tapp finance

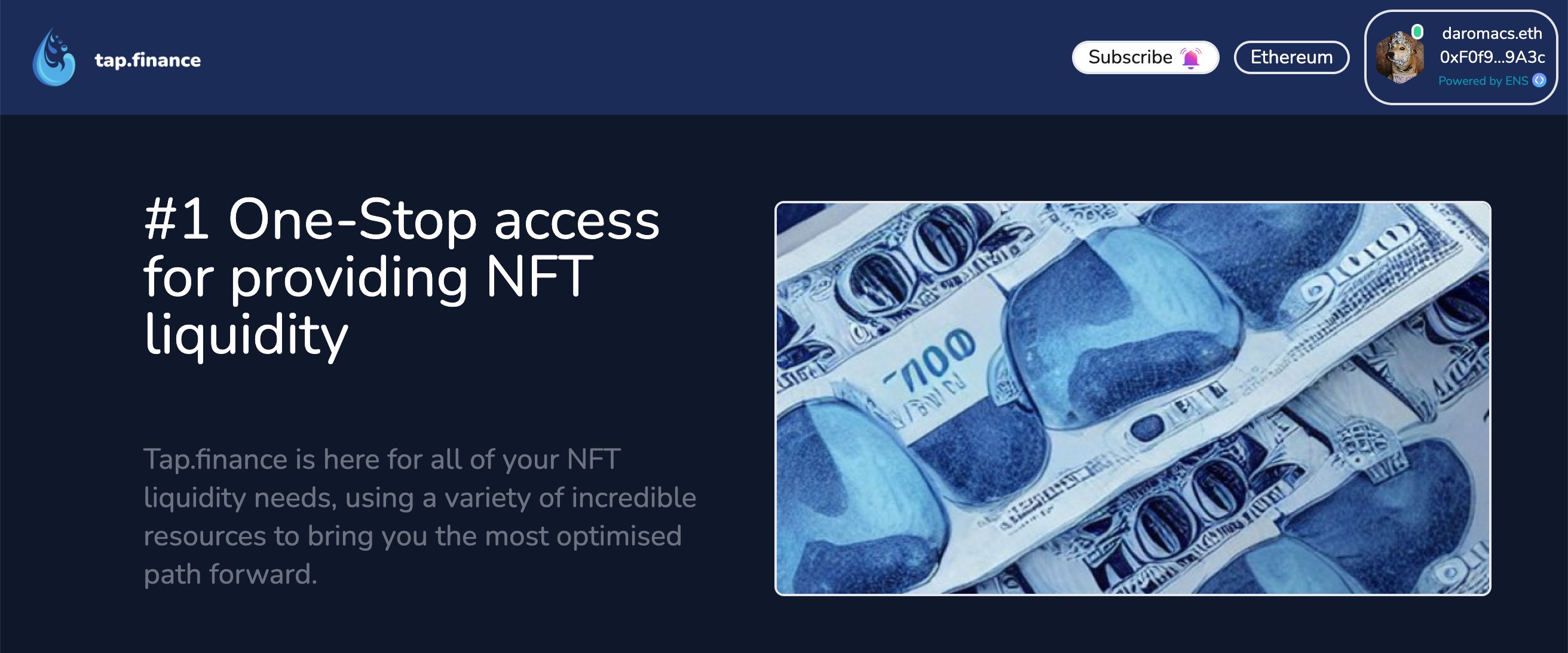

Tapp finance is Liquidity routing protocol for NFT AMM supporting multiple EVM chains - Ethereum, Polygon, Optimism, Skale network, and EVMOS. It aggregates information on liquidity pools of NFT AMMs. Users can discover the best pools.

tapp finance

Created At

Winner of

🤝 Lens Protocol — Integration

🤝 ENS — Integration Bounty

Project Description

- Background In Web3, there is no doubt that the NFT market is part of the core in Web3. NFT, which started with art and some digital brands, is now being used for a variety of purposes, such as gaming, Metaverse, and even real tickets and memberships. This trend will continue to accelerate in the future. However, in many collections, there is insufficient liquidity and NFT purchasers are unable to resell at the appropriate time. This has kept large investors and DAOs from inflowing funds and has hindered the development of the market. For the further development of the NFT market, which is the core of Web3, it is essential to solve this liquidity problem.

