PayPay

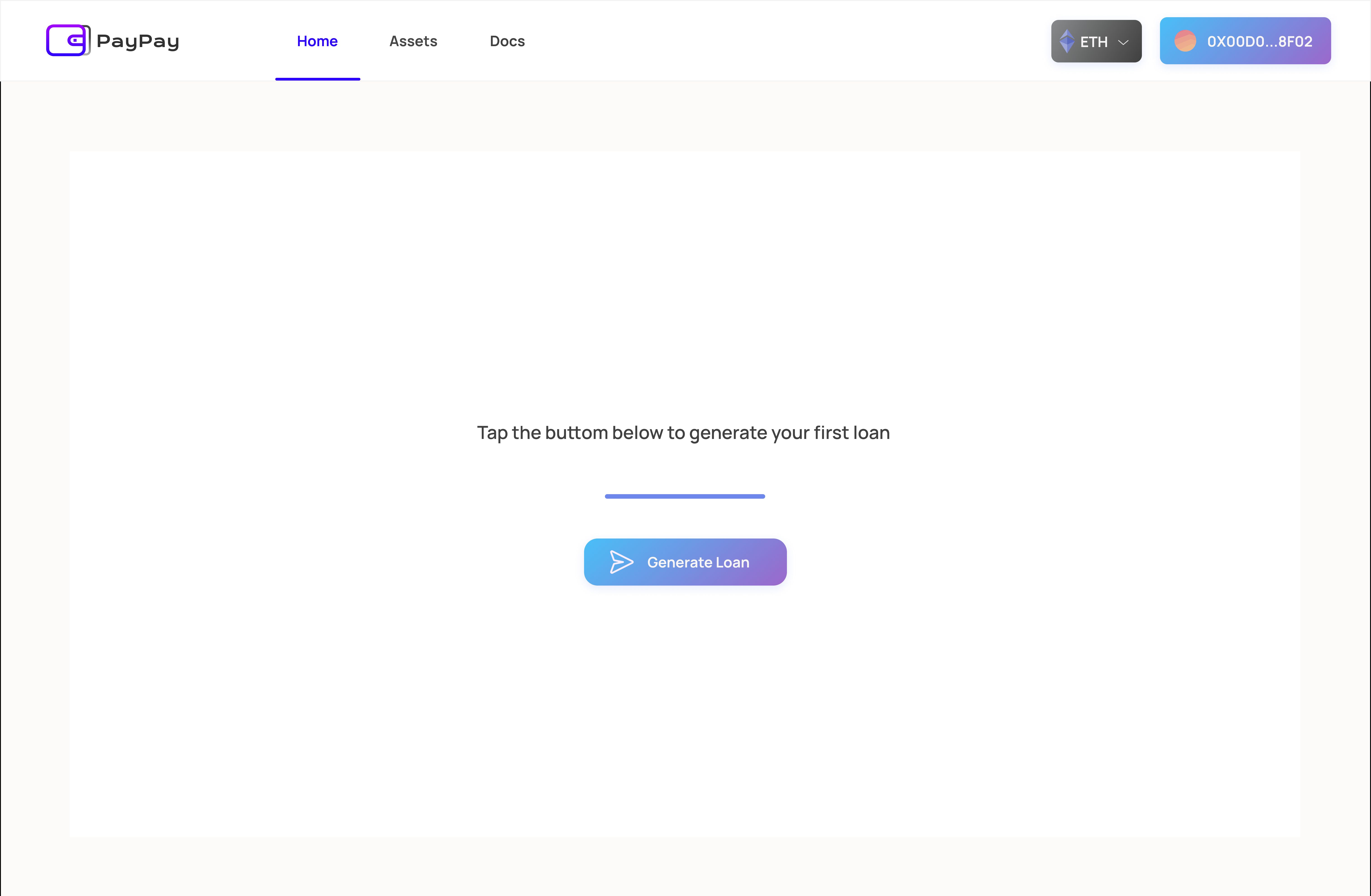

Decentralized marketplace protocol for tradeable NFT lending.

