volatility-fee-hook

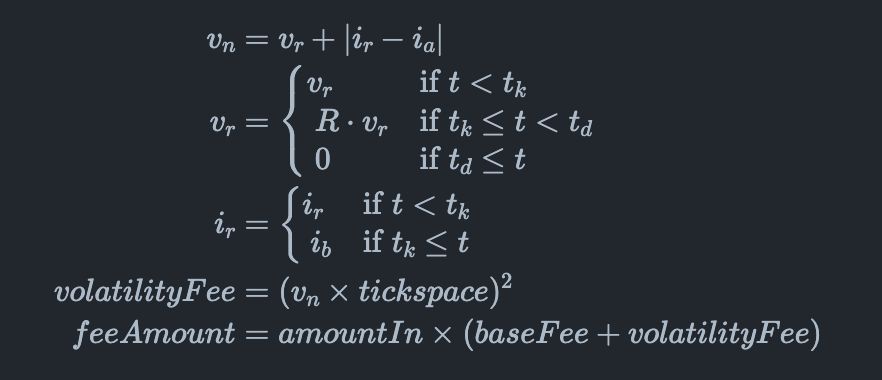

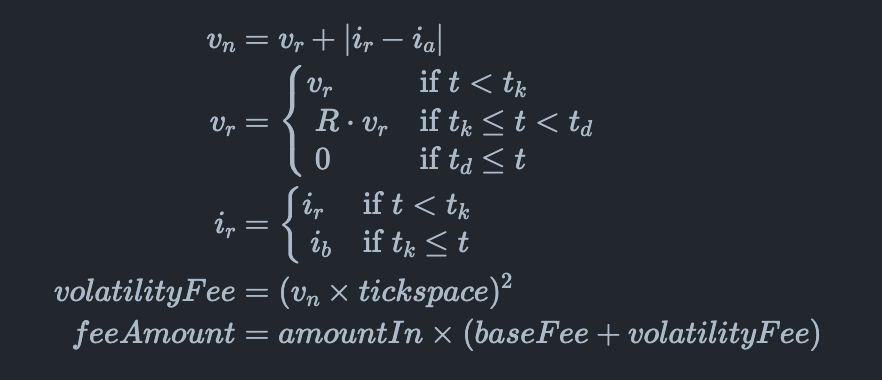

volatility fee hook is to reduce impermanence loss. As a result, liquidity increases, which also benefits users.

Project Description

n the world of decentralized finance, the concept of impermanent loss is a critical one. Pairs with high volatility are especially susceptible to this phenomenon, often experiencing larger impermanent losses than their low volatility counterparts. To put it simply, the more the price of the tokens in a liquidity pool diverges, the higher the potential for impermanent loss. This can be detrimental for liquidity providers as they might end up with less value than if they had just held onto their tokens outside of the pool.

How it's Made

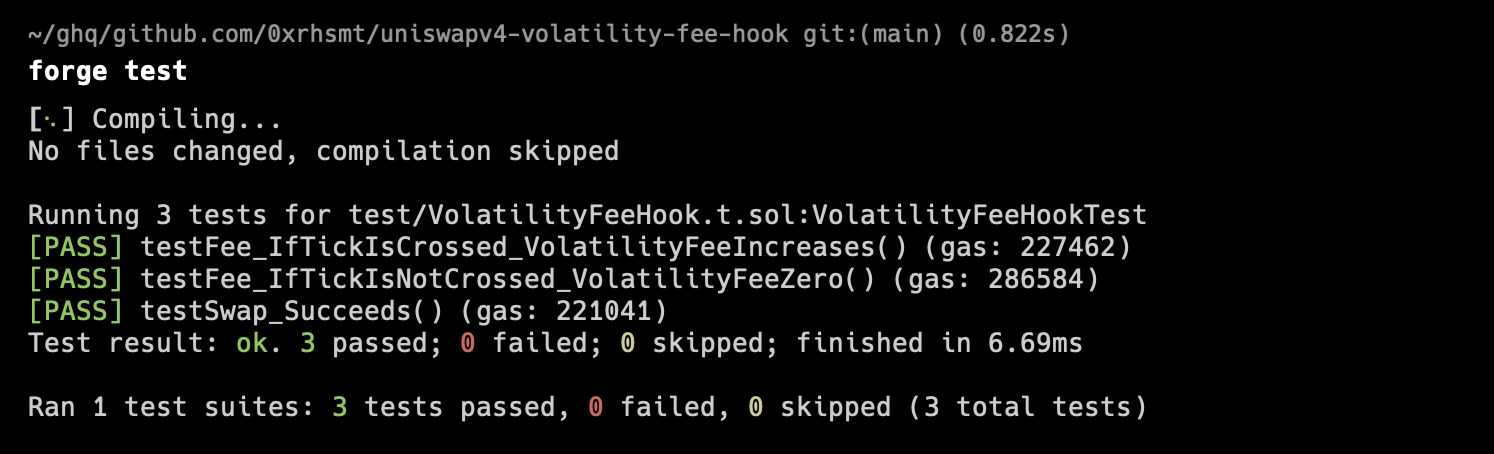

We are using foundry which is a smart contract development toolchain. We use uniswap hook, a new feature of uniswap v4. Test code is also written.

We consulted the extensive sample of uniswap hooks. https://uniswaphooks.com/

And the uniswap v3 book was also very helpful. https://uniswapv3book.com/