TreasuryDAO

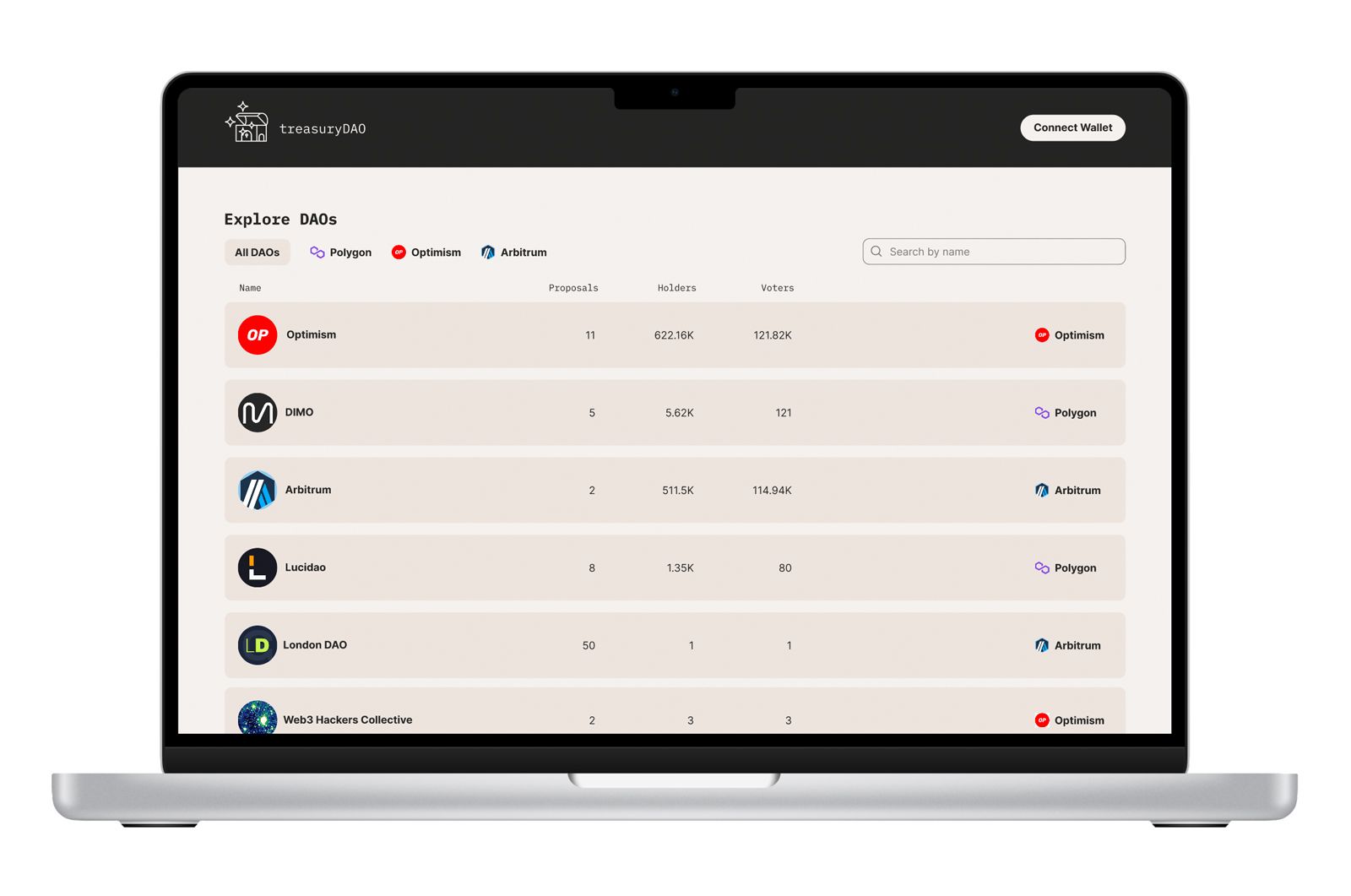

Treasury DAO is a foundational toolkit for on-chain treasury management in any existing DAO.

TreasuryDAO

Created At

Winner of

🌍 Uniswap Foundation — Best Ecosystem Hack

5️⃣ Aave Grants DAO — Built with GHO

🥇 The Graph — Best New Subgraph

5️⃣ Chainlink — Best Hack

Project Description

The problem:

DAOs excel at coordinating people and capital to achieve shared goals. However, most of the DAOs delegate their treasury into a multi-sig wallet controlled by a few people. This is the only feasible way to manage treasury in a professional way: open liquidity positions, execute hedging strategies, etc. ENS or Optimism are two examples.