- What is tapp finance

Tapp finance is Liquidity routing protocol for NFT AMM supporting multiple EVM chains - Ethereum, Polygon, Optimism, Skale network, and EVMOS. It aggregates information on liquidity pools of NFT AMMs. Users can discover the best pools for providing liquidity for their NFT holdings.

-What’s good for users

Users will be able to provide liquidity to the optimal pool of NFT holdings. In the current situation, most NFTs are not utilized as assets by holders and it is one of the major reasons why the liquidity of the NFT market does not increase. Once they start using tapp finance, they can effectively utilize their assets, thereby contributing to improving the liquidity of the NFT market.

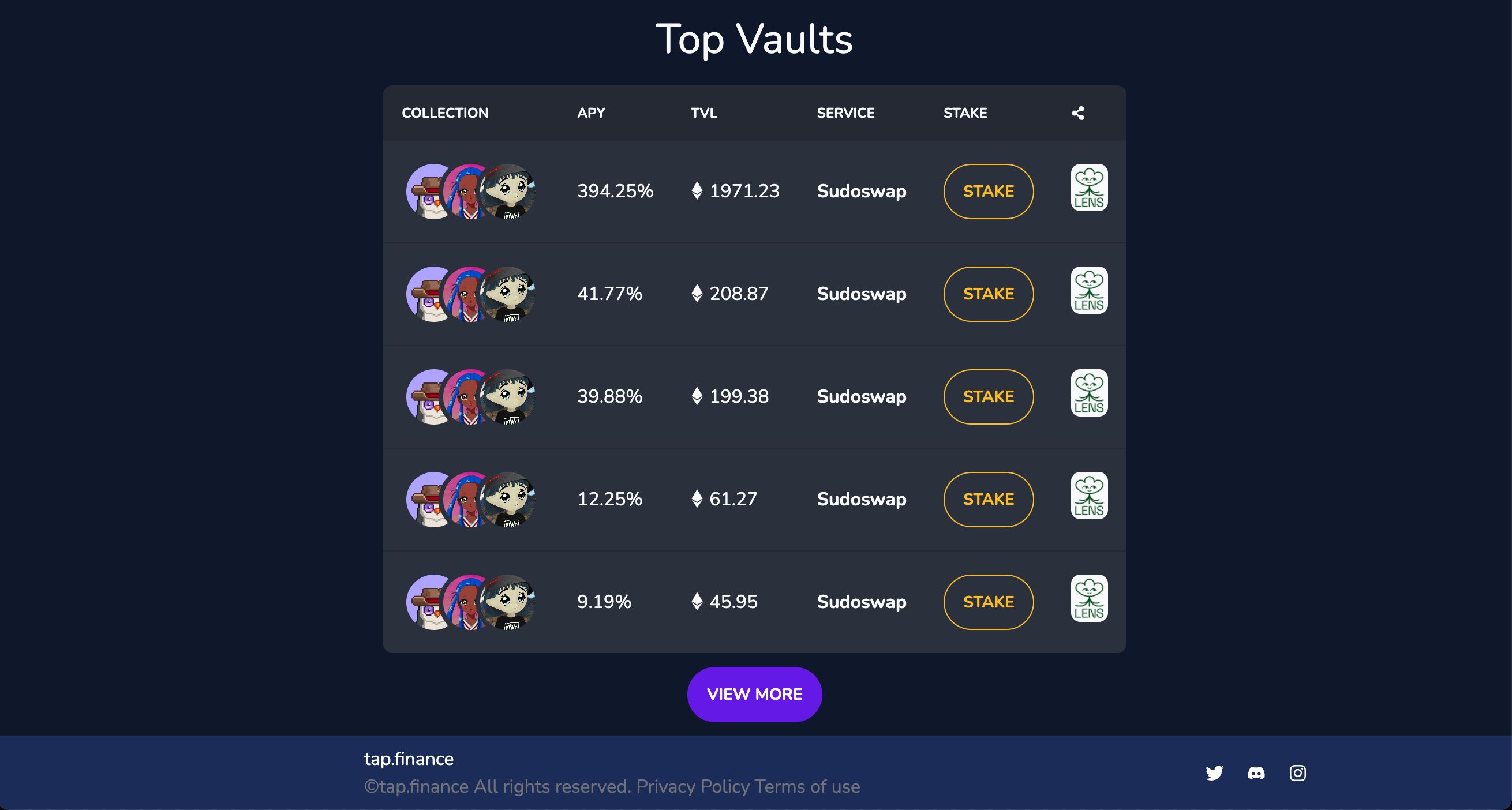

