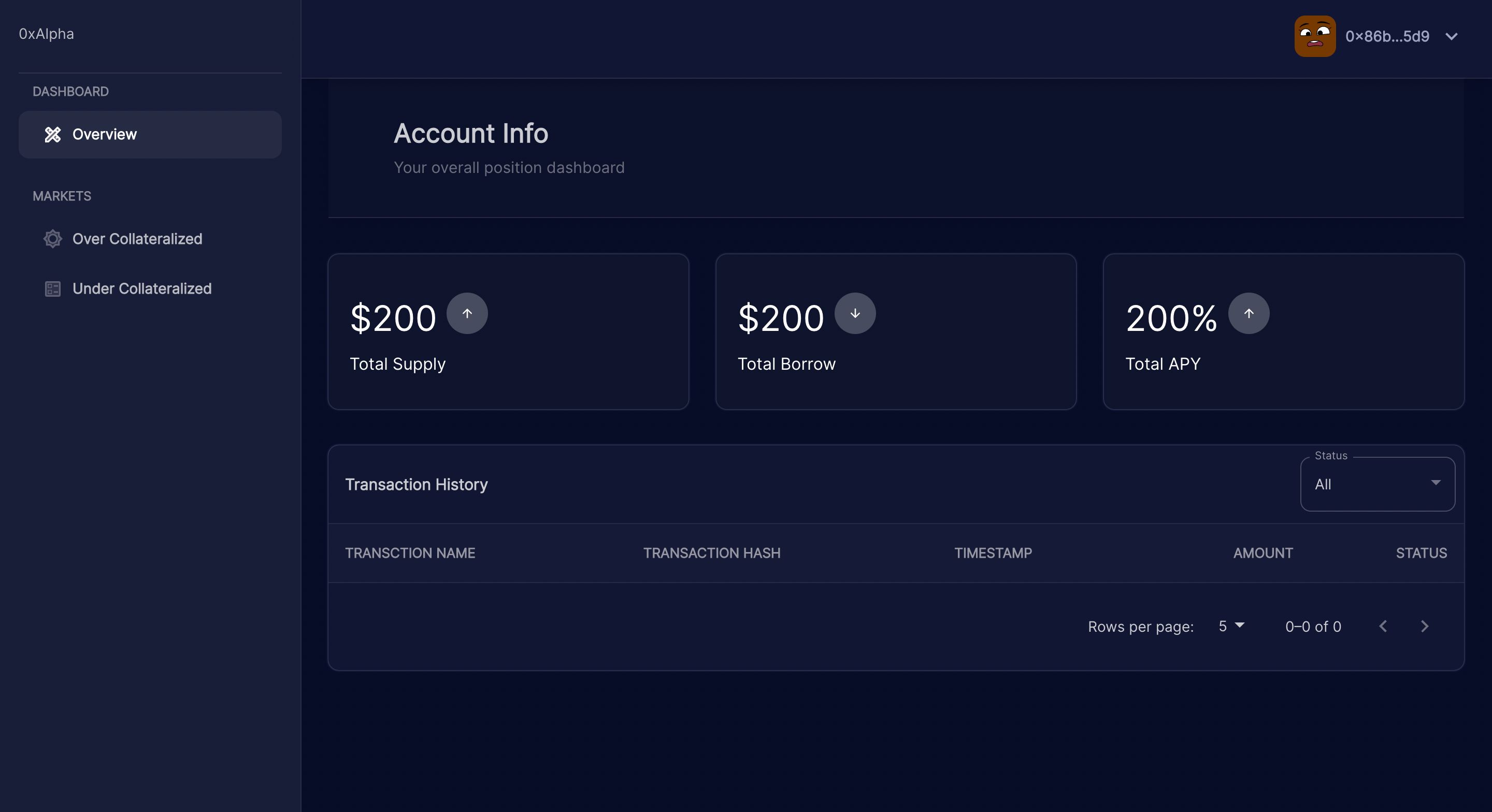

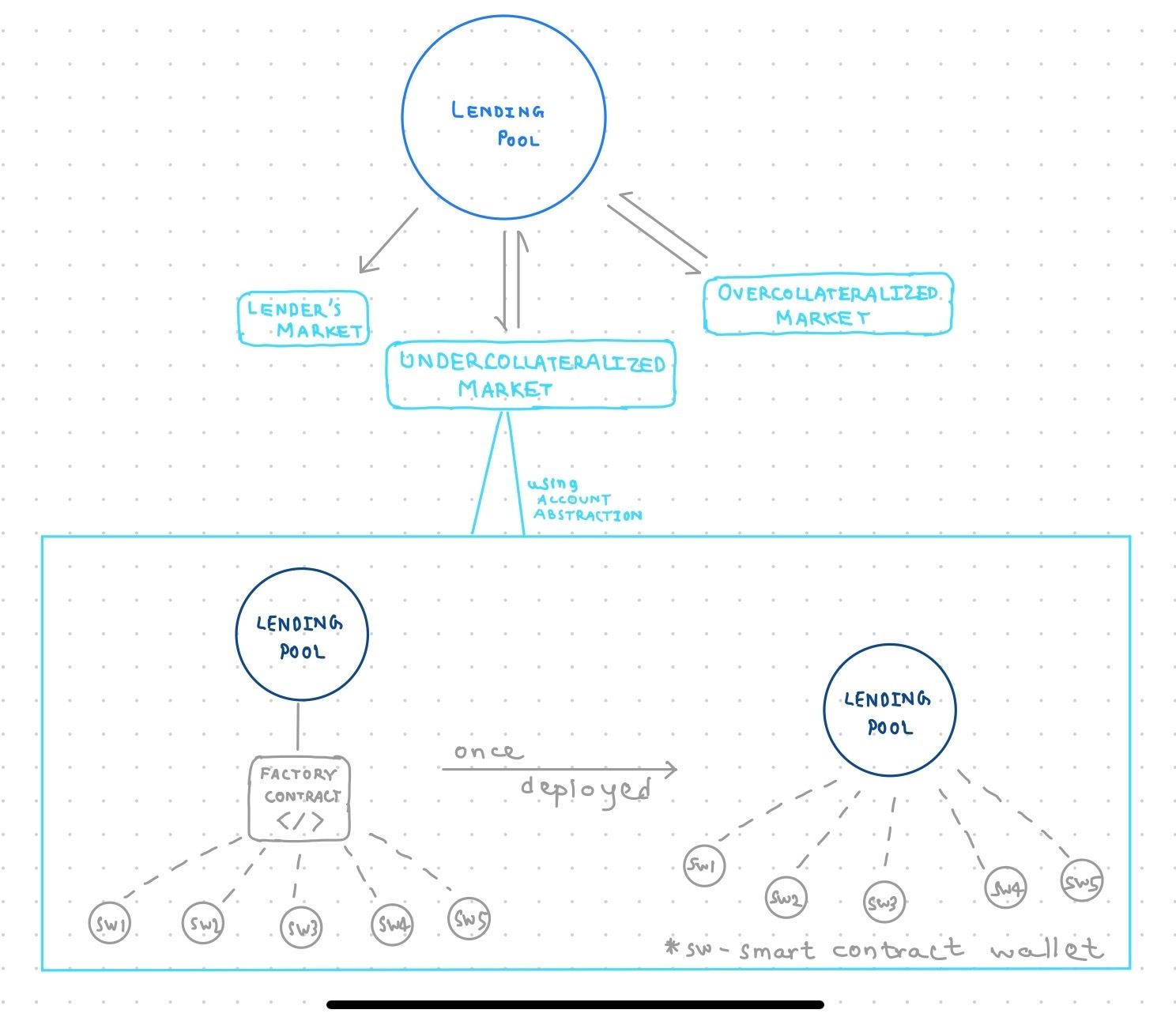

WAGBI is a money market protocol that solves the current On-Chain Lending problems using the several new technologies and the account abstraction primitive. The major problems we are targeting is:

- On-chain lending is the future. It can not be over-collateralized.

- Mass adoption of users can not happen with the current UX, Added gas fees, and time-inefficient tx processes

- Higher supply rates can not occur without capital efficiency.

With WAGBI the key features are:

- Maximised borrow capacity for Users

- Seamless User Experience

- Increased capital efficiency due to a unified liquidity pool and multiple borrower markets.