Solution:

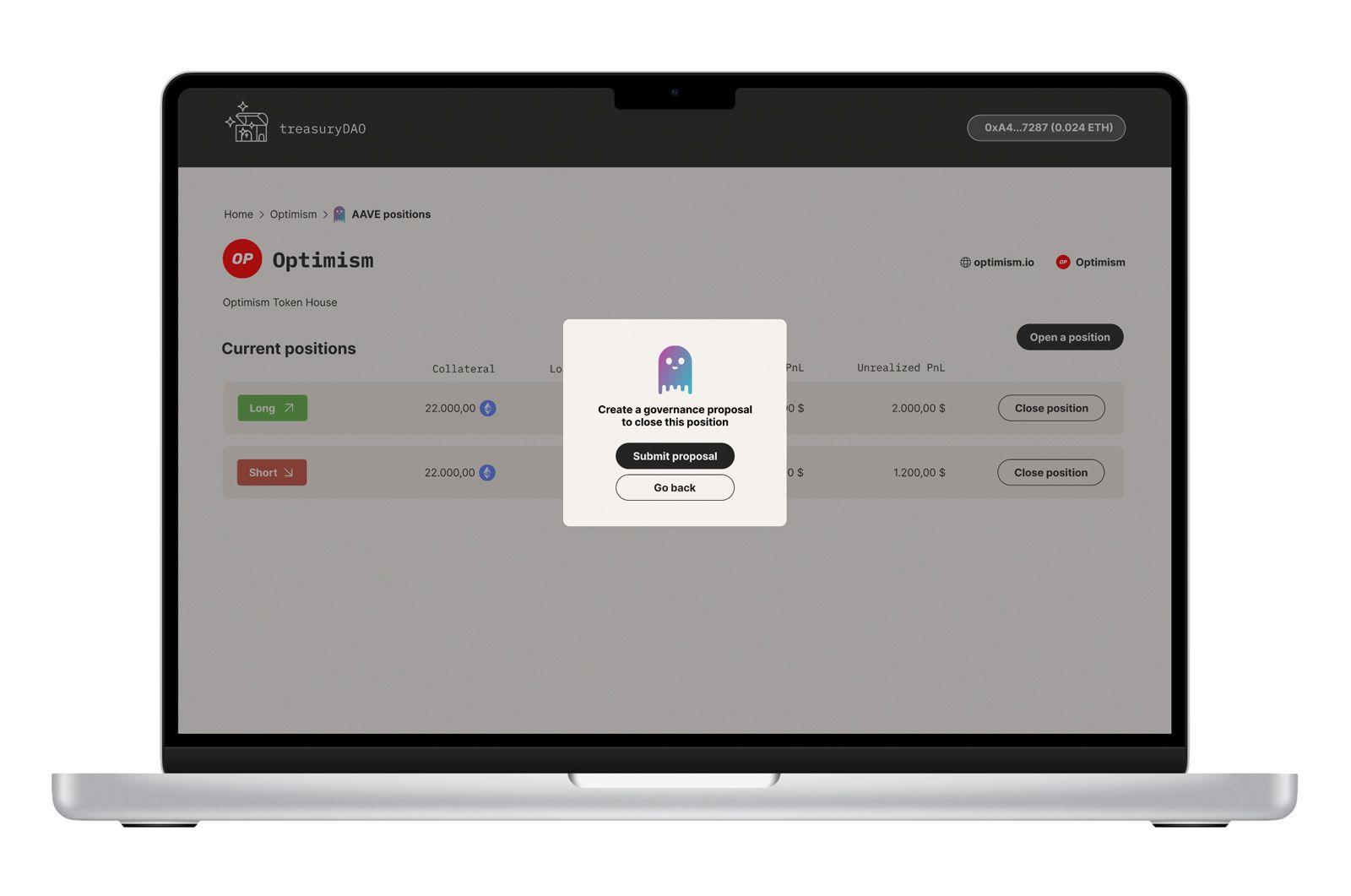

Treasury DAO is a foundational toolkit for on-chain treasury management for any DAO deployed on Polygon, Optimism or Arbitrum. We have created a set of tools to enable any DAO to interact with protocols through payloads and governance proposals.

