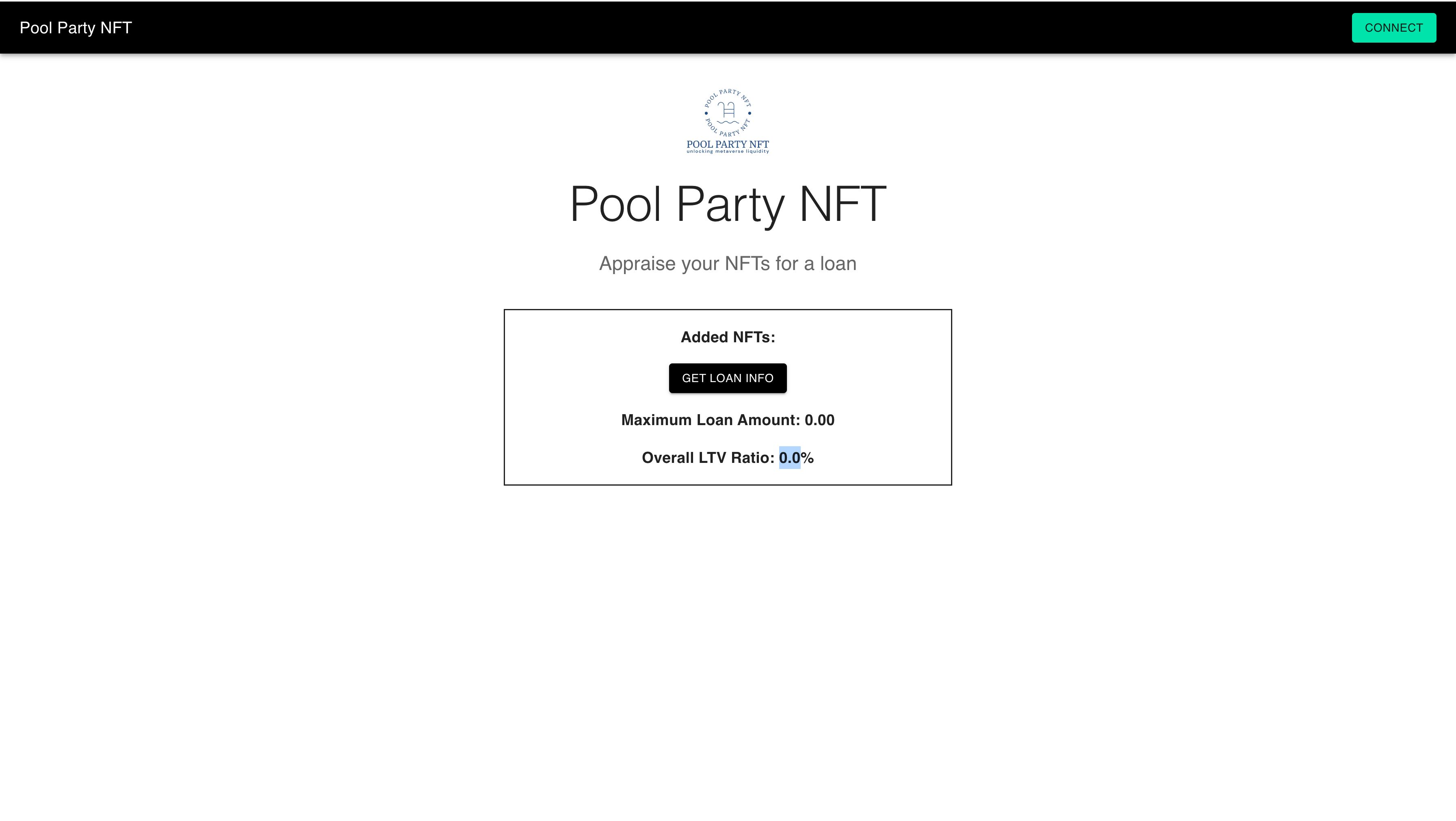

PoolPartyNFT

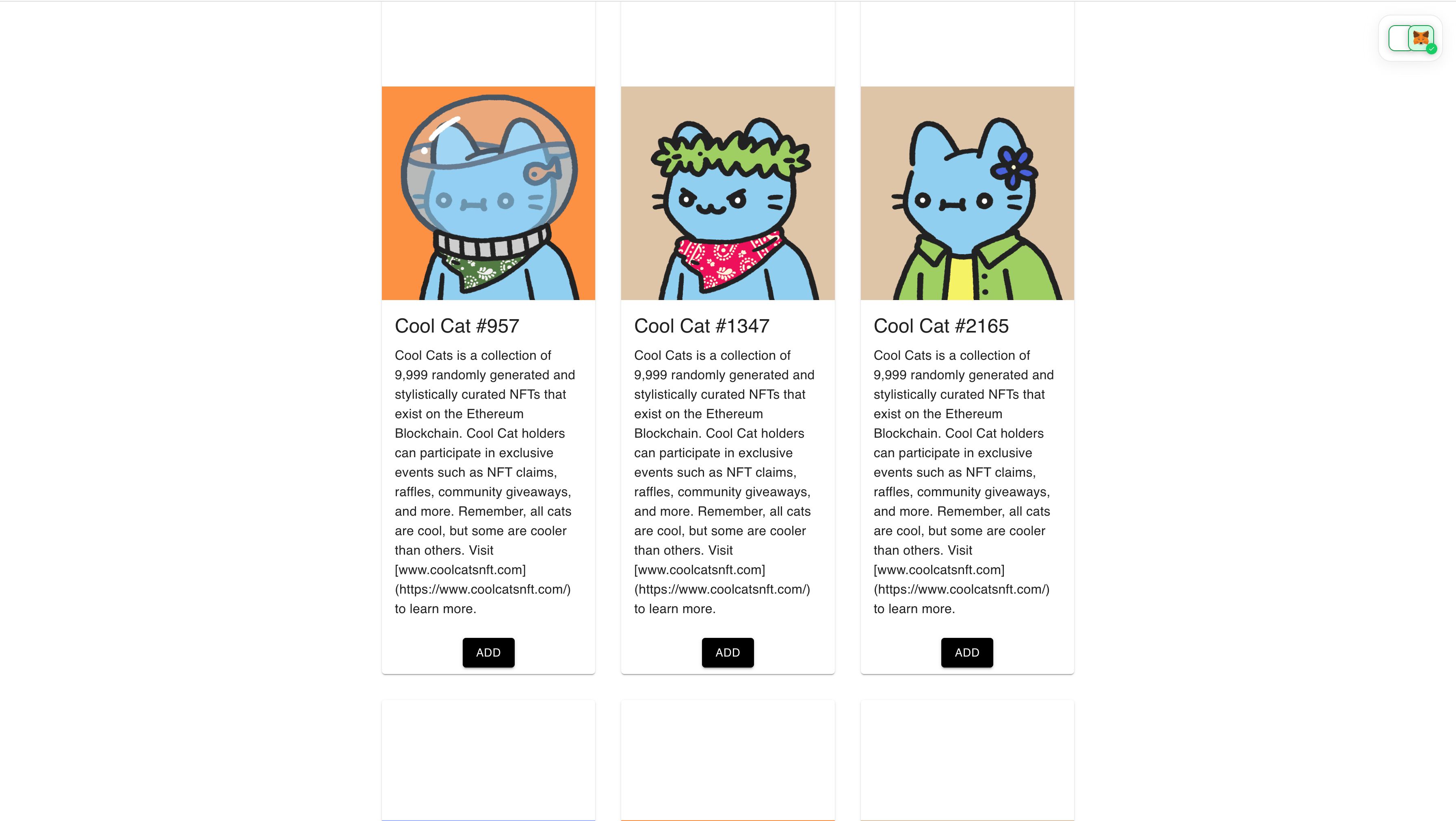

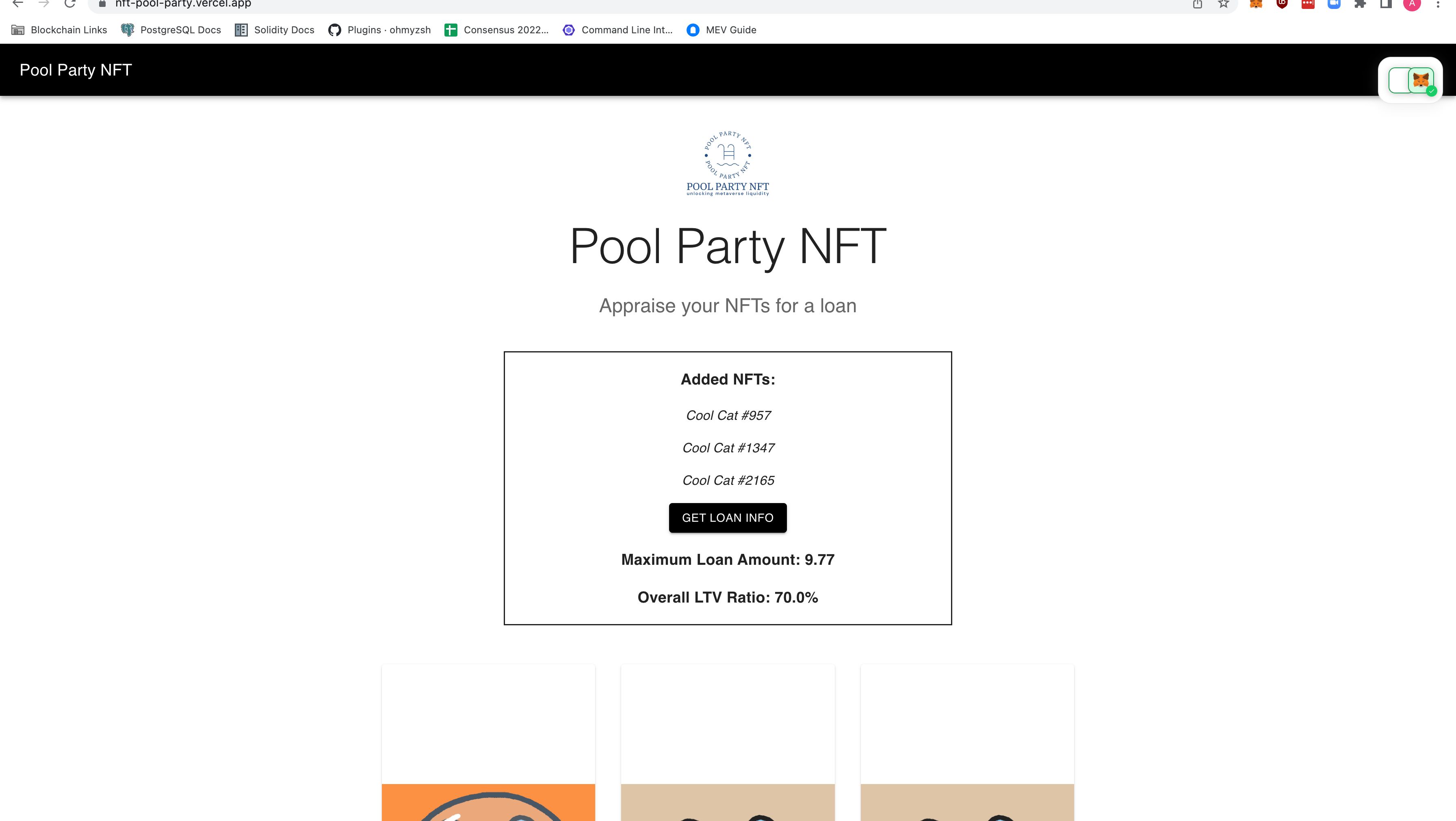

Pool Party NFT enables liquidity (USDC loans) for Metaverse Land NFTs at a set interest rate through price prediction and risk assessment. The lands deposited are redistributed to rental protocols and event organizers to increase yield for land holders.

PoolPartyNFT

Created At

Winner of

🚀 Optimism — Just Deploy!

🏊♂️ NFTPort — Pool Prize

🥇 Reservoir — Best Use

Project Description

Billions of dollars is locked up in Metaverse land. Peer-to-peer solutions exist to enable NFT liquidity at a small scale, but large holders are out of luck when lending against hundreds, or thousands of Metaverse assets.

Pool Party NFT aims to solve this problem in a similar manner to how Aave solved liquidity for erc20s. Through our USDC pool, which anyone can contribute to, large scale loans against bundles of NFTs can be given with quantitative risk analysis on the combined appraised value.

Because Land is a platform, which can be built on top of, the NFTs at the Pool Party do not sit still; they are reallocated yield generating opportunities like rental protocols which are used by metaverse event organizers. This yield goes back towards paying borrowers’ interest and can even pay off their loans.