-What’s good for NFT projects NFT projects can improve the liquidity of collections. In the current situation, many collections have a low number of transactions, which creates a cycle of even fewer transactions because buyers are concerned that they will not be able to sell at the right time. The provision of sufficient liquidity to the pool of collections by tapp finance can reduce buyer friction and result in a cycle of increased transactions. How tapp finance works Staking and creating liquidity pools on tapp finance is easy and straightforward. Steps to stake your NFTs in an existing pool :

- Go to tapp finance

- Connect your wallet

- Check your NFTs and pools for them

- Choose a pool to stake in

- take a pair of ETH and NFT in the pool

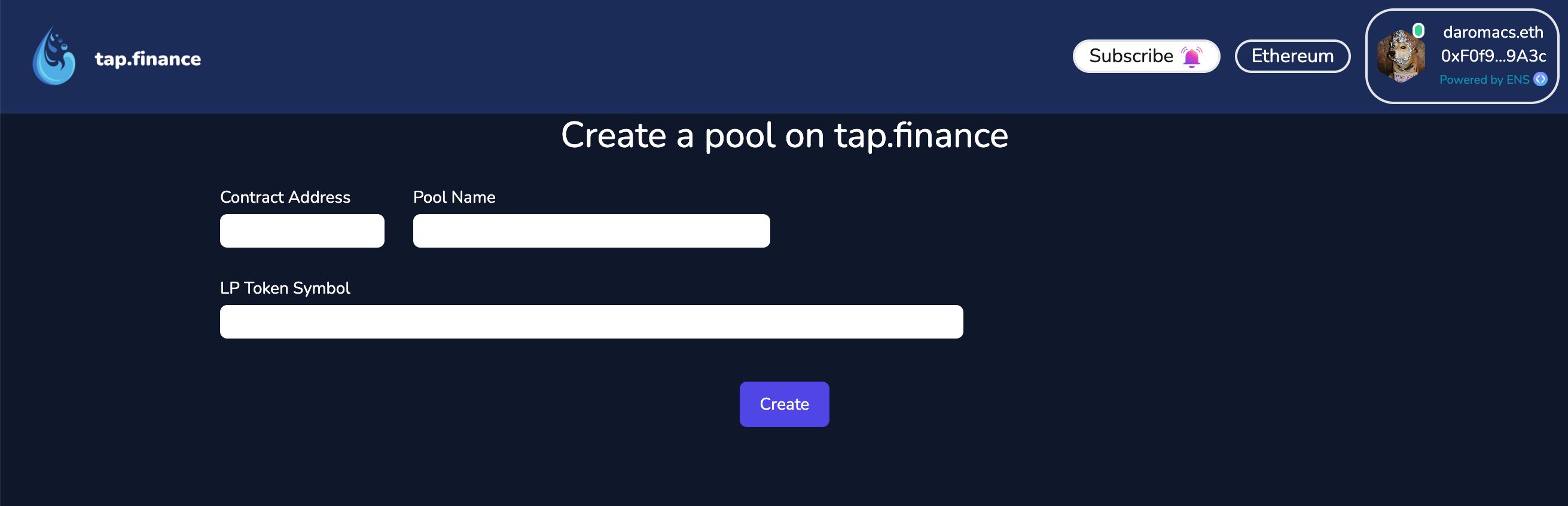

Steps to create a new pool on tapp finance :

