Sellary

Sellary allows freelancers, DAO contributors or employees to claim their streamed income instantly - by wrapping the future value of SuperFluid money streams into tradable NFTs.

Project Description

Sellary is a future income NFT protocol built on Superfluid. It enables money stream receivers to instantly exchange their money flows against their accumulated future value.

Assume Hacker Pepe currently works at Developer DAO and receives his wage as a real time income stream via Superfluid. Suddenly he stumbles upon a DeadFellaz NFT listed at 2 ETH, well below its collection’s floor. If he had to wait until his streamed salary finally accrued sufficient funds to buy it, someone else would have sniped it before for sure.

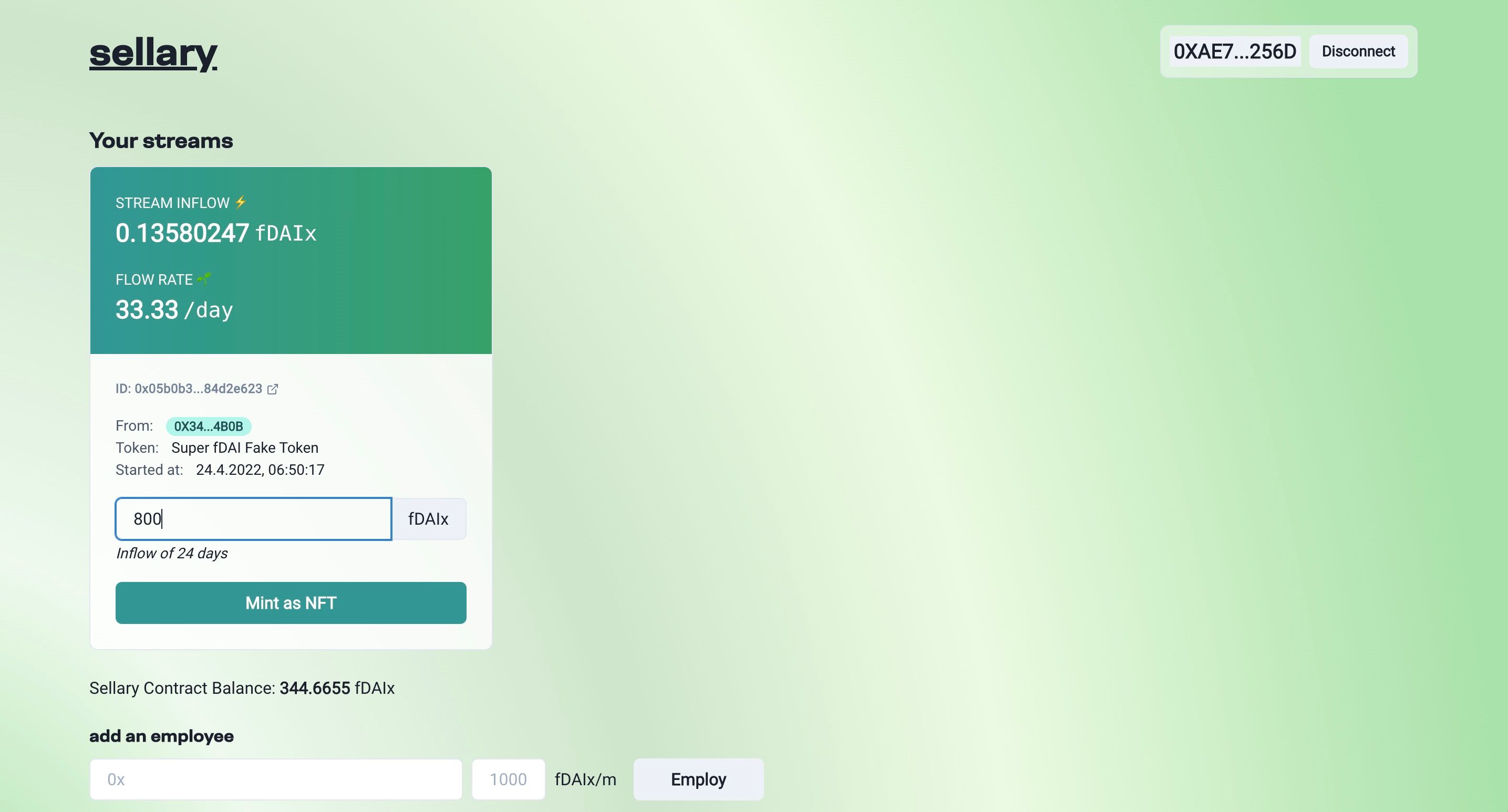

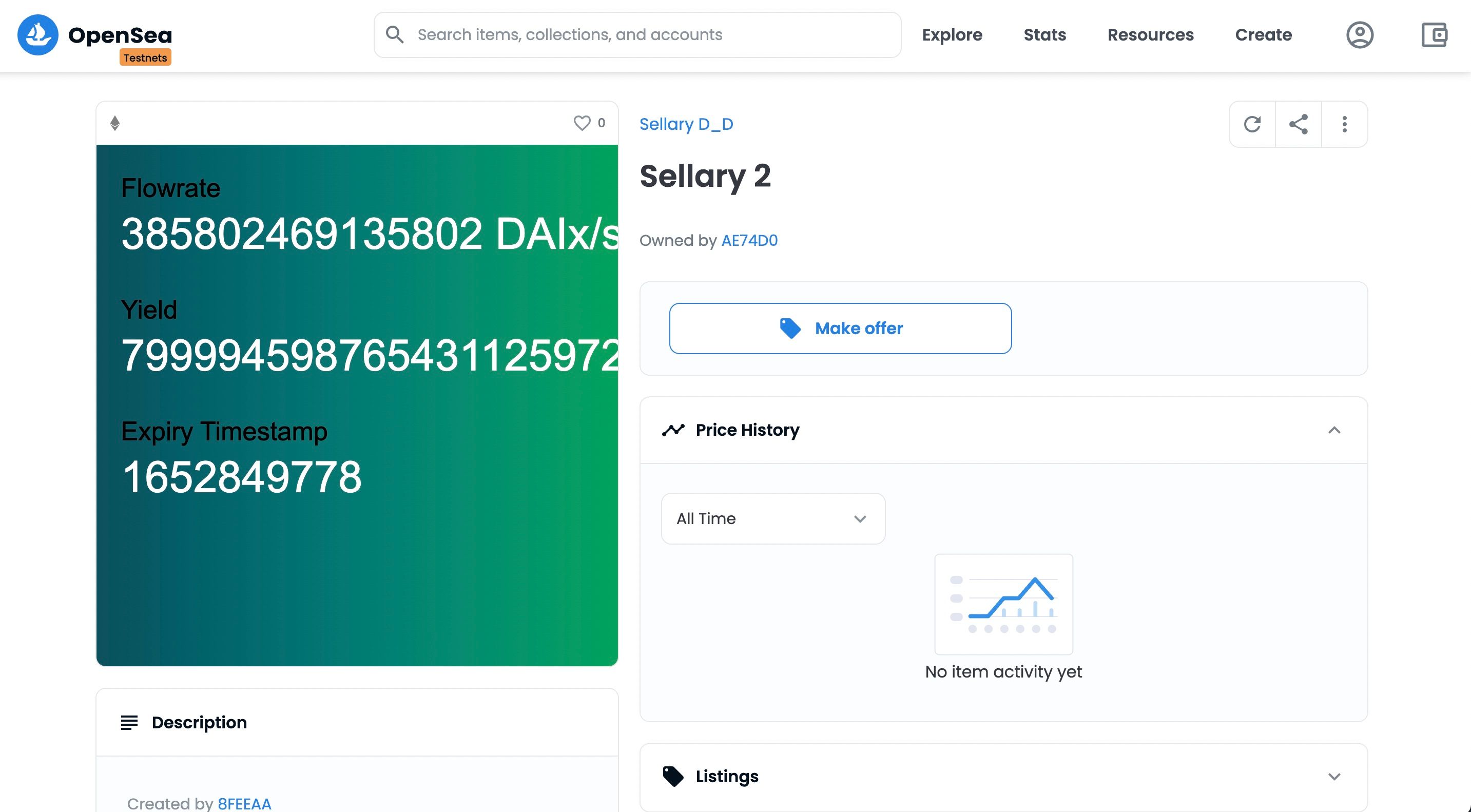

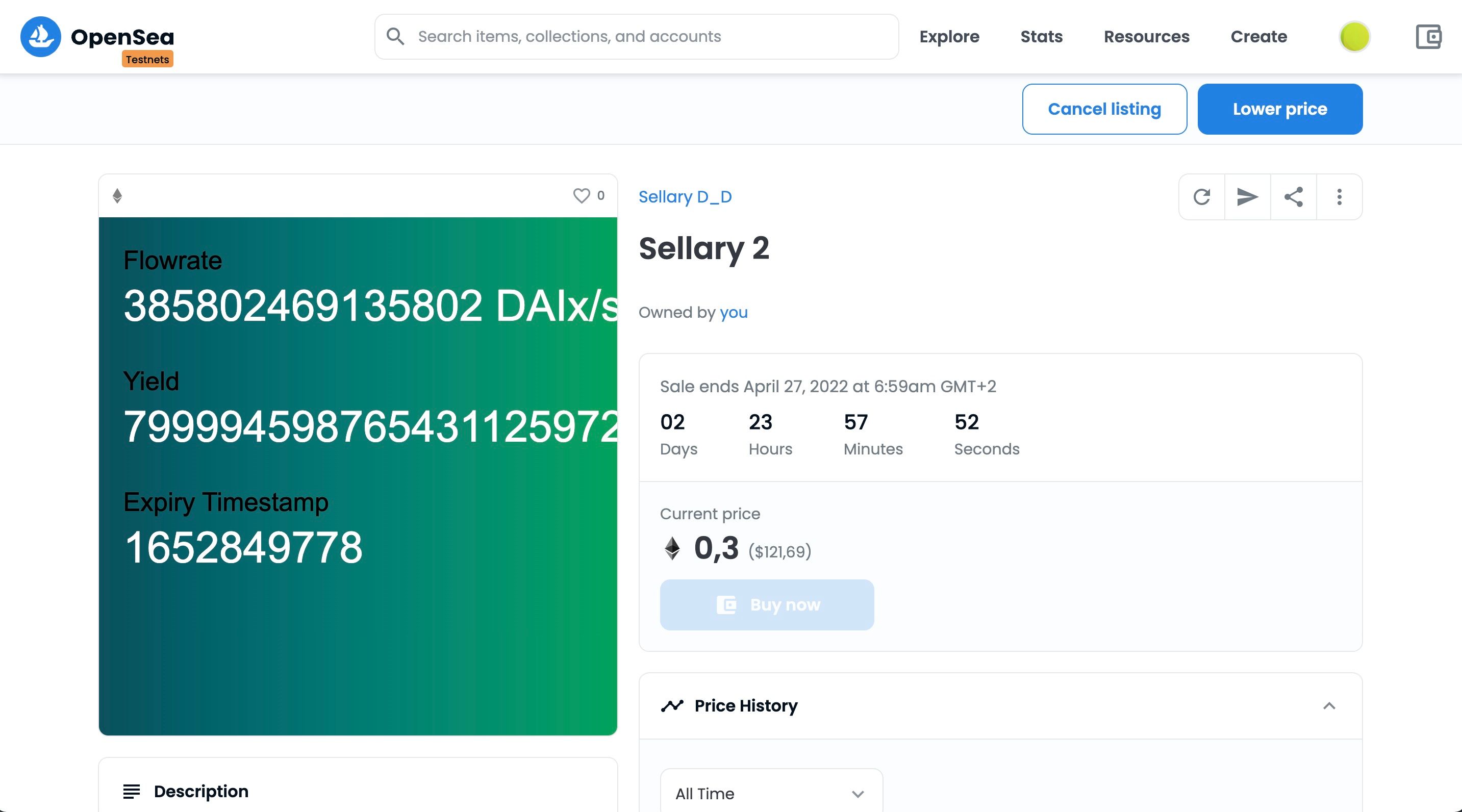

How great would it be for Pepe if he could instantly get his income stream’s value?! Sellary allows him to wrap his real-time revenue stream into an NFT and offer it to investors on public marketplaces. The token’s initial price is determined by the underlying money flow rate and the duration Pepe wants to sell it for. Once an investor buys the token (potentially at a discount), Sellary delegates the stream’s output to the respective new holder. Pete can use the proceedings to take the Deadfellaz bargain and make a profit from its developing market value.

