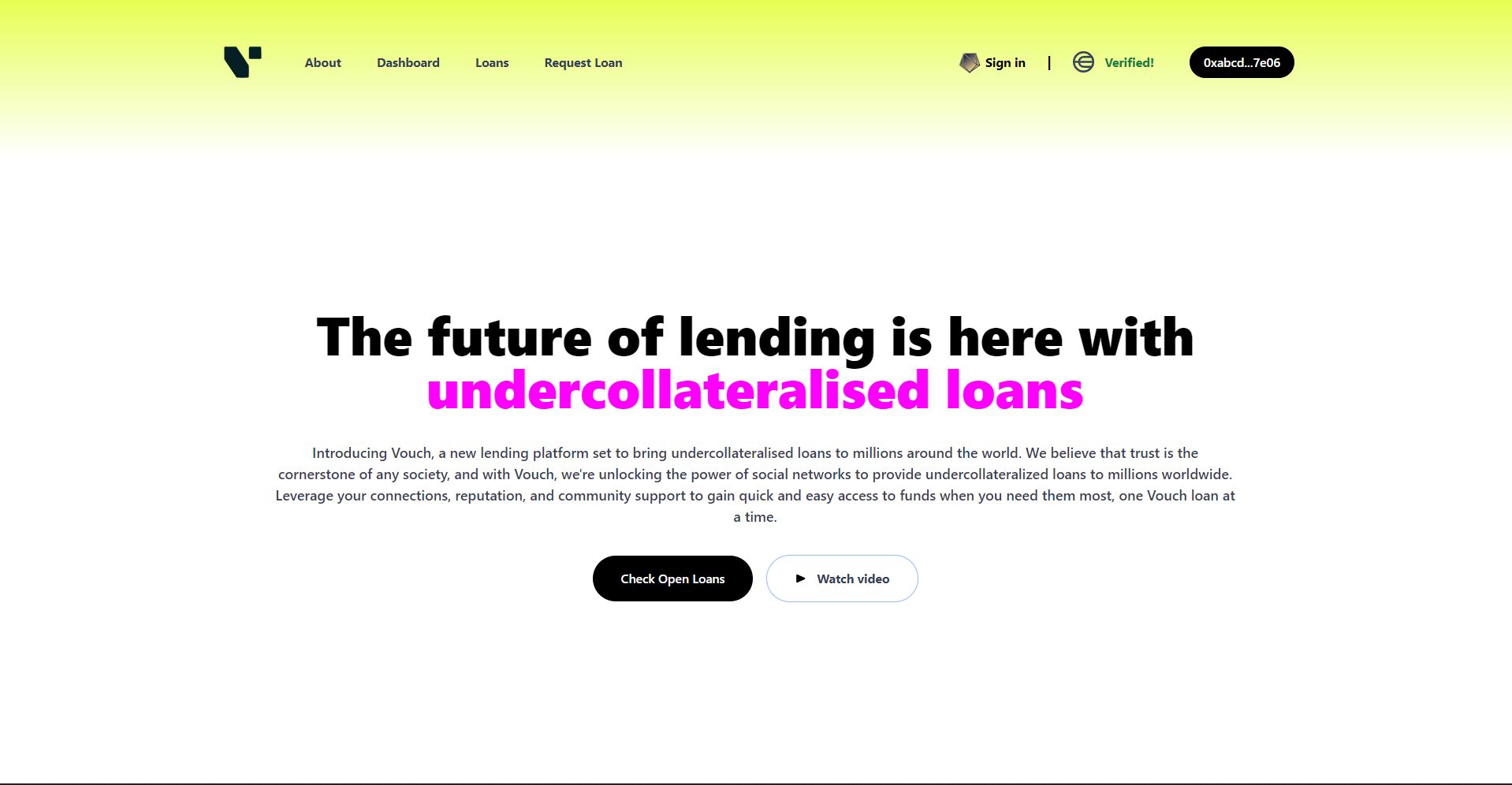

Vouch

Undercollateralised lending protocol based on a merit and vouch system. The higher your merit the lower your APRs are to the protocol. Vouchers only vouch for people they trust and in return get a proportional share of the loan fee.

Project Description

Introducing Vouch, a lending protocol designed to tackle the challenge of undercollateralized loans in DeFi. In the current DeFi landscape, overcollateralization reigns supreme due to the lack of trust on-chain. However, we're venturing into this untapped market by introducing a unique trust-based lending mechanism fueled by 'Vouches' and a merit system.

