OMNI Protocol

A general money market that supports ERC721 (Especially Uniswap V3 LP) and ERC20 assets.

Project Description

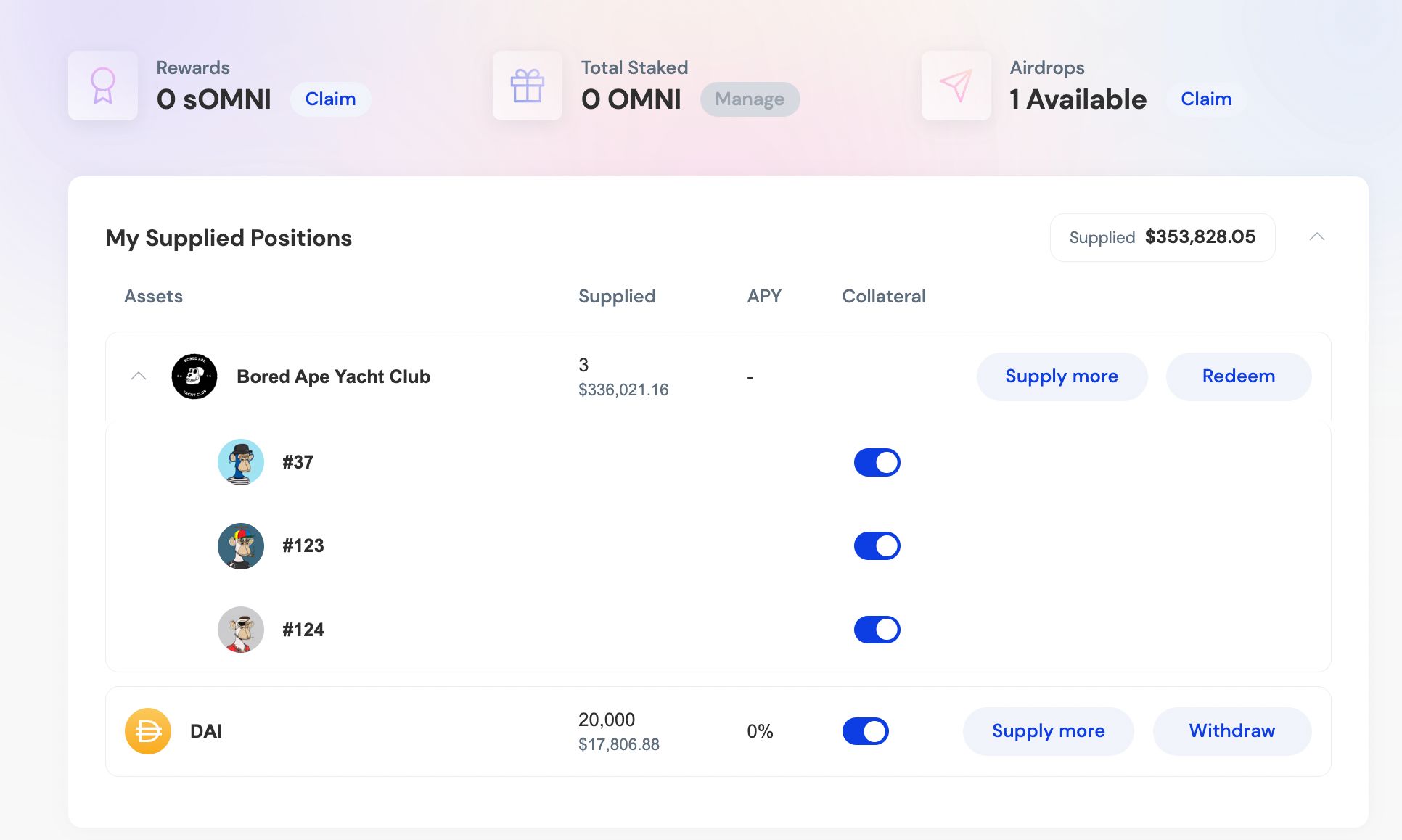

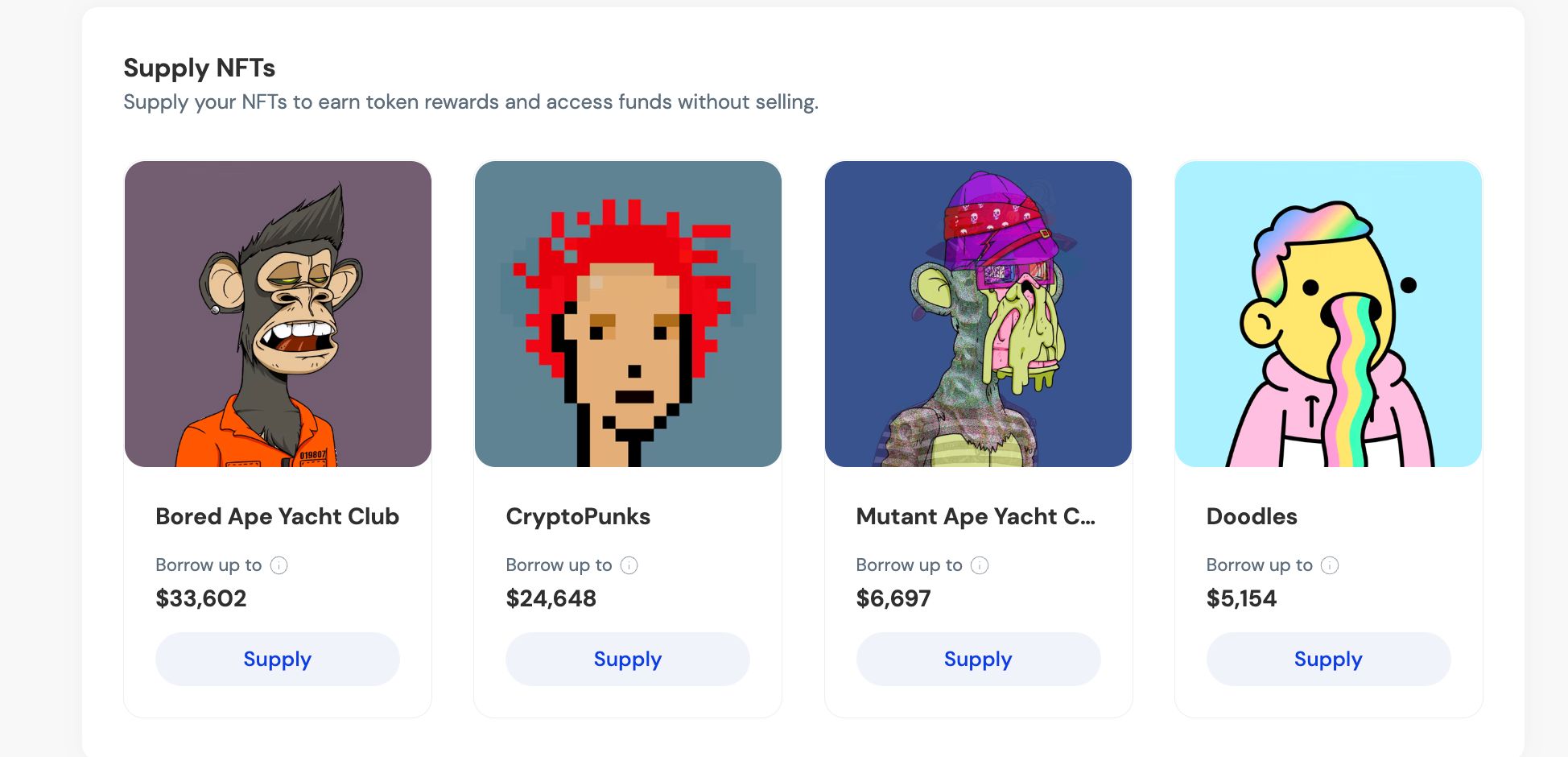

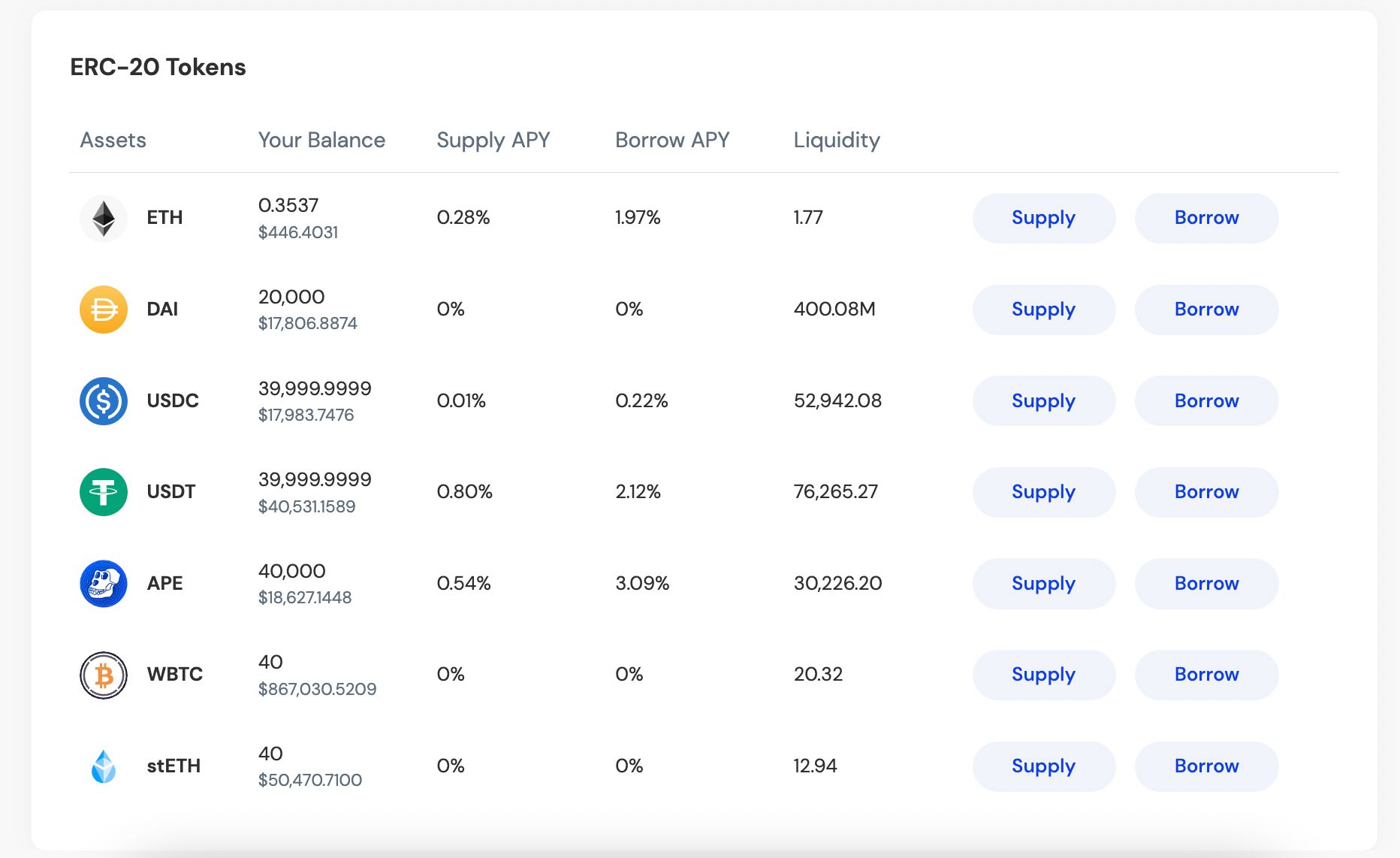

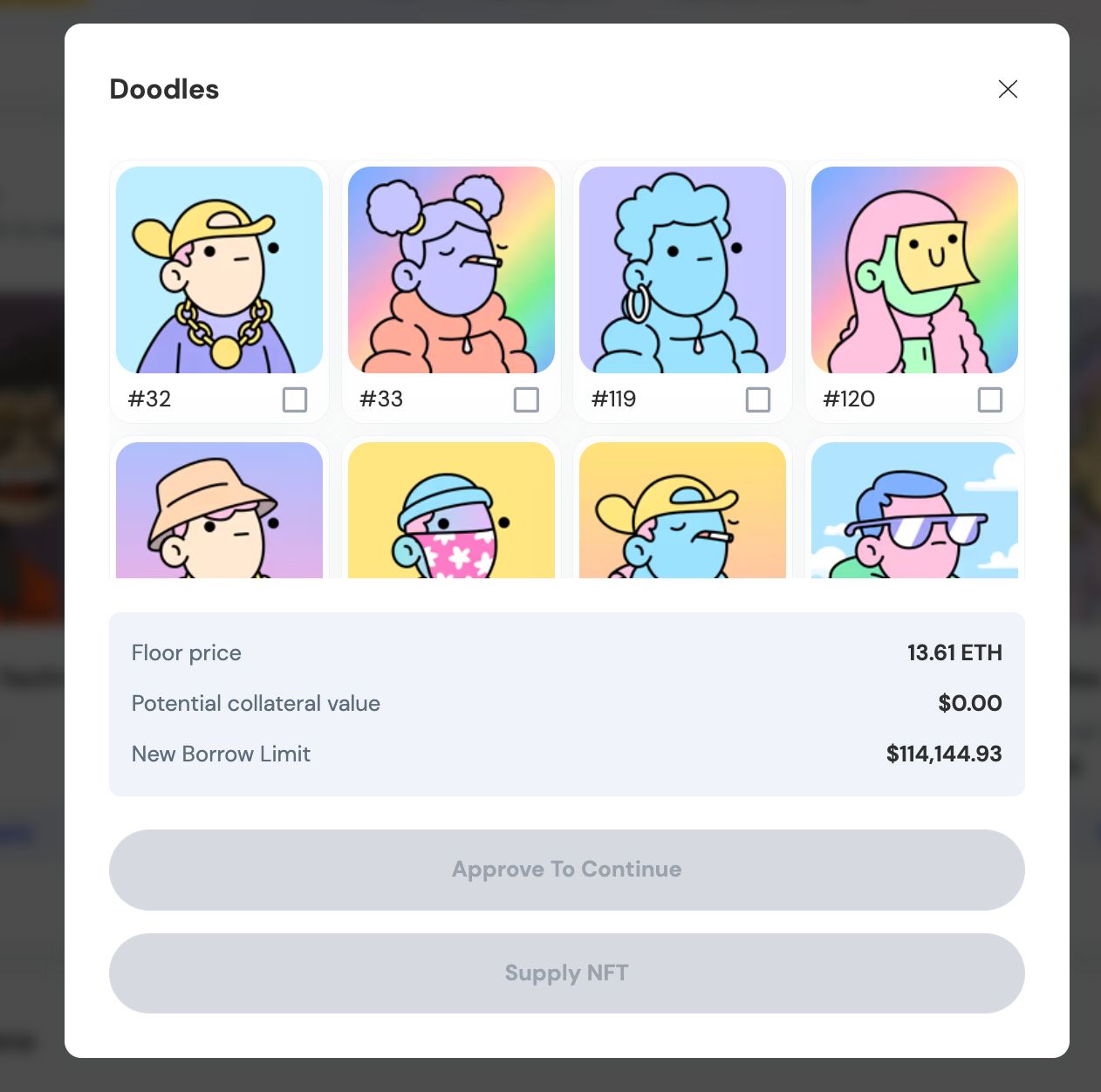

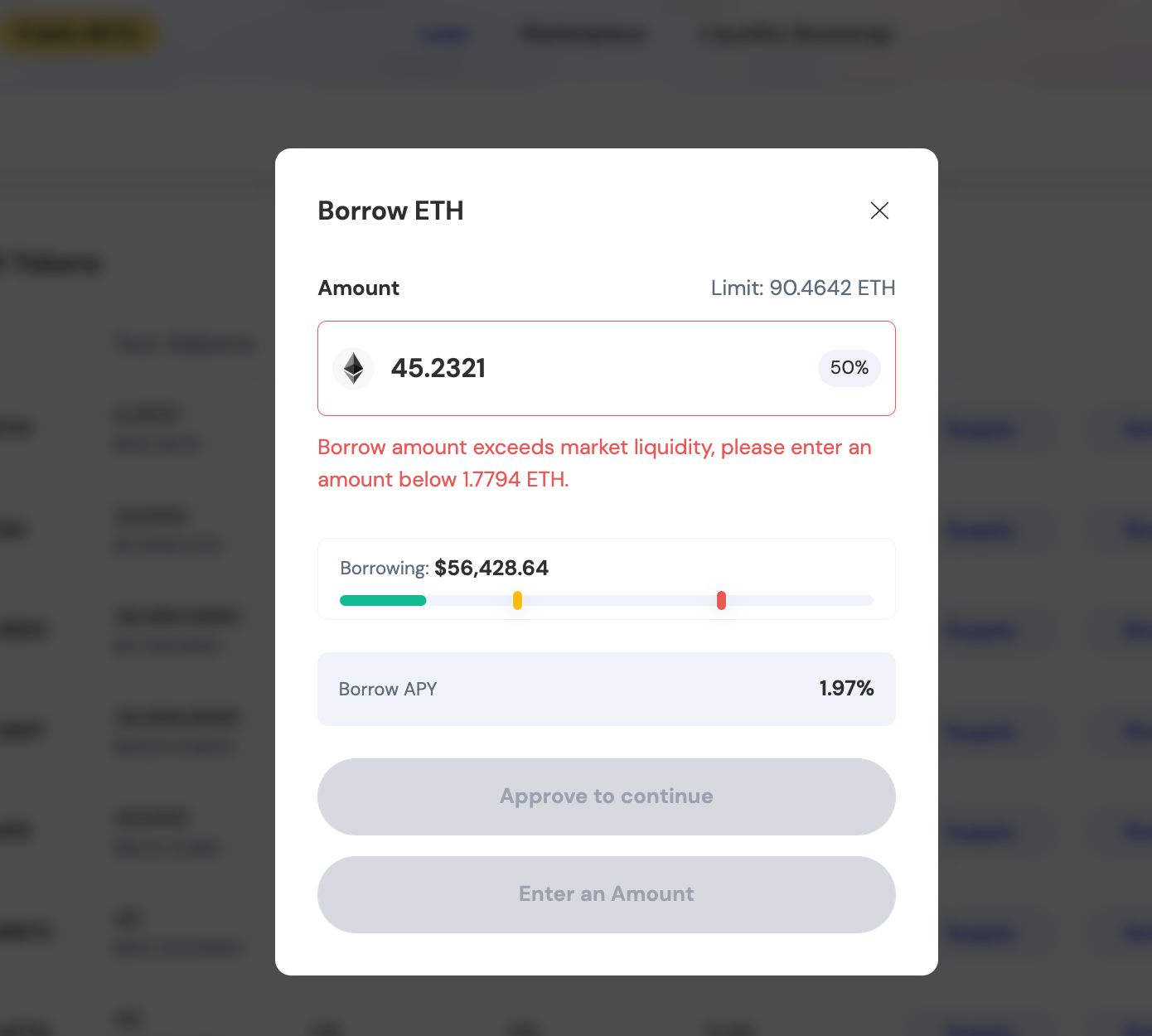

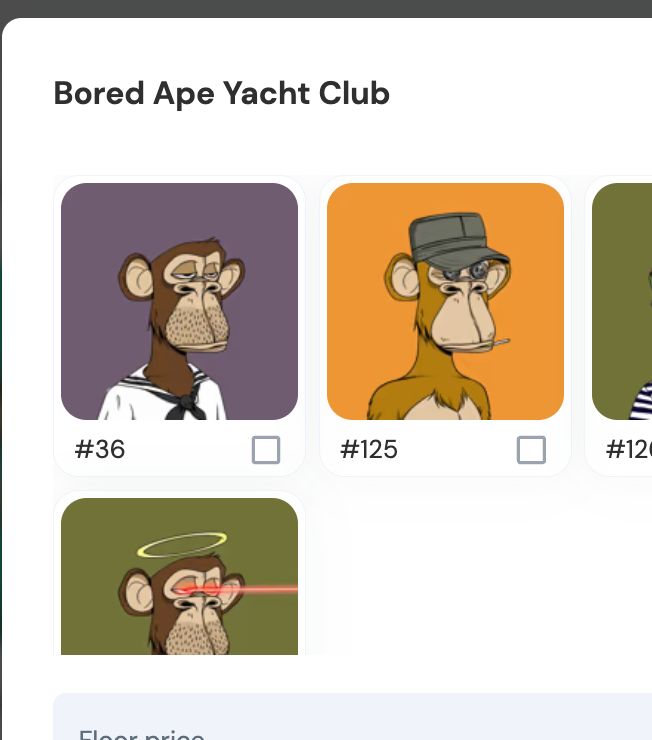

In this project, we are adding support for lending Uniswap v3 ERC-721 LP tokens for use as collateral in our