Purple Pay

Scan and pay payment protocol to send and accept cryptocurrency payments globally

Project Description

Purple Pay is built on Polygon for instantaneous transactions, fees that are fractions of a penny, and a net-zero environmental impact.

The original use case for cryptocurrency was Bitcoin- self-sovereign money. Bitcoin’s core ability to make cross-border payments happen without an intermediary was revolutionary.

Despite a decade of innovation in the space, it has continued to be a speculative asset with limited real-world usage. The ability of people to transact with each other ensures we have access to products, services, and an incentive for people to build those products/services.

Payment infrastructure, ie. the ability to allow people to send and receive payments is a fundamental need. We believe crypto payment infrastructure will be pivotal in helping people get access to credit.

Here is how people can use Purple Pay:

- Send and receive crypto: Create unique links to receive funds in your wallet

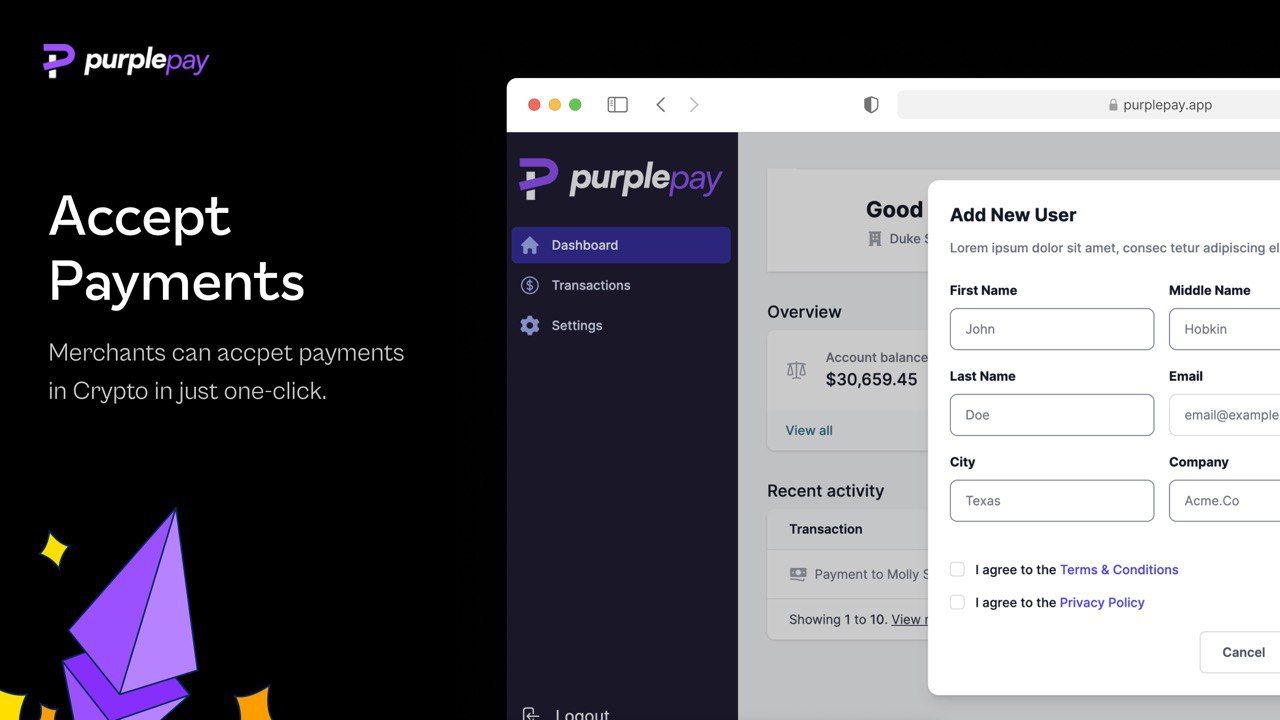

- Accept Payments: Merchants can accept payments now through Purple Pay API

- Scan and pay: Clean payments with scan and pay infrastructure, no more lengthy wallet addresses