PayPay

Created At

Winner of

🚀 Optimism — Just Deploy!

🥇 Chainlink — Best Use

🏊♂️ SKALE — Pool Prize

💪 EPNS — Best Use

🏊♂️ Superfluid — Pool Prize

Project Description

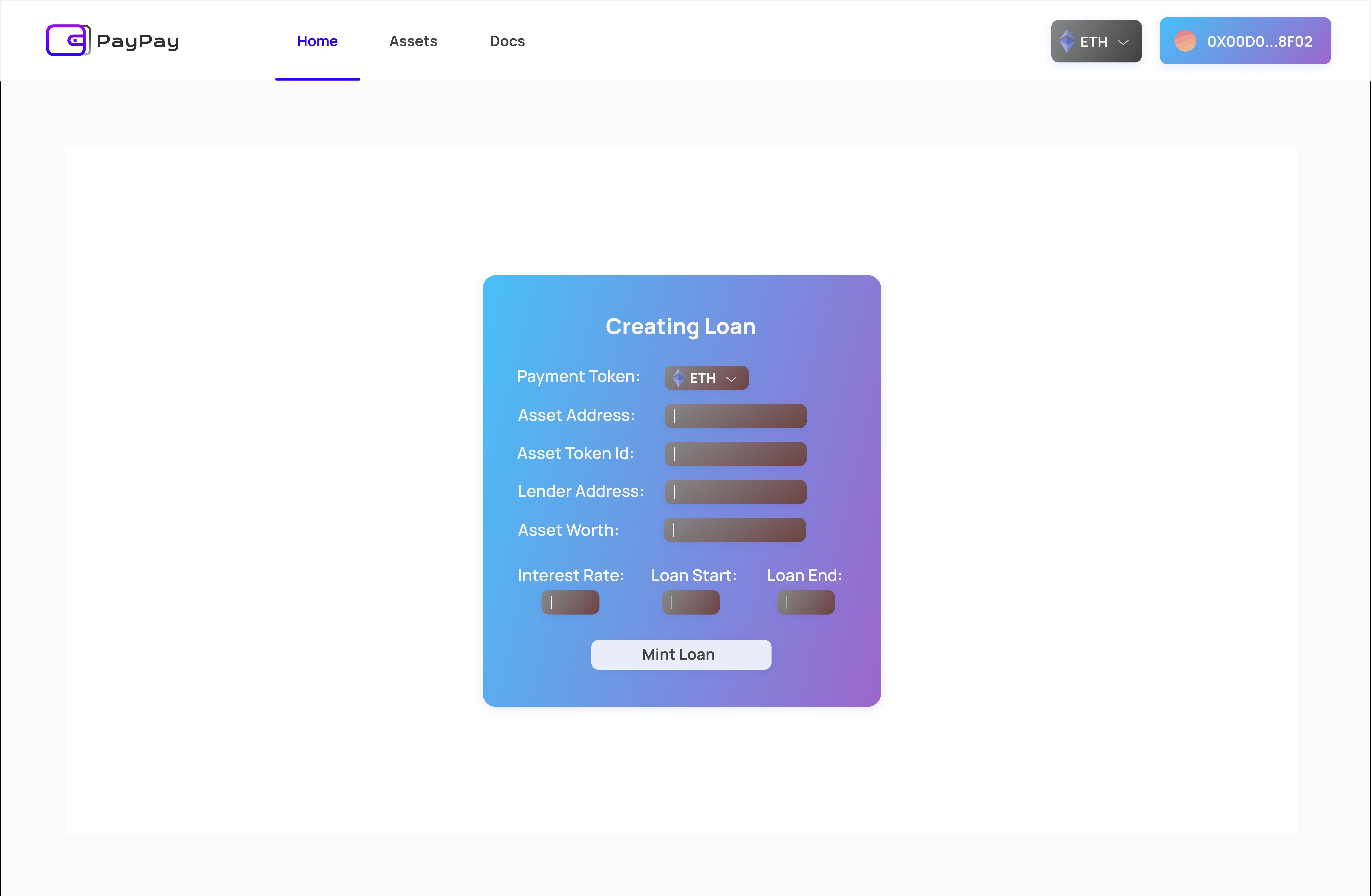

PayPay is designed to enable various NFT lending mechanisms such as Buy Now Pay Later (BNPL), real estate mortgages, or NFT subscriptions. A digital or real-world asset, represented as an ERC721 NFT is locked in vault managed by 2 counterparties, a lender and a borrower, for a certain amount of time.

