Symbiotic Bonding Curves

Symbiotic Bonding Curves enable sustainable funding for DAOS that evolves together with them. Built as an Aragon plugin.

Symbiotic Bonding Curves

Created At

Winner of

🏆 NounsDAO — Best Public Good

💰 Aragon — Best DAO fundraising plugin

Project Description

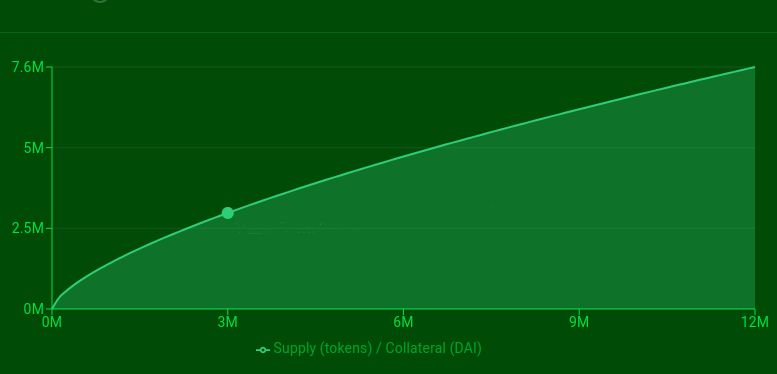

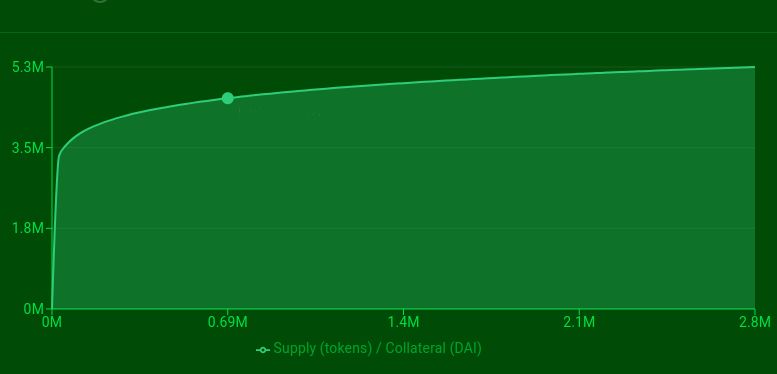

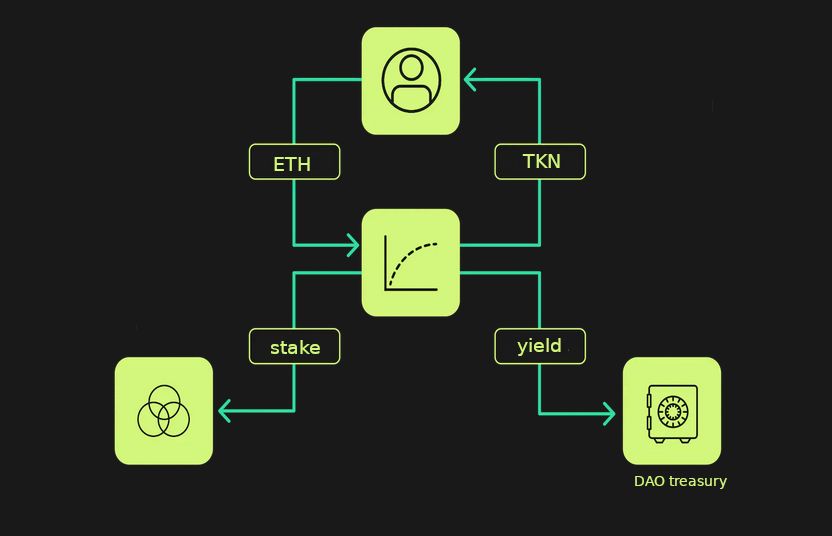

I implemented a Bonding Curve plugin for Aragon DAOs which wraps the reserve token into a liquid staking protocol, allowing it to earn yield while backing the token. Due to the rebasing design common in LSD token, we can handle the resulting yield in three different and interesting ways: -1) Withdraw the yield and send it to the treasury -> Automatic cash flow for the DAO in the token of the protocol they are based on (which creates a win-win situation, since LSDs are doing validation work) -2) Mint-and-Burn. This locks the underlying liquidity in the contract. Due to the nature of bonding curves, it enforces a minimum token price, which can only grow from there -3) Modify the reserve ratio. If we account for the new funds without minting tokens, we effectively increase the reserve ratio, flattenign the curve. This over time would have the effect that the curve would settle around a time-averaged fair market price, and allow the communtiy members to enter and exit fairly.