- Go to tapp finance

- Connect your wallet

- Check your NFTs and pools for them

- (If there’s no suitable pool existing) create a new pool on tapp finance

Future works(Aggeragation of NFT lending services & Yield workflow automation)

- Aggregation of NFT lending services Provide aggregation services in the NFT lending sector, where there are higher yields in the NFT finance sector and more liquidity is required.

- Yield workflow automation Users can create their very own personalized workflow based on the status of the NFT's pool of AMMs and NFT lending services on multi chains.

How it's Made

@Ethereum & Polygon & Optimism & Skale Network & EVMOS We are supporting multiple EVM chains - Ethereum, Polygon, Optimism, Skale network, and EVMOS. We deploy our liquidity pools contract to create/stake on tapp finance on those chains.

@ENS & Lens protocol & Quicknode We are using ENS, Lens protocol, Quicknode to enable users to log in to tapp finance. It provides users simple and easy-to-understand experiences for on-boarding. And users can use their social graph on tapp finance in the future.

@IPFS We published our community NFT on IPFS as well as the requisite .json data and images. We also have the option of using our ever-growing Push Protocol to send IPFS payloads to any of our channel members.

@Dune analytics & The Graph We obtain pool information with different methods for each liquidity pool protocol. Dune Analytics API predesigned queries are used to get Sudoswap data on a Python Flask backend, mainly the 24-hour volume and the Total-Value-Locked (TVL) on each pool. This is done so that users can compare which pool gives them the best options. For other NFT liquidity pools we intend to use The Graph to generalize events and store the same data as that of Sudoswap in Dune Analytics, with the advantage of having it exposed on a GraphQL API that is much more versatile than a regular REST API.

@Tellor Network We used Tellor Network and its fantastic documentation to create a community NFT, which we will distribute to drum up interest and a sense of agency surrounding our project. The Tellor Oracle Protocol made it fantastically easy to code our smart contract to retrieve data- we decided to use it to change the image of our community NFT when it increases in value (vs decreases in value) so that our community would feel more incentivized to rally interest around the Tap Finance project. After seeing how simple and transparent Tellor makes it for smart contracts to receive data, we are looking at other applications of the technology in the future, like assembling votes from our community members in smart contracts which can distribute more NFTs or contain decision power surrounding the future of our project. The future is bright!

@Push Protocol With a simple tap of a “subscribe bell” (pending their consent/signing, of course) our users are added to our Push Protocol channel and clued into future updates. They will be notified via Push protocol when the liquidity pool lock expires or when an NFT on Sudoswap is sold. In the future, users can opt in for specific push protocol “newsletters”, for examples opting to be notified when sudden large changes (i.e. 10% +- in a day) occur in the APR or delta value of the liquidity pool.

@Midpoint

We used Midpoint to set up a feedback mechanism. Users can submit a form which will use a Midpoint set up with midpoint to give us positive or negative feedback (using Twilio). Users then can see the transactions that have been occurring and have a verifiable way to make sure their voices are being heard on our platform, and also be able to determine the quality of our offerings. Midpoint makes the whole process much easier by taking care of the smart contract integration with Twilio’s post requests.

@Next.js & Tailwind CSS & DaisyUI & Fleek The frontend is written in Typescript with Next.js used as the framework, and tailwind css as well as daisyUI for styling. For the contract interactions, we use wagmi, ethers.js and RainbowKit. For the deployment, we use Fleek, so we don’t depend on the centralized hosting service.