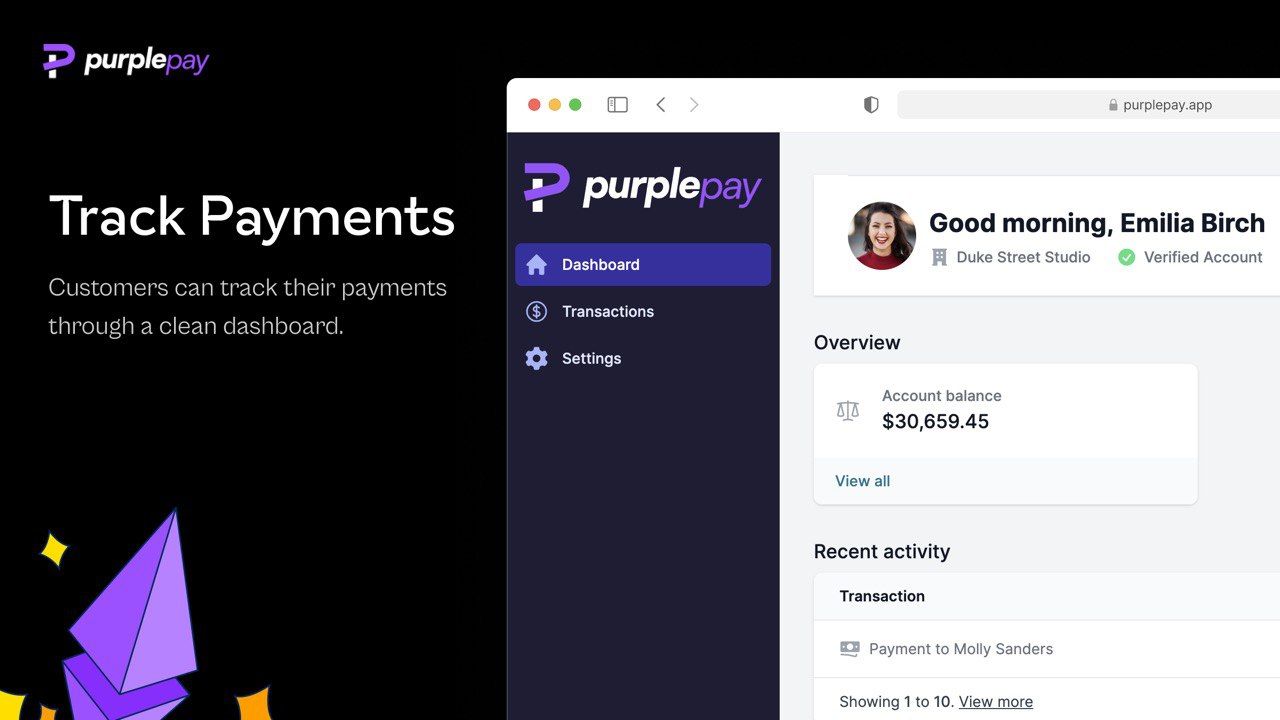

- View reports: Manage payments and view reports at the click of a button. No need to spend time evaluating block explorer transactions

To make it easier for folks to make payments going forward we want to integrate Biconomy’s relayer protocol along to make transactions gasless. We also seek to provide multi-chain and multi-coin support by using Etherspot’s SDK and LiFi’s bridge API.

Our belief is that most governments have a strong anti-crypto stand because they see it as a way for money-laundering activities and other tax evasion practices.

Our vision with Purple Pay is to solve regulatory concerns by creating a KYC-compliant protocol through ZK-enabled-decentralized identity that adheres to money-laundering regulations globally. At the same time, it does not reveal the identity and other details of the people making those transactions.

How it's Made

Building a payment protocol is hard. Building one for scale is harder. Here are a few challenges that we came across while building out Purple Pay:

- Secure authentication:

- Challenge: Ensure maximum amount of security so no fraudulent transactions can take place

- Solution: Using the Django framework that is battle tested for its security including CSRF token, click-jacking, and cors protection

- Session-based payments

- Challenge: Tracking the status of the payment on a real-time basis while having a limited validity

- Solution: Created a session-based payment system for the user to have 60 minutes to make payment.

- Permissionless money flow : Leveraging smart contract to move the money to the merchant

- Challenge: Finding a permissionless way to disburse amount to the merchant while taking a commission in a secure non-custodial way

- Solution: Made a factory contract that served as a permissionless way to carry out transactions to a merchant smart contract wallet during merchant onboarding

- Anonymity for merchant information:

- Challenge: Restricting merchant information

- Solution: We are only collecting email address and phone number

- Database architecture

- Challenge: Multiple stakeholders and moving parts- merchants, smart contract, authentication

- Solution: Designed the tables to reduce repetitive and redundant queries

- API contract design with respect to speed/scalability and security

- Challenge: There’s a trade-off because the number of validations and verifications we increase, the more bottlenecks it introduces and reduces the velocity of transactions and adds friction to the system

- Solution: Introduced industry standard JSON token which allows you the flexibility of limited time validity of the token enabling modulating the time it is valid- reducing the chances of unauthorized usage.