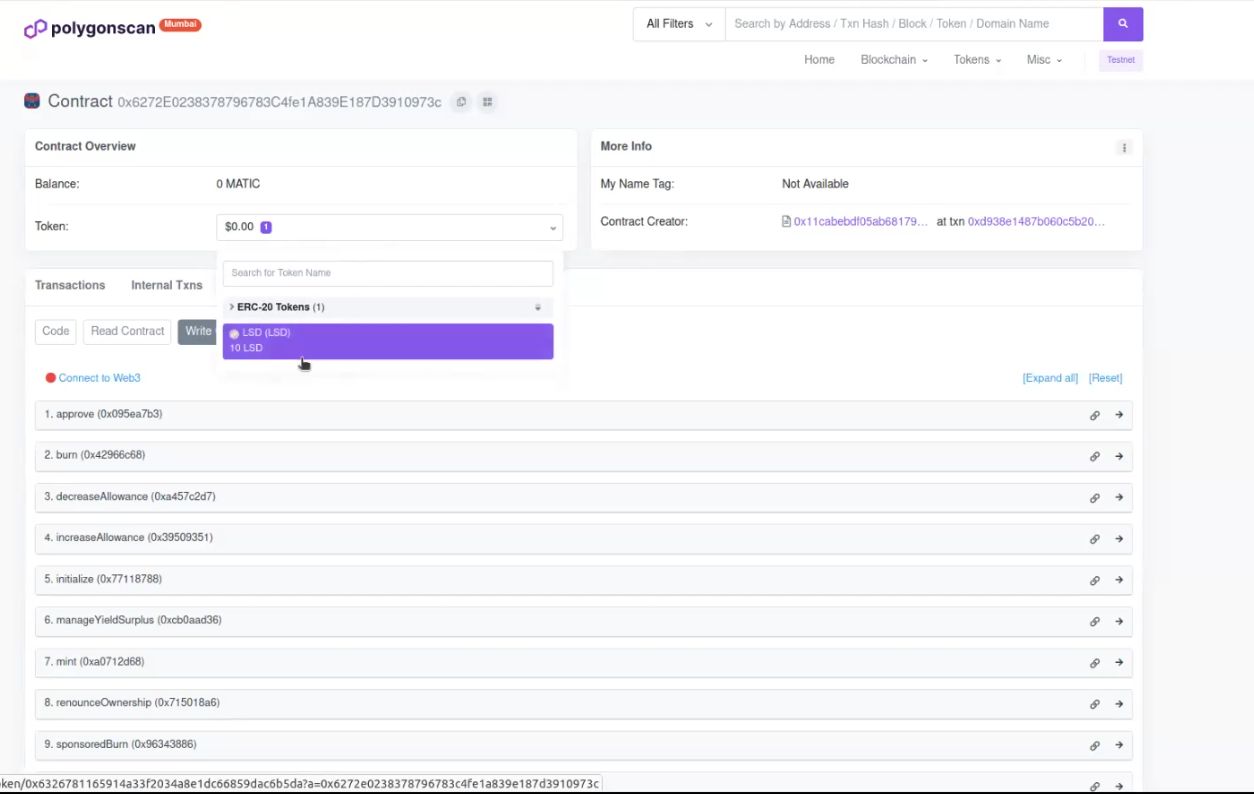

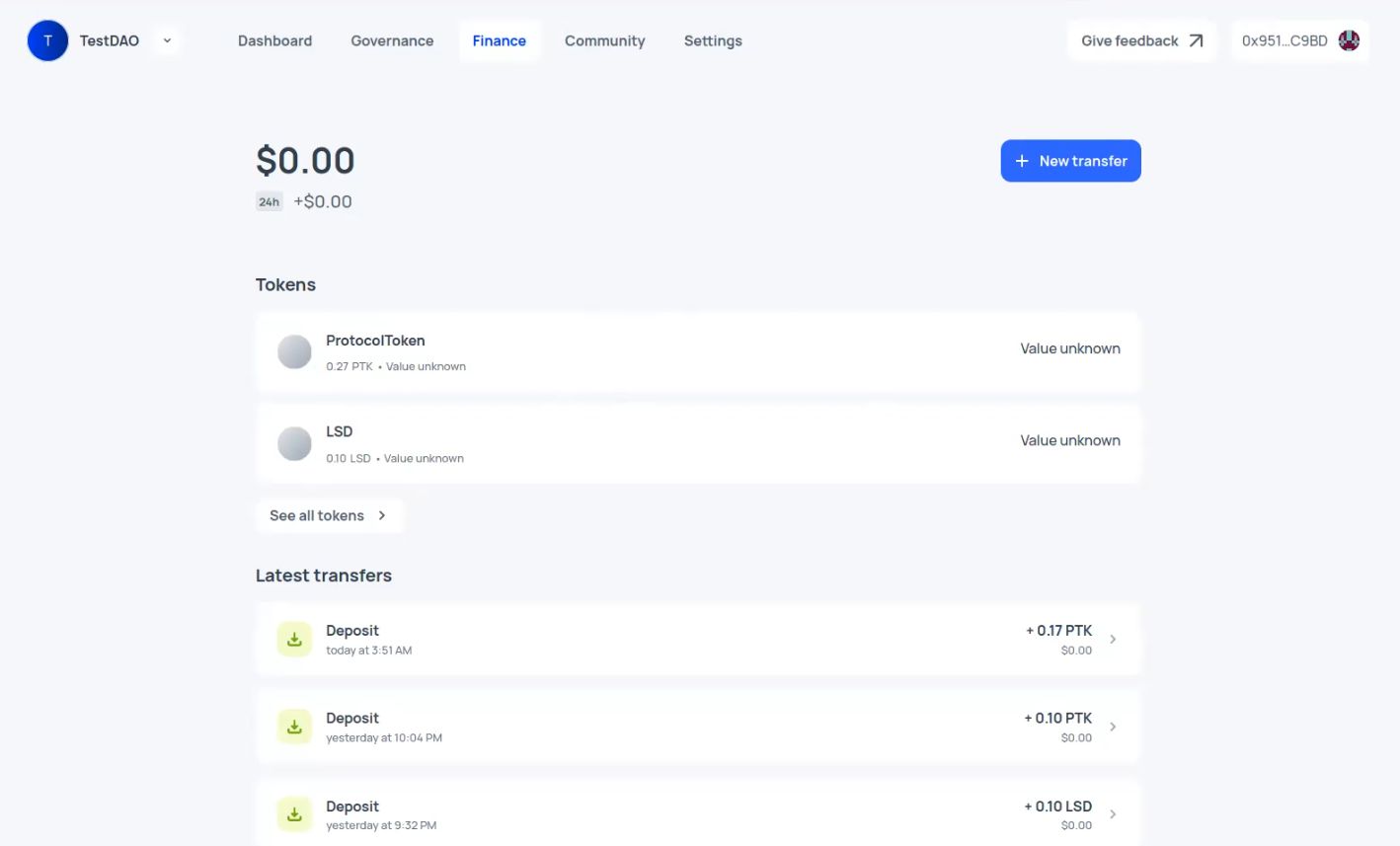

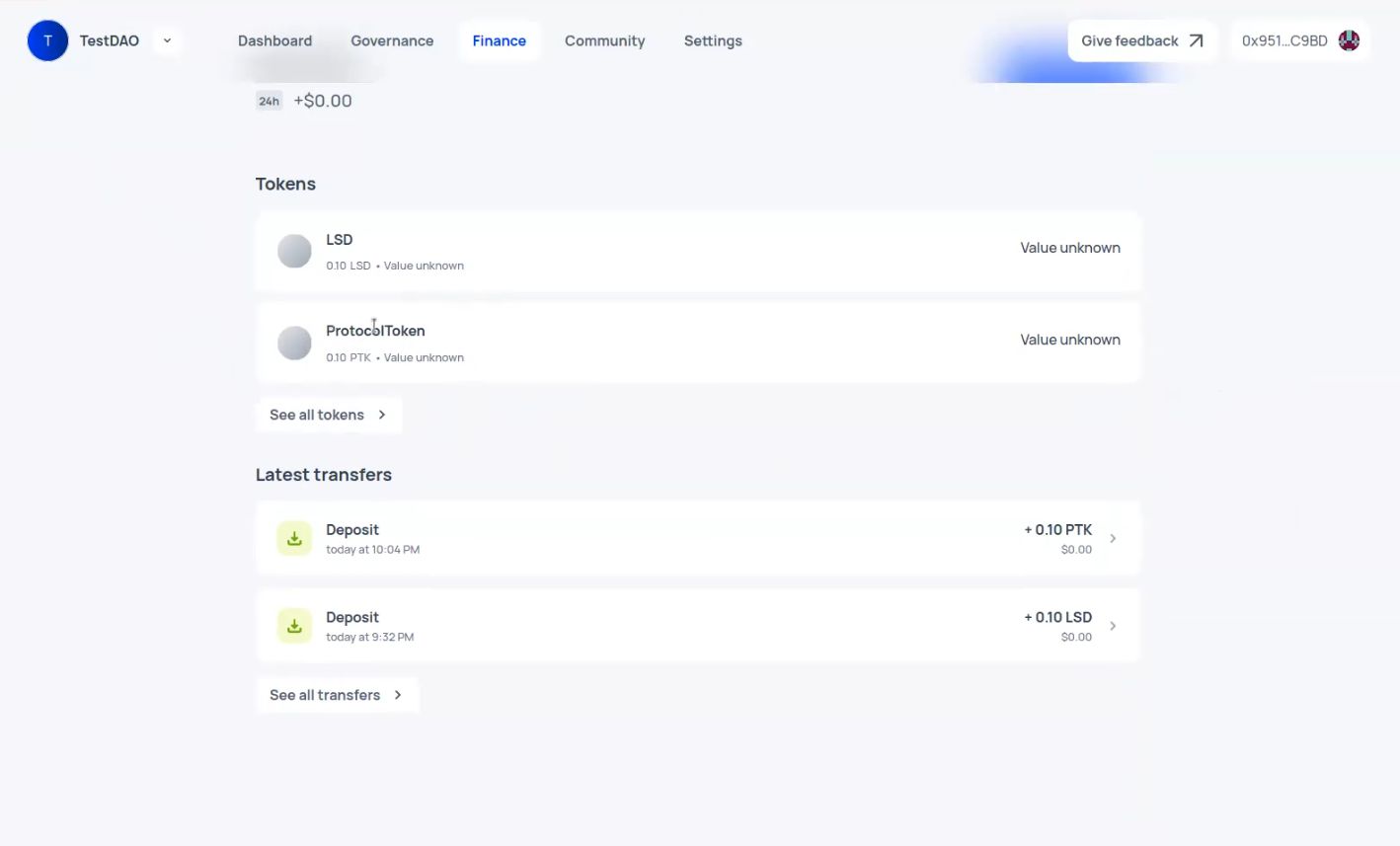

This is a PoC and uses mocks for the reserve token and the LSD. The plugin itself is functional though, although I didn't get the time to finsih the script that would properly integrate it into the Aragon DAO (for now it is only linked).

How it's Made

-Solidity (Foundry) using the Aragon osx contracts (really straightforward to work with for plugin creation!) -Some original Solidity Scripts to avoid using JS. -Deployed and working on Polygon Testnet, verified on etherscan -Chainlink automation -Gasless transactions enabled on contract level