Pool Party NFT brings mass liquidity to the Metaverse. https://twitter.com/NFT_PoolParty

How it's Made

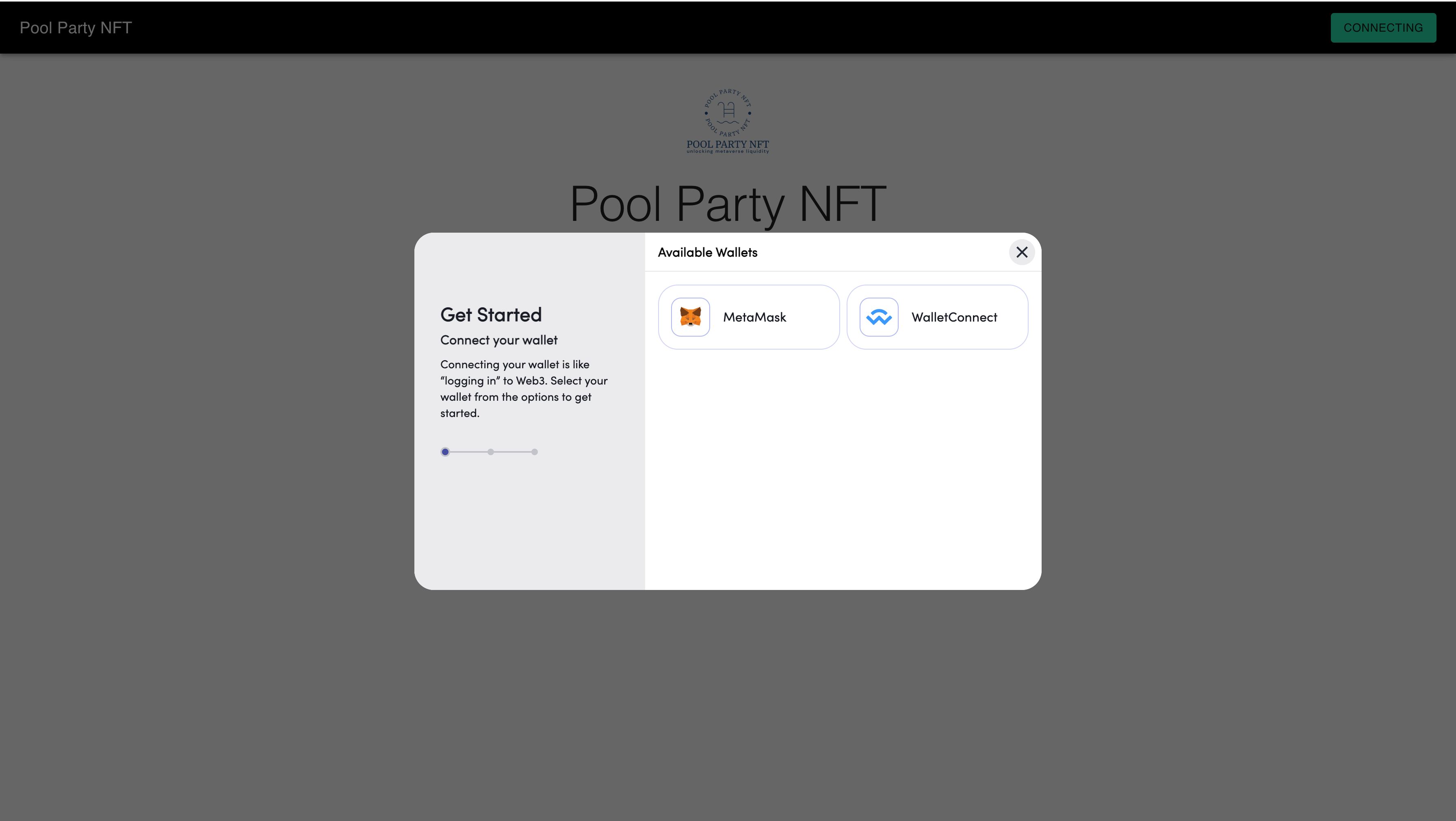

We were inspired by Aave and Compound lending pool tech and how it solved the liquidity problem in crypto lending space. We've embarked on a journey to solve the same problem for NFTs. To appraise the NFTs in the right way we've used historical data from Covalent and Reservoir APIs and combined them together with our data model. We've used Polygon, Cronos and Optimism to make our solution available across the ecosystem and to reduce transaction fees.