Nucleus

DeFi lending protocol with real-time dynamic risk management

Project Description

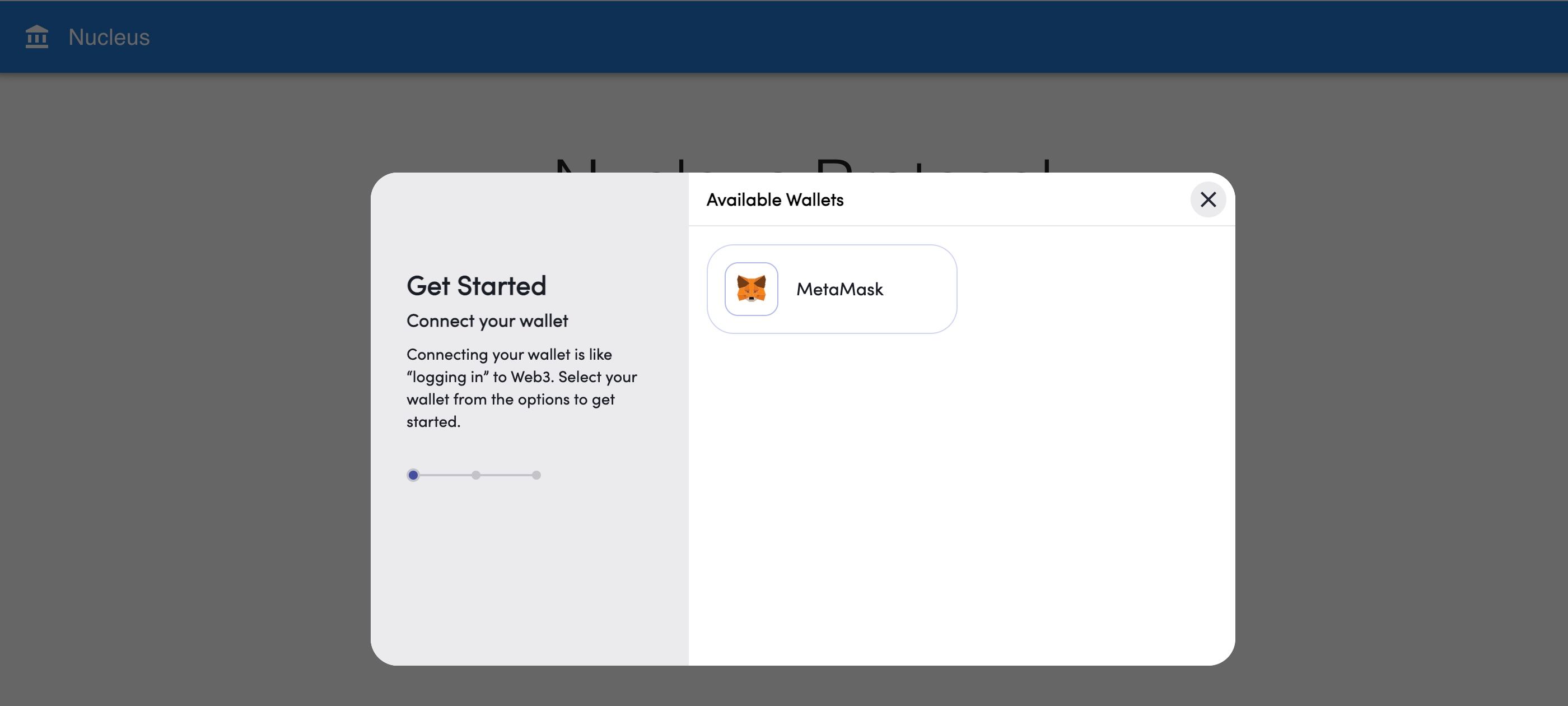

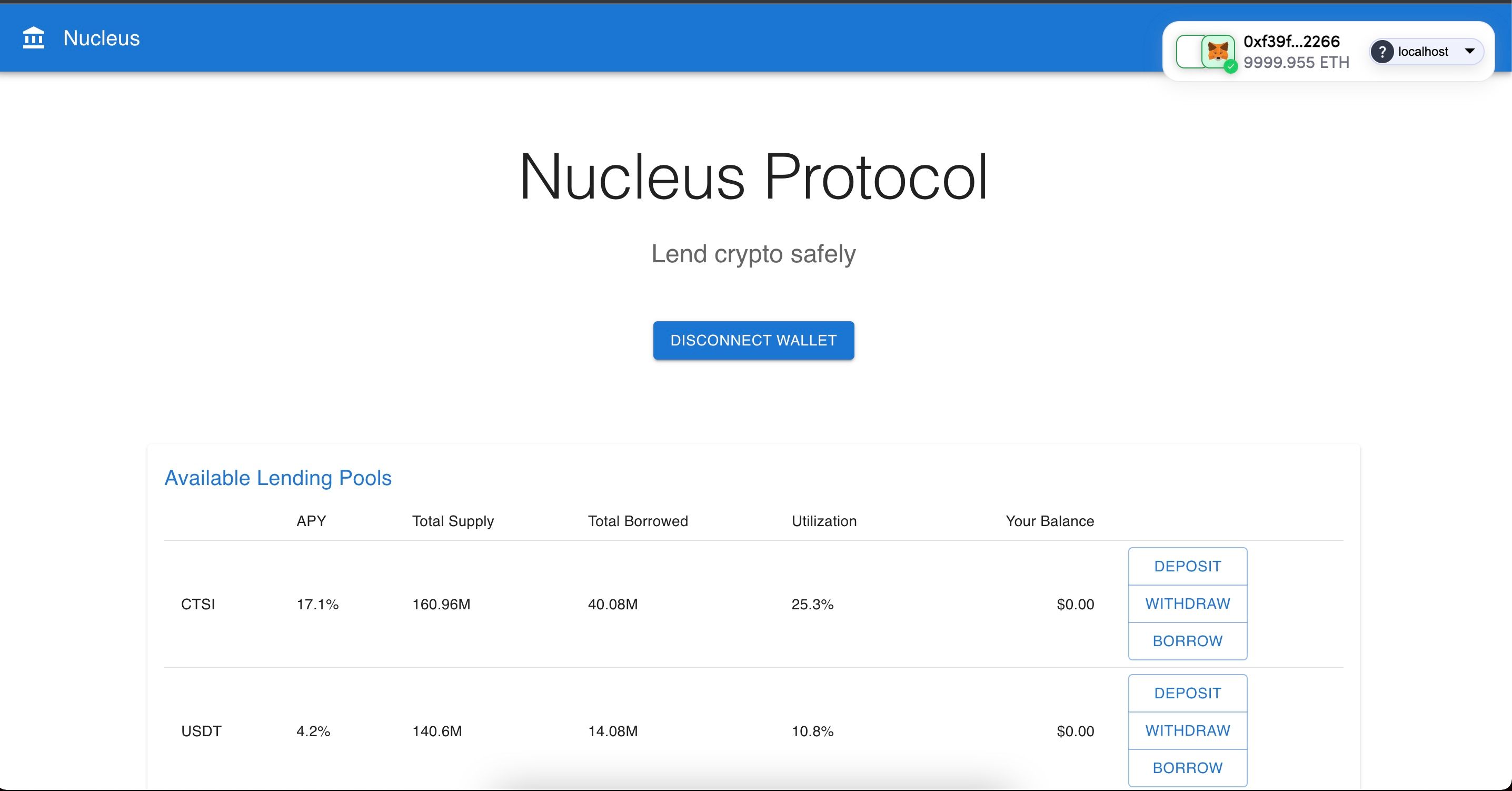