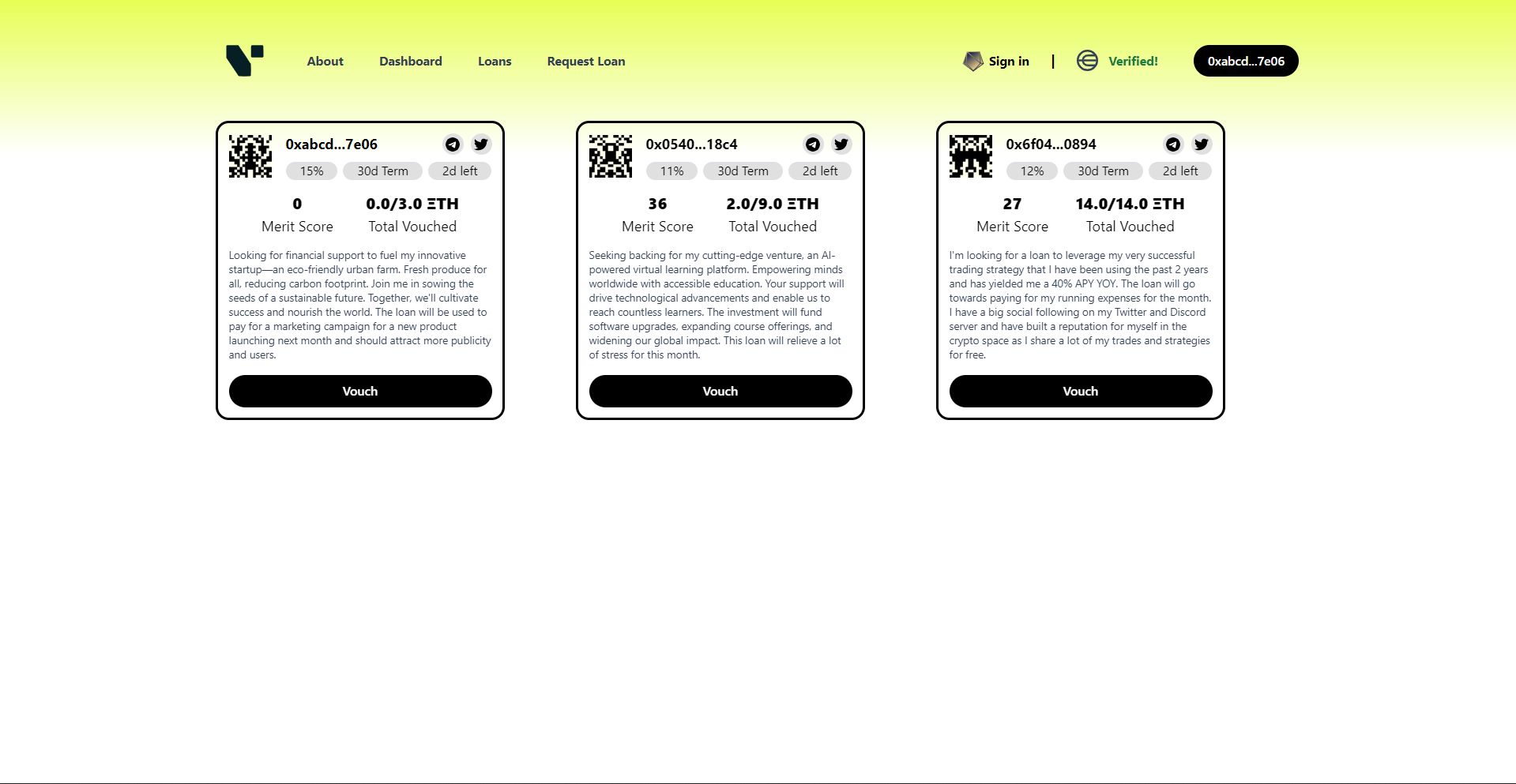

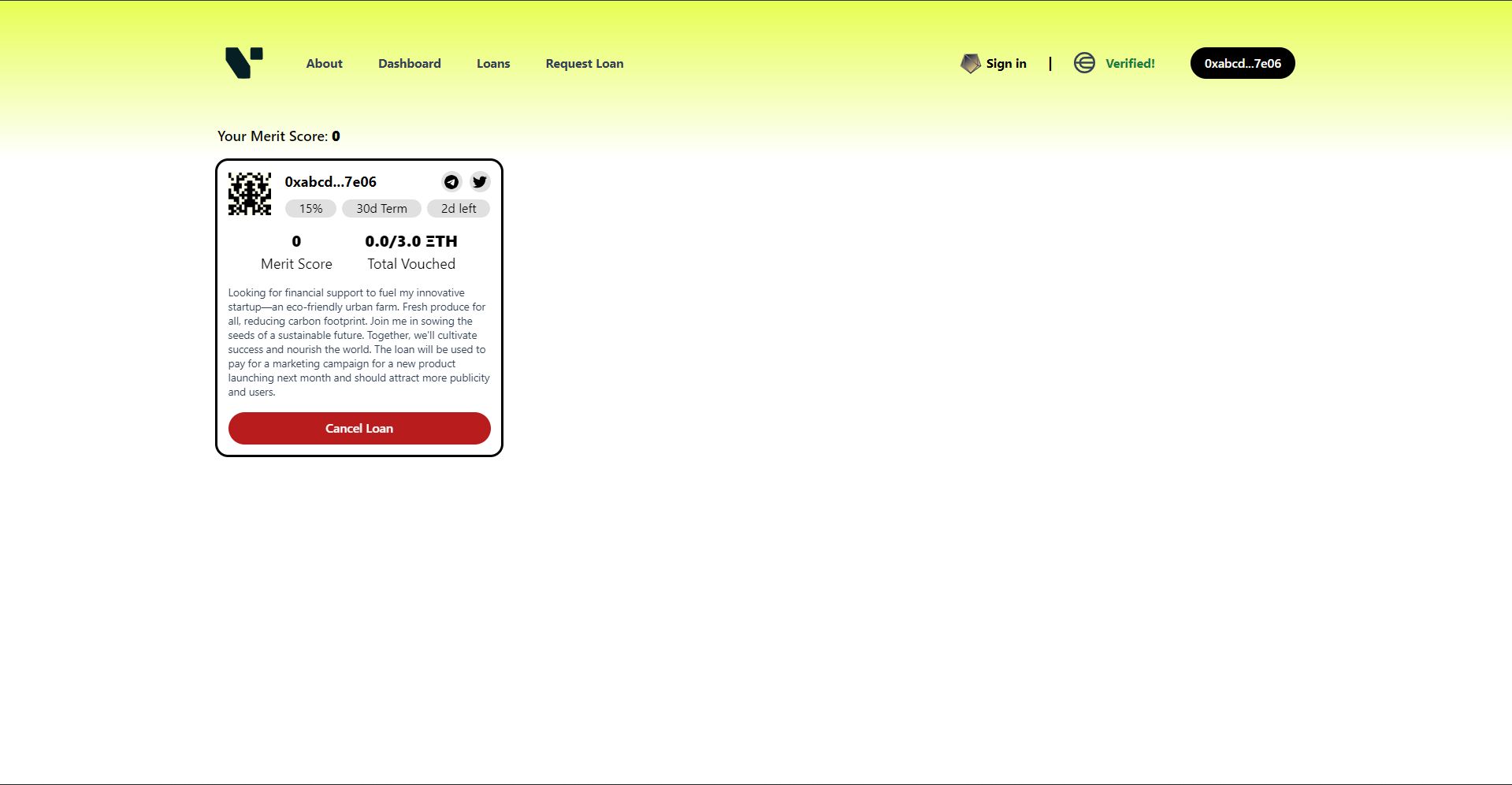

Loanees can request funds through our dApp, specifying their desired loan amount and duration. To initiate a loan, they must lock up a minimum of 50% of the requested amount in the protocol. If they fail to repay on time, this collateral will be slashed and distributed to the vouchees – those who vouched for the loan's success. The Annual Percentage Rates (APRs) are determined by both the loan term and the loanees' merit scores. As they repay their loans promptly, their merit score increases, leading to more favorable terms for future loans.

Our platform empowers users to vouch for loans by contributing a portion of the requested amount. Not only do vouchees receive their money back once the loan is repaid, but they also get a share of the loan fee as an added incentive.