The PayPay vault contract has various use cases. The closest analogy is that of a real estate mortgage. A bank lends a borrower funds to purchase a house. While the title of the house is transferred to the borrower, a lien is placed on the house that gives the right to the borrower to repossess it if the borrower defaults on the mortgage. PayPay vault has other use cases however, enabling Buy Now Pay Later (BNPL) mechanics for users wishing to split their NFT purchase costs over time. Similarly, PayPay vault can be used for subscriptions, such as NFT DAO memberships, enabling a much more stable recurring funding system as opposed to one-time lump sum fundraising.

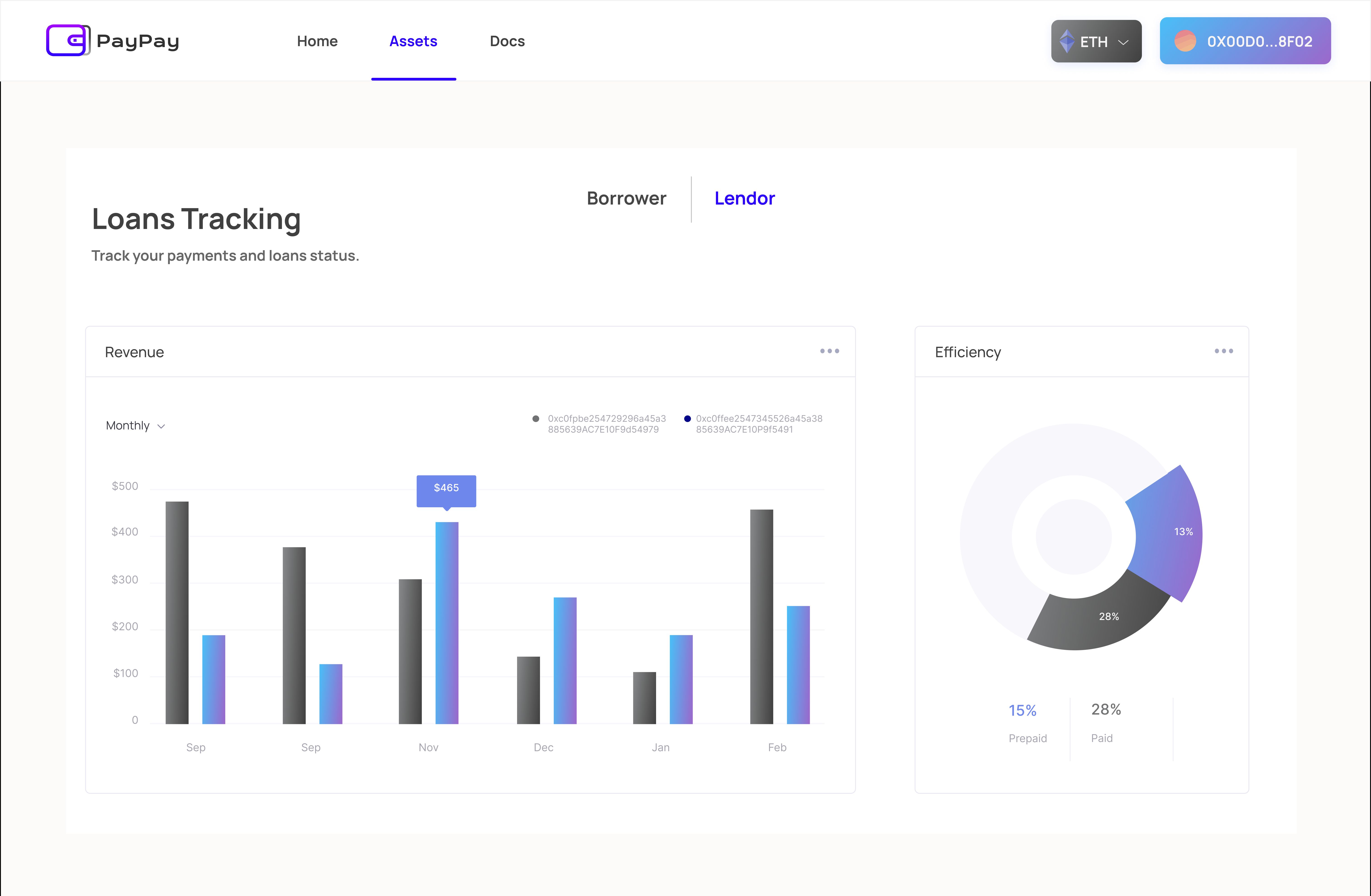

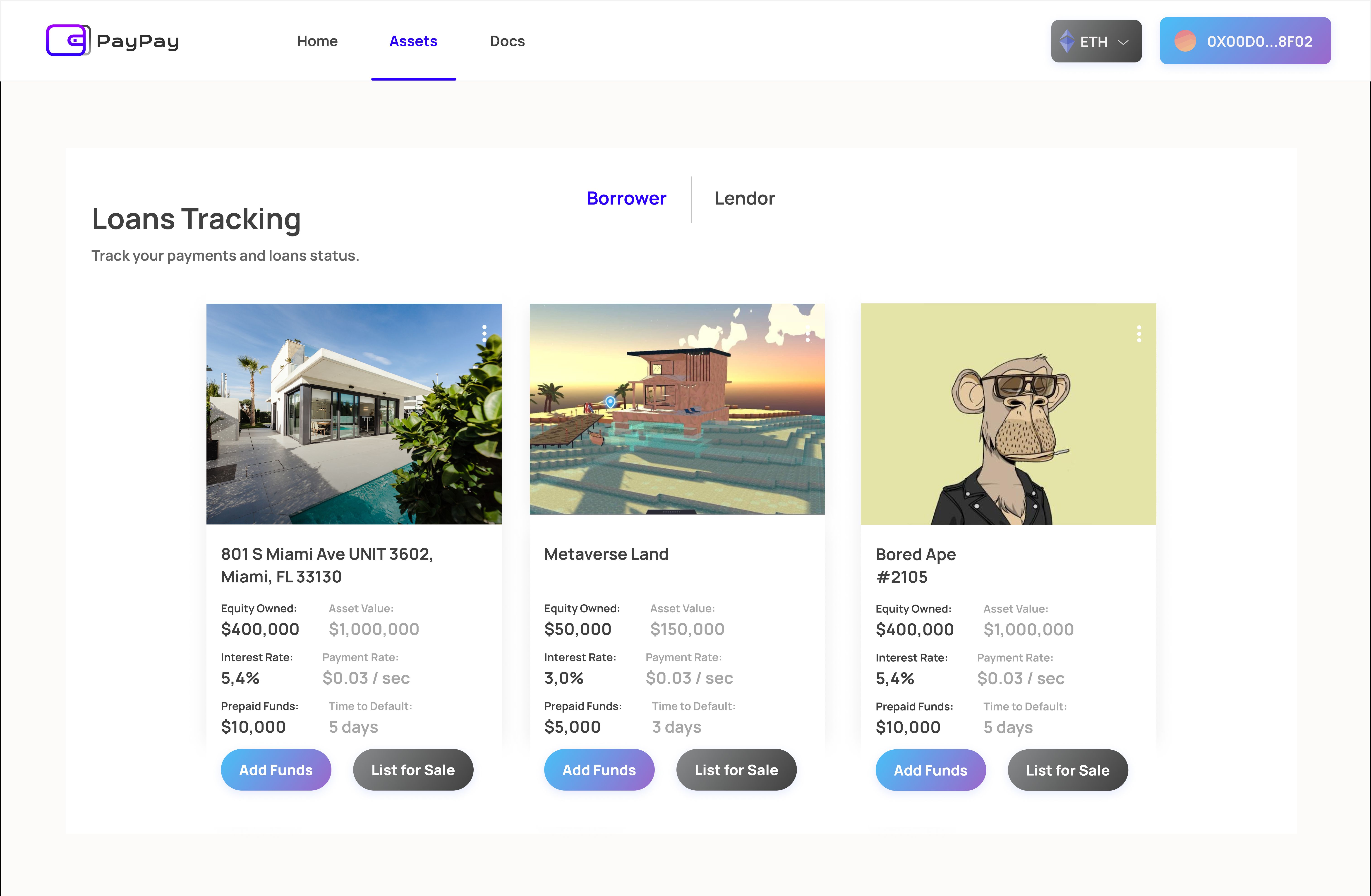

The lender, which is usually the original owner of the asset, earns cashflows paid by the borrower to acquire the asset before the vault expires. The borrower is looking to access the benefits of the NFT (real estate title, DAO membership) today without having to fully purchase the NFT on day 1. This is not a temporary rental however, as if the borrower pays both the interest and principal on the vault, the asset NFT will be unlocked and transferred to the borrower.

The borrower pays the lender 2 cashflows, principal which increments the borrower’s equity ownership, and interest, in the form of fixed coupon payments. The cashflows of the vault resemble that of a callable bond as the borrower has the option but not the obligation to fully pay the principal at any time to avoid paying future interest. Unlike a traditional bond however, all payments are continuous and streamed per second.