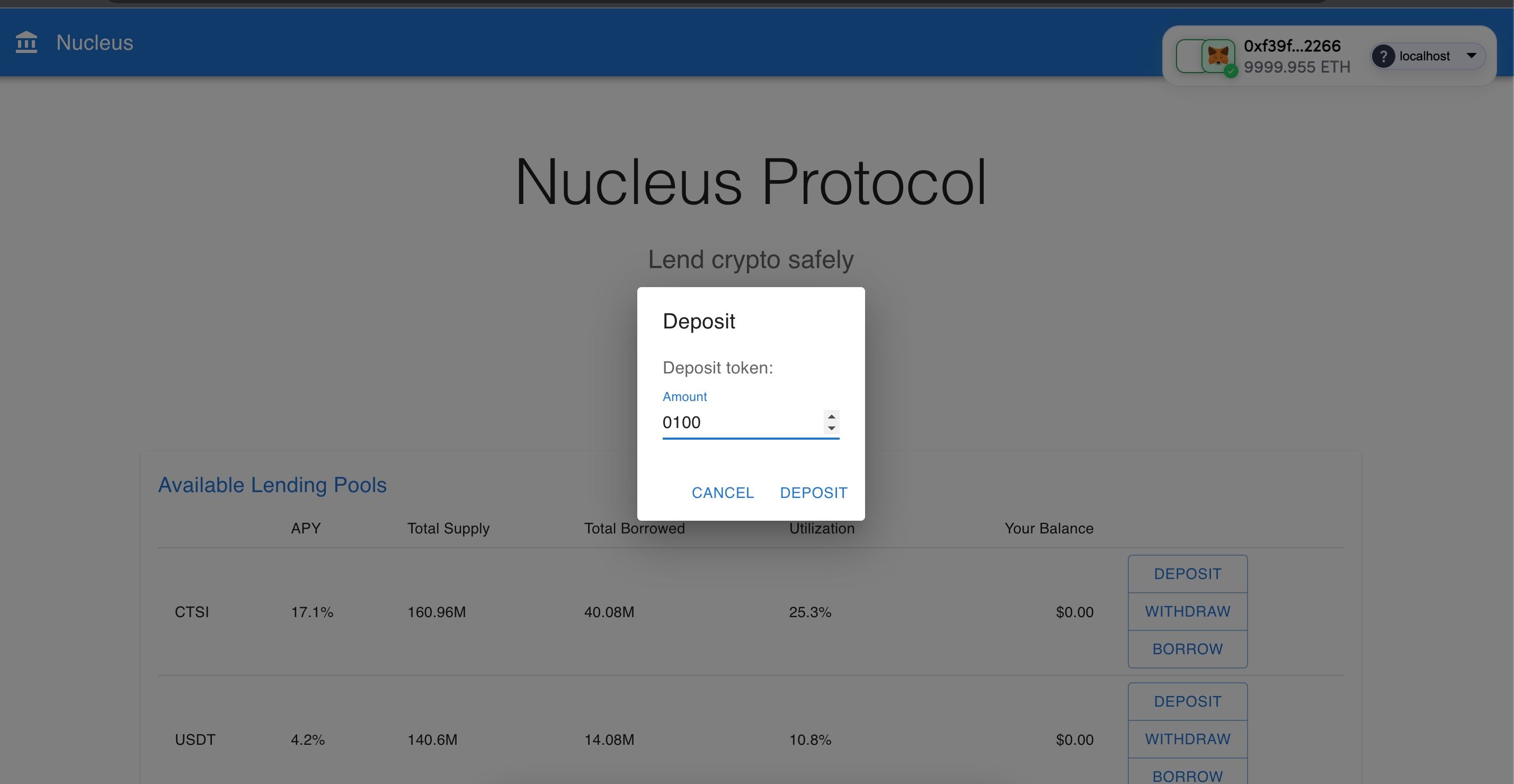

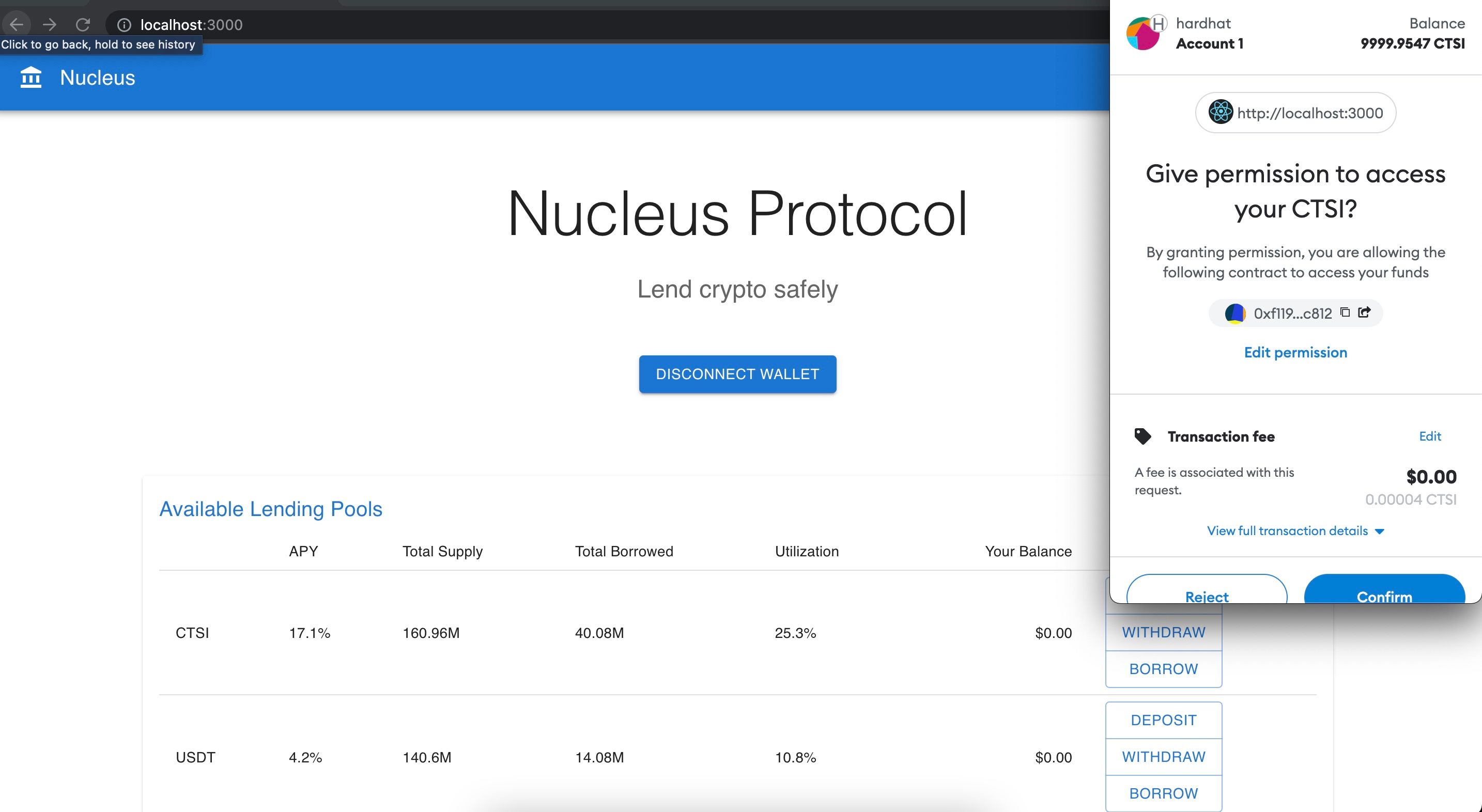

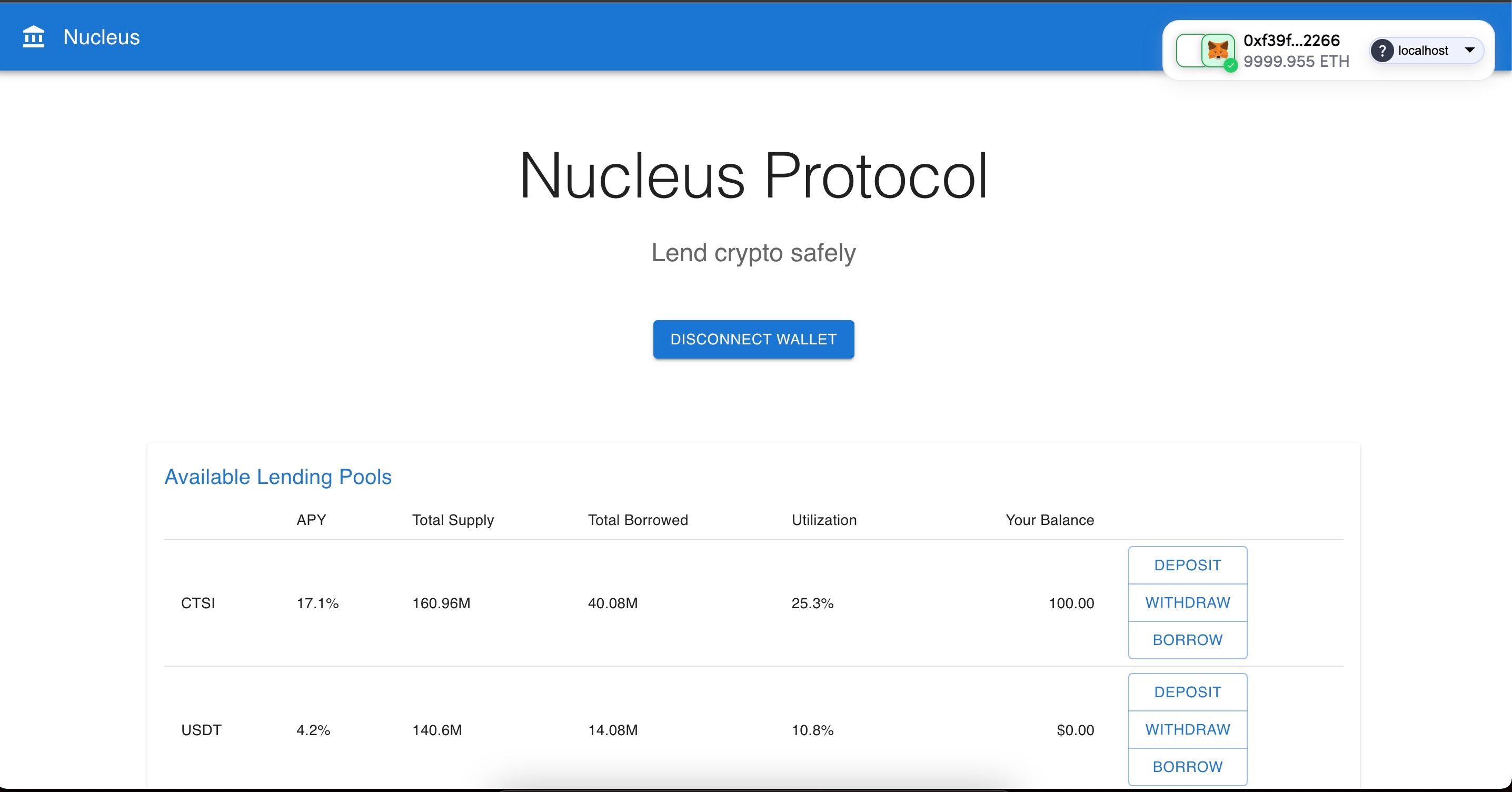

This project creates (1) a DeFi lending protocol that allows deposits into a deposit pool on a Cartesi roll up, borrowing against deposits, repaying them, and settling net interest. It also creates (2) sophisticated financial analytics, that computes collateral risk limits based on onchain data represented within Cartesi.

How it's Made

The (1) DeFi lending protocol and (2) financial analytics were coded in Python and run on a Linux virtual machine on Cartesi. Deposits, withdrawals, and settlements are transacted on a Cartesi Hardhat roll up. Onchain data feeds are fed from representations on Cartesi of major cryptocurrencies (ETH, stablecoins).