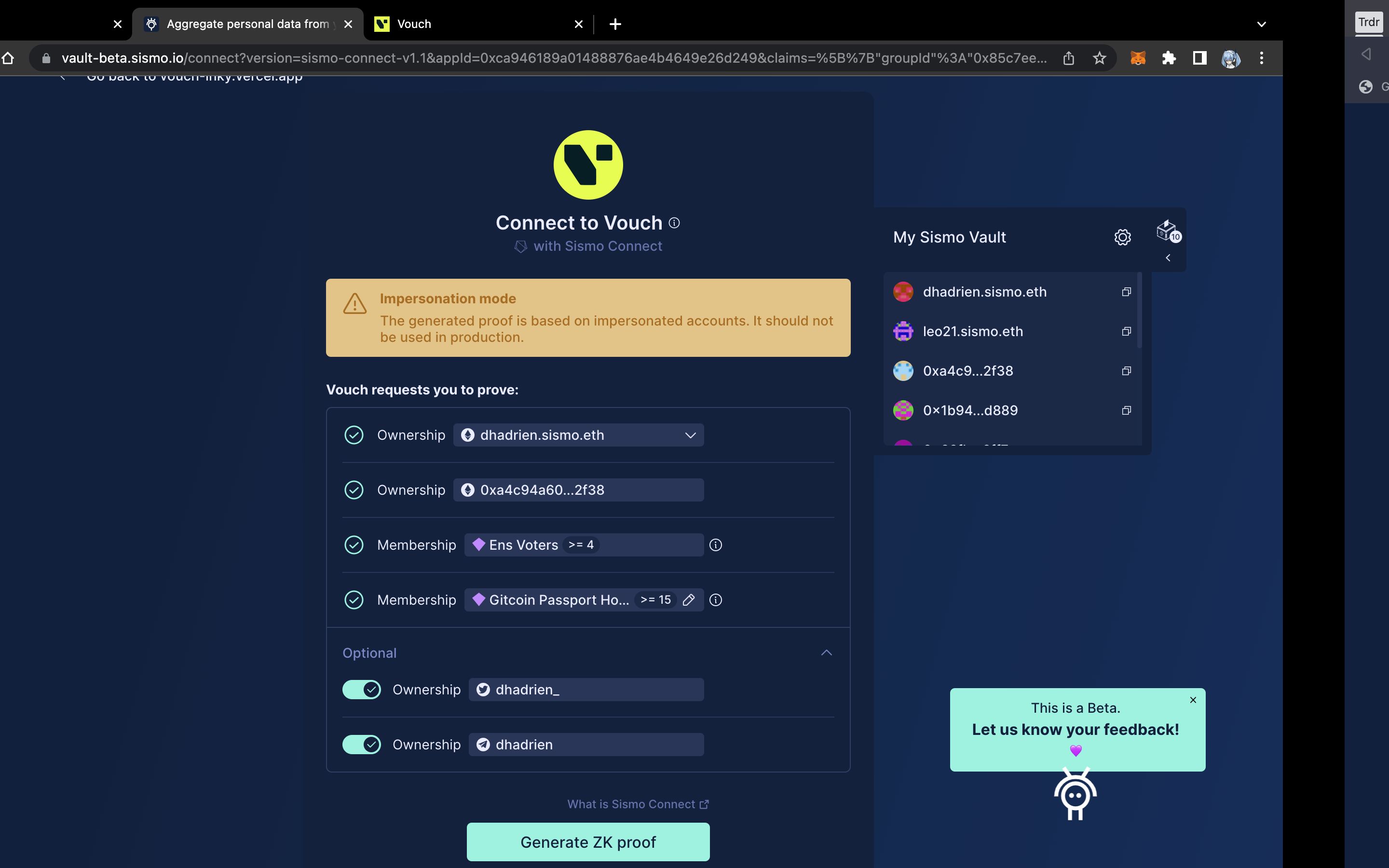

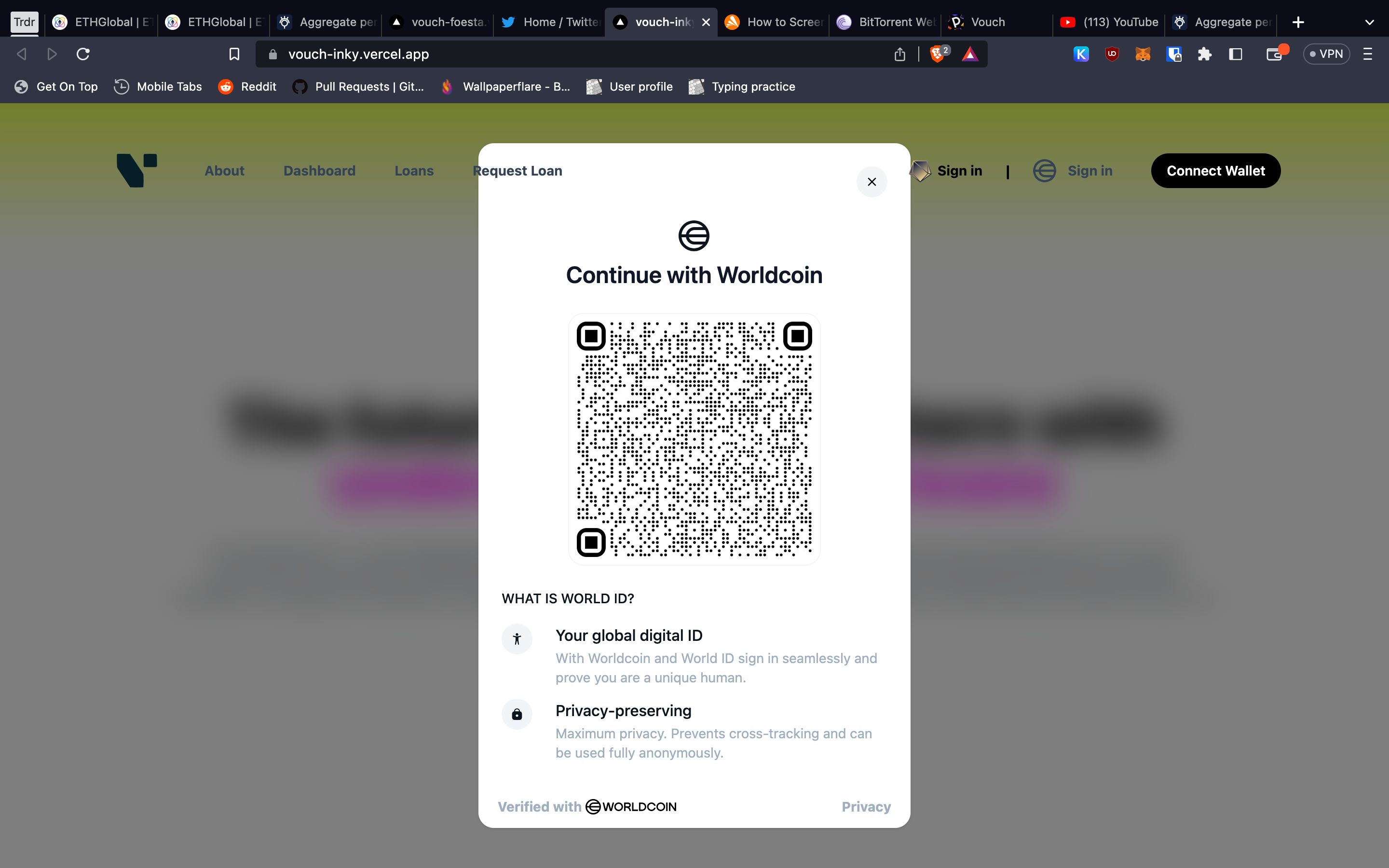

To ensure the integrity of our app and protect against bots and untrustworthy actors, we've implemented robust user verification systems. Leveraging Worldcoin and Sismo, we authenticate real-life humans, ensuring a secure and trustworthy environment for all participants.

How it's Made

This project uses the Metamask sdk to handle browser wallet injection into the application. From there we use NextJs and React to build out our backend and our frontend. We leveraged Worldcoin and Sismo to verify users as this was a major part of our application as we wanted only real people to use it. We made heavy use of HardHat for testing our smart contracts leveraged Vercel to deploy our website. We also leveraged hardhat to deploy to Celo chain. We chose Celo due to the exceptionally low fees and EVM compatibility. We did some inverse linear normalization to calculate user APR's which took a little time to figure out and code in solidity. Finally we attempted to use on-chain verification for Sismo as we really liked the fact we could verify users twitter and telegram profiles which added increased levels of trust.