The vault’s risk profile is similar to that of a mortgage: if a user defaults on the payments at any time, the lender may claim the locked asset. In some circumstances, the vault may be underwater if the value of the locked NFT asset declines below the balance of the vault (remaining principal + interest), providing no incentive for the borrower to continue payments. This is by design, and lenders should look to use relatively stable assets and implicitly require a security deposit by overvaluing the required principal payment (eg. 20% premium).

PayPay is not just an NFT lending platform but a tradeable lending platform. This is due to how both counterparties, lender and borrower, are actually represented as NFTs. Whoever owns the “borrower” NFT can continue payments in hopes of claiming the locked asset, and whoever owns the “lender” NFT can claim the cashflows streamed to the vault. Both roles and their associated cashflows are therefore tradeable.

Thanks to leveraging NFTs as proxies to the underlying counterparties, lender and borrower addresses do not have to be static and can be traded, bundled, or fractionalized with any marketplace or protocol that supports ERC721 NFTs. This enables a couple additional use cases.

A lender wanting to claim the Net Present Value (NPV) of future cashflows can sell the lender NFT to a third-party that discounts those future cashflows less than the original lender (eg. views the mortgage as less risky). A borrower wanting to exit the vault but still claim the value of their accrued equity can sell the borrower NFT to someone that wishes to continue making payments to claim the NFT (eg. if the locked asset has increased in value or if the borrower thinks they might default).

How it's Made

PayPay vault is a standalone meant to connect crypto asset, lender, and borrower. We use various technologies to enable scalability and capital efficiency.

PayPay vault leverages Superfluid to enable stream payment of principal and interest. To keep a simple architecture, the PayPay vault does not manage the stream itself but simply checks that its current balance of super tokens is sufficient to cover accrued interest and principal. This enables a borrower to easily manage streams through the SuperFluid UI and also cancel them if they transfer the borrower role NFT (a new stream will likely be opened by the new borrower).

PayPay is deployed on various L2s including Polygon, Optimism & SKALE to enable easy to use and cost efficient decentralized finance. Keeping track of multiple NFTs, interest rates, and time parameters would have been possible, but much more expensive on Ethereum Mainnet.

The final component we use is Chainlink Keepers, which we leverage to enable automatic claiming of the locked asset for the lender. This enables the lender to automatically claim the collateral if the vault is in default. This is important as in the future a lender might want to immediately auction off the locked asset. We also plan to extend the PayPay vault with a Chainlink oracle to enable variable interest rates based on an interest rate oracle.