What we have built on this hackathon:

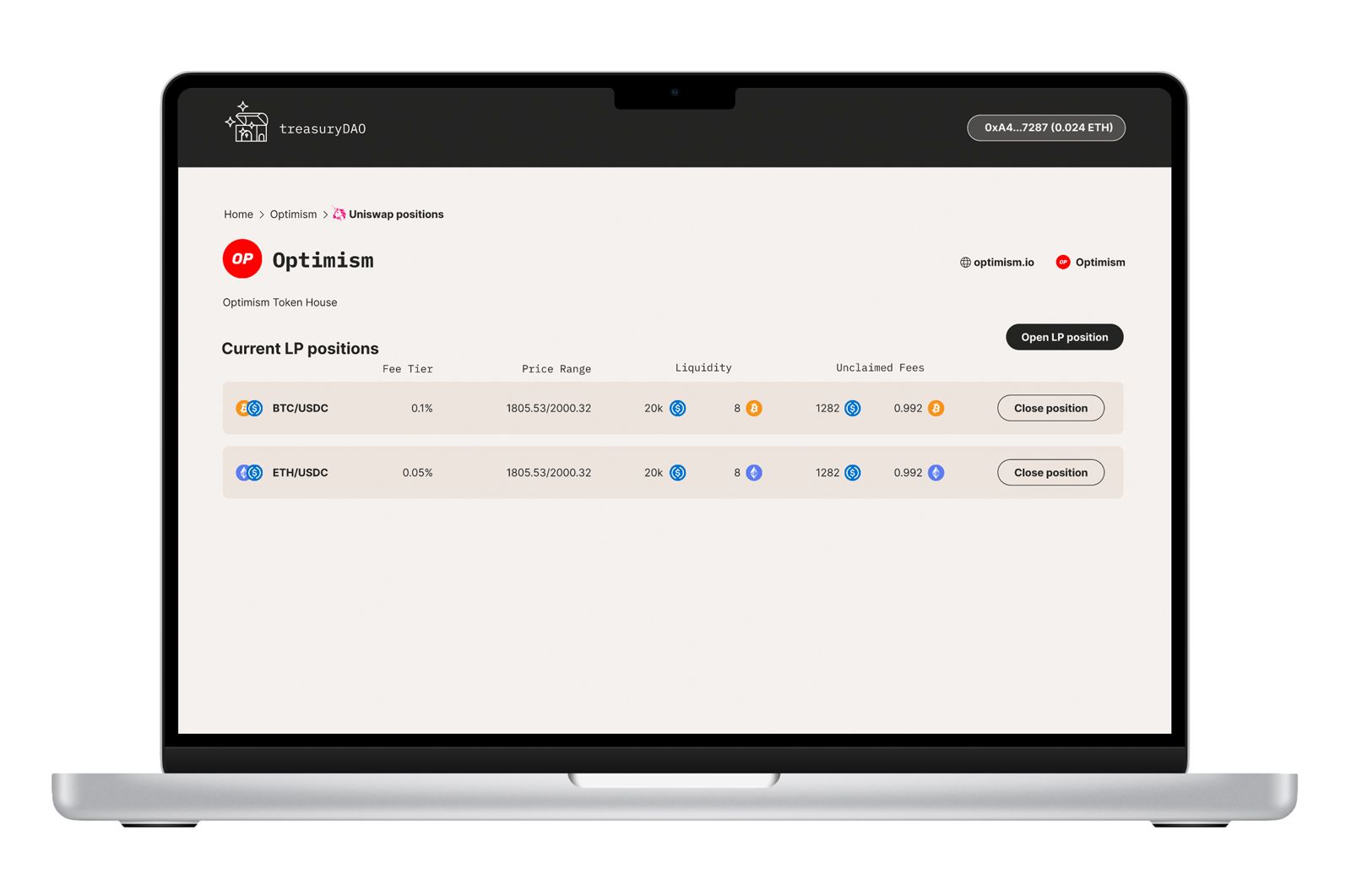

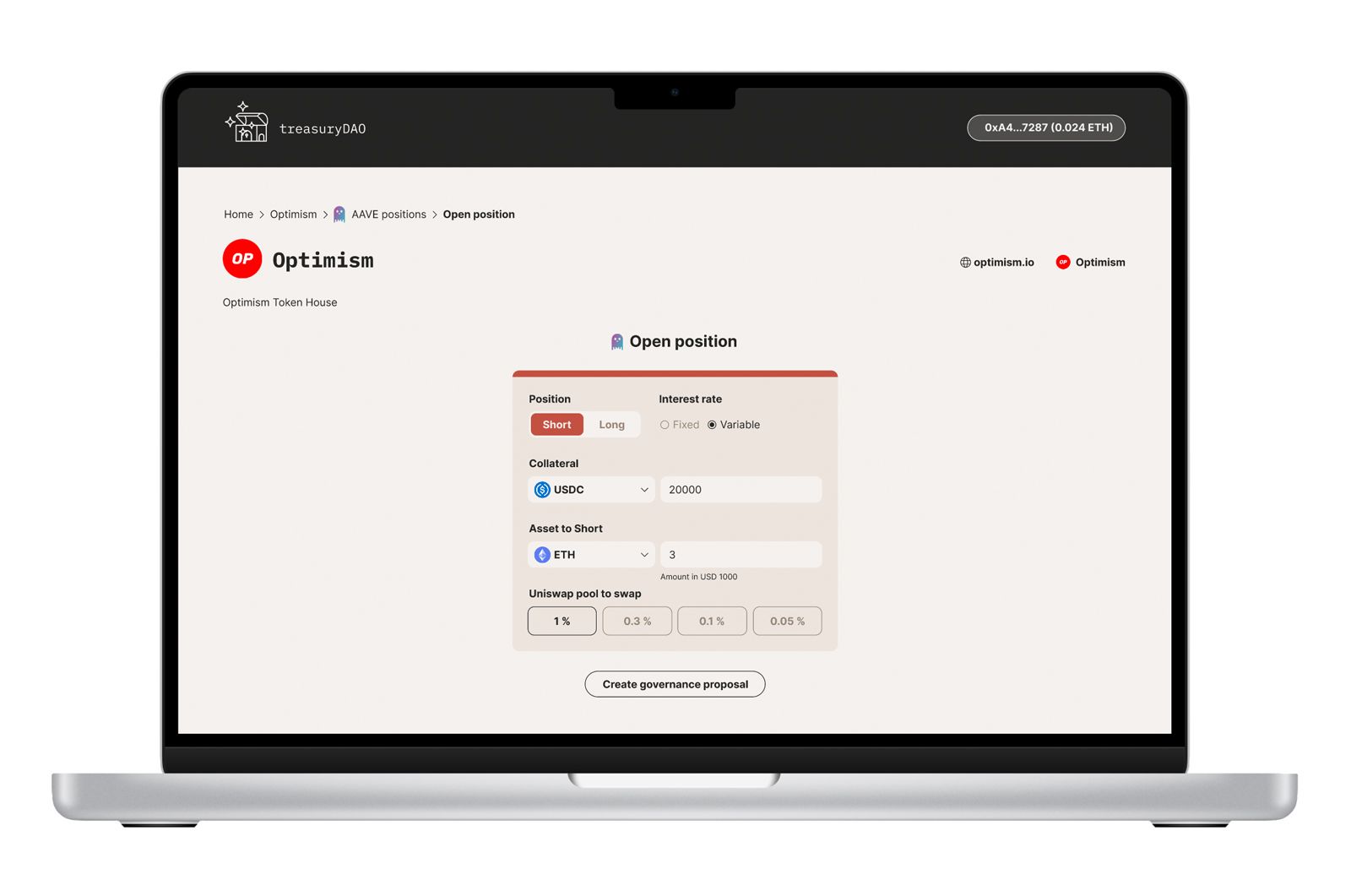

- Enable an existing DAO open short/long positions by making the DAO contract interact with AAVE through a governance proposal payload.

