NFT Pool Party

Launch your NFT collection on Uniswap & earn ongoing income streams from royalties (again)

NFT Pool Party

Created At

Winner of

🏊♂️ Scroll — Pool Prize

🪝 Uniswap Foundation — Best use of Hooks

Project Description

We invented a way for artists to launch NFT IDO collections directly on Uniswap LP pools and provide instant liquidity for buyers/sellers and sustainable royalties without breaking the ERC-721 standard. Because the artist is the initial liquidity provider for these Uniswap LP pools, they continue to earn royalties on every trade through-out the LP pool's lifespan.

How it's Made

Normally, Uniswap LP pools deal with ERC-20 pairs, but in our case, we leveraged v4 hooks and virtual tokens to trick the LP pool into becoming a bonding curve determining the price when buying and selling NFTs.

How does it work?