Sellary provides instant liquidity and flexibility for money stream receivers. Realizing long term revenues as NFTs let employees benefit from much better interest rates and is dramatically more convenient than requesting credit at a bank. Investors can consider Sellary NFTs an attractive investment opportunity that’s backed by an individual’s salary.

Technically Sellary is an ERC721 contract that’s controlling all stream flows for recipients. Entities (“employers”) who’d like to offer the protocol’s advantages to their employees stream collective funds to their dedicated Sellary treasury contract that controls the beneficiaries’ income streams. A receiver can decide to wrap their stream into a Sellary NFT by just calling the contract’s issueSalaryNFT function providing the desired duration the NFT should capture in value. After the NFT is minted, the original salary stream is replaced by a new income stream that’s targeted at the first NFT holder. All subsequent transfers delegate the stream output to the respective new owners. After the NFT’s lifetime has ended, the original salary recipient can claim back their original salary stream by burning the asset.

Potential extensions:

• Pooling. Instead of purchasing individual NFTs, multiple stream NFT representations are collected in a pool that investors can collectively invest into (like Uniswap)

• Investor’s Insurance. Buyers can hedge against the risk of defaulting stream origins (i.e. by keeping 1% of NFT sales in an insurance pool)

• Multichain support. Integrate other chains, e.g. via Connext

• add EPNS support to be notified when an NFTs has reached its lifetime and can be claimed by the salary owner

• Delegated claim burning: anyone can burn mature NFT streams and receive a small reward that’s deducted from the NFT sales price

How it's Made

Sellary is built on top of the Superfluid money streaming protocol. Our contracts rely on OpenZeppelin’s primitives and we use Hardhat as our toolchain of choice for building, testing and deploying. Frontend-wise we make use of React / NextJS and decided to go with web3modal to connect to injected providers and WalletConnect.

typescript

pnpm monorepo with two packages

hardhat

typechain

oz erc721 base impl

nextjs / react

chakraui

web3modal in context

ethers.js

server based metadata (next) unrestricted minting fetching assets directly from chain