money market protocol, Omni. In addition, we have created a cross-chain bridging solution that allows users to deposit assets on one chain and bridge it over to another chain to open up arbitrage and additional lending and borrowing opportunities. Omni (ethnyc.omniprotocol.xyz) is a protocol we recently launched as a public beta. In the initial launch, the protocol allows users to deposit ERC-721 and ERC-20 assets and borrow ERC-20 assets via over-collateralized positions. We currently support 4 NFT collections (BAYC, MAYC, CryptoPunks, and Doodles) and 7 ERC-20 assets (ETH, DAI, USDC, USDT, APE, WBTC, and stETH). In this project we have added support for the yield bearing Uniswap v3 LP NFT. In order to do this we have established a formula and methodology for pricing these assets and establishing collateral and liquidation thresholds. We see great potential in users depositing these LP tokens and borrowing the underlying pool tokens to increase the value of their LP position and boost yields. This can happens so long as yield from holding the LP token exceeds the interest rate charged for borrowing. We also added support for bridging between ETH mainnet and L2 chains. We believe this can allow users to arbitrage interest rates by supplying some assets in one network while paying different borrow interest rates in a different network. This is the start of our L2 strategy but we will continue to think about use cases and offer more services in the future.

How it's Made

The platform takes AAVE v3 as base and expands on it to add multiple features such as: 1- NFT collaterlization by adding a new derivative token called the NToken that represents supplied NFTs 2- NFT oracle that uses TWAP to calculate NFT prices and prevent fluctuation 3- supports UniSwap V3 LP NFT tokens with on-chain pricing by reading uniswap on chain token metadata 4- omni chain support by deploying on the networks: Polygon, Optimism, Boba, SKALE