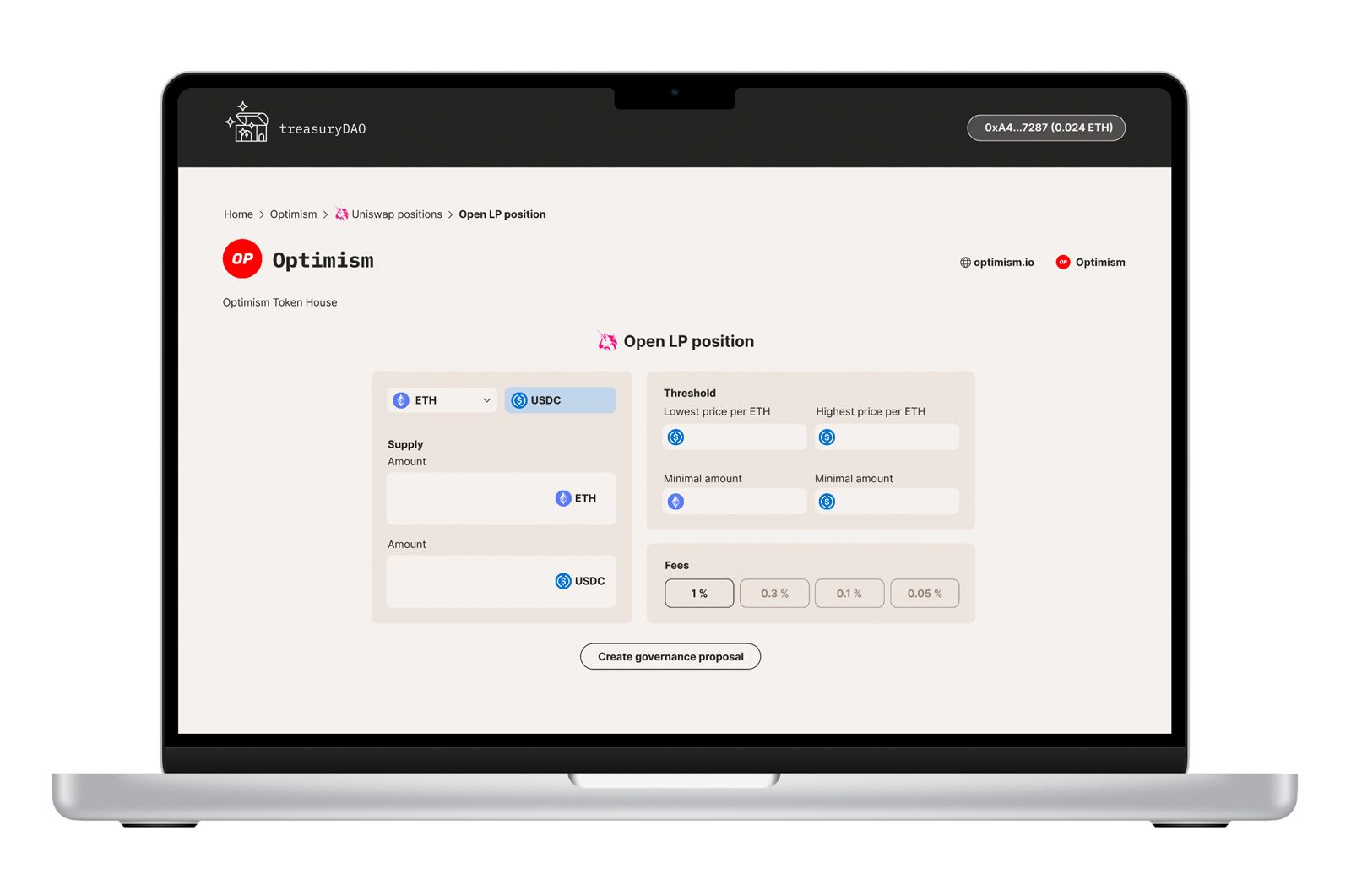

- Enable an existing DAO to Open/Close an LP position in Uniswap V3 by making the DAO contract interact with Uniswap and Chainlink through a governance proposal payload.

Our competitive advantage: Due to our approach of facilitating interaction between DAOs and DeFi protocols via governance payloads instead of developing new smart contracts.

How it's Made

-Our project is fully functional for DAOs deployed in Mainnet: Polygon, Arbitrum, and Optimism.

-

The Graph: We created a factory smart contract that deploys contracts in order to create the DAO. By utilizing The Graph, we have built two custom API subgraphs that retrieve information about the DAOs, and their operations.

-

Chainlink: Creating a governance proposal to open an Uniswap position but executing that position with a considerable delay (when the proposal is approved) is a challenge. We consume several Chainlink data feeds to enable DAOs to interact with DeFi protocols.

-

Uniswap: We have developed a governance payloads builder to enable any existing DAO contract to open LP positions by interacting with the Uniswap contract.

-

AAVE: We have developed a governance payloads builder to enable any existing DAO contract to hedge (short) any asset by interacting with the AAVE and Uniswap contract. It also supports long positions.

-

Ethereum Foundation: We have created a UI toolkit to enable any DAO to open governance proposals and interact directly with the most popular protocols like AAVE and Uniswap.