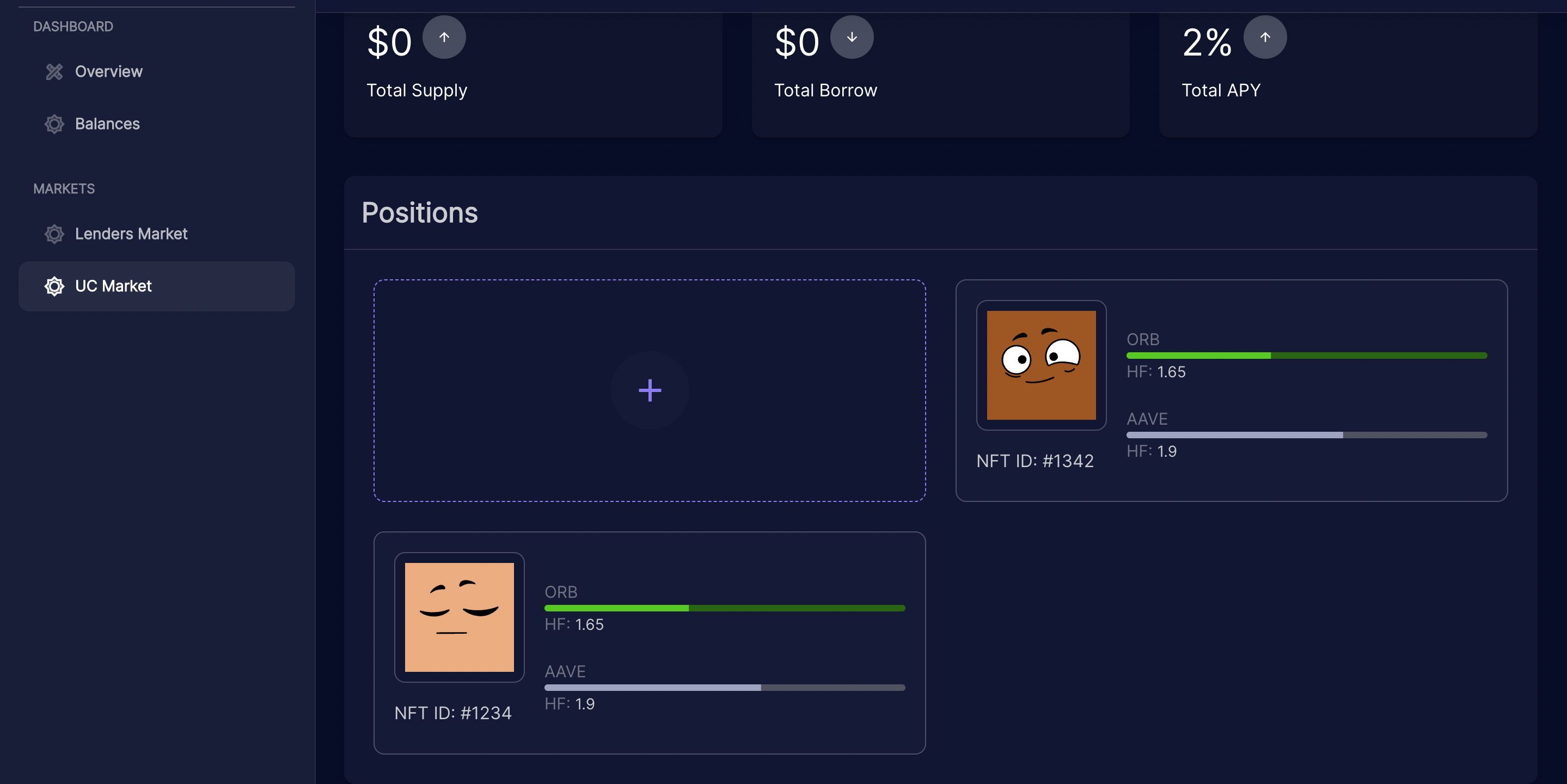

- NFT-based marketplace to buy liquidatable positions in the protocol (Liquidator's market)

The key uses are:

-

Users can borrow more than their collateral. They can go Leverage Long. Get >10x exposure on their tokens, leverage their staking yields, Use the borrowed funds and invest in Vaults and Indices to earn passive yield or Leverage Liquidity Provisioning on Uniswap.

-

Earn higher supply rates: WAGBI's multiple borrower markets increase borrow utilization. This ensures higher rates for the suppliers.

-

Buy underwater positions at a discount from the Liquidator's Market

How it's Made

EIP-4337 implementation was hard due to the lack of literature available around it. Enabling undercollateralisation was hard considering the lack of good projects around it.