OMZ

OMZ is a MultiChain OTC market with notification function for p2p trading

OMZ

Created At

Winner of

📜 Scroll — Just Deploy

Prize Pool

🔟 Push — Top 10

🏊♂️ Polygon — Pool Prize

💸 Hyperlane — Best DeFi

Project Description

OMZ is a MultiChain OTC market with notification. The seller must deposit stable token in escrow for the transaction, and the deposit ratio is determined by the seller himself. Based on their decision, the buyer purchases stable token in escrow to complete the transaction. In the process of making a transaction, you can receive an alarm according to the transaction.

How it's Made

We used the Polygon chain, which is relatively faster in a MultiChain based OTC transaction, as the underlying chain to store information on OTC orders and match them. Through MultiChain OTC transactions, you can buy or sell coins or tokens from various chains, allowing you to quickly exchange various tokens within Polygon for tokens on other chains. And network primarily supports Polygon, Optimism, and Ethereum.

We used Push Protocol to enhance user experience in asynchronous OTC transactions. When a new sales listing appeared in OTC transactions, it notifies everyone through Channel notifications, and during the transaction, it informs the seller and buyer of the progress of the transaction.

<Example Case of trading MATIC >[Seller Flow]

The seller must first list the token they want to sell.

- Choose the token for sale and enter the quantity.

- Set the USDC price for the token.

- Select the deposit rate for escrow. (With options of 1, 5, 7, 10, or 50% deposit rate). -> A higher deposit rate increases the buyer's trust. *If the deposit rate is selected and the seller does not make a deposit after the transaction is completed, the deposit amount will be deducted from the buyer (Penalties may apply)

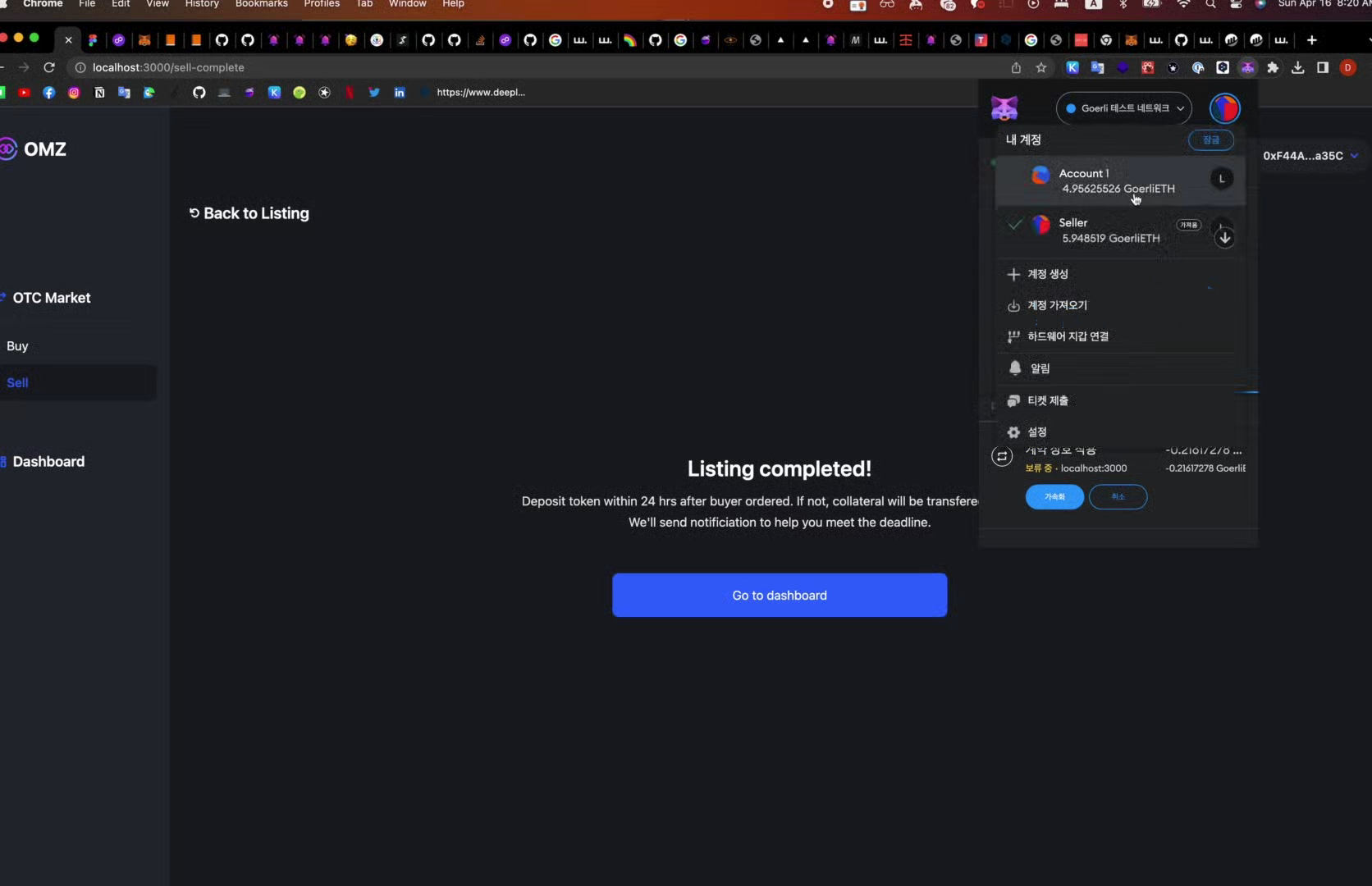

- Click the "Make a List to Sell" button to list the order for sale.

After listing the token, the seller receives a notification if there is a waiting buyer. Once the buyer deposits USDC into escrow, the seller receives USDC payment for the sold token.

[Buyer Flow]

-

The buyer places an order for the token that meets the seller's conditions by checking the order list provided by the seller.

-

After the order is accepted, the buyer can view the details of the order and history on the dashboard.

-

The seller receives a notification through the push protocol for the order.

-

If the seller deposits MATIC into escrow -> the buyer receives a notification that MATIC has been received, and the seller receives a notification that they have received USDC payment.

If the seller does not deposit MATIC into escrow -> the buyer receives a notification that they have received the listing collateral (USDC), and the seller receives a notification that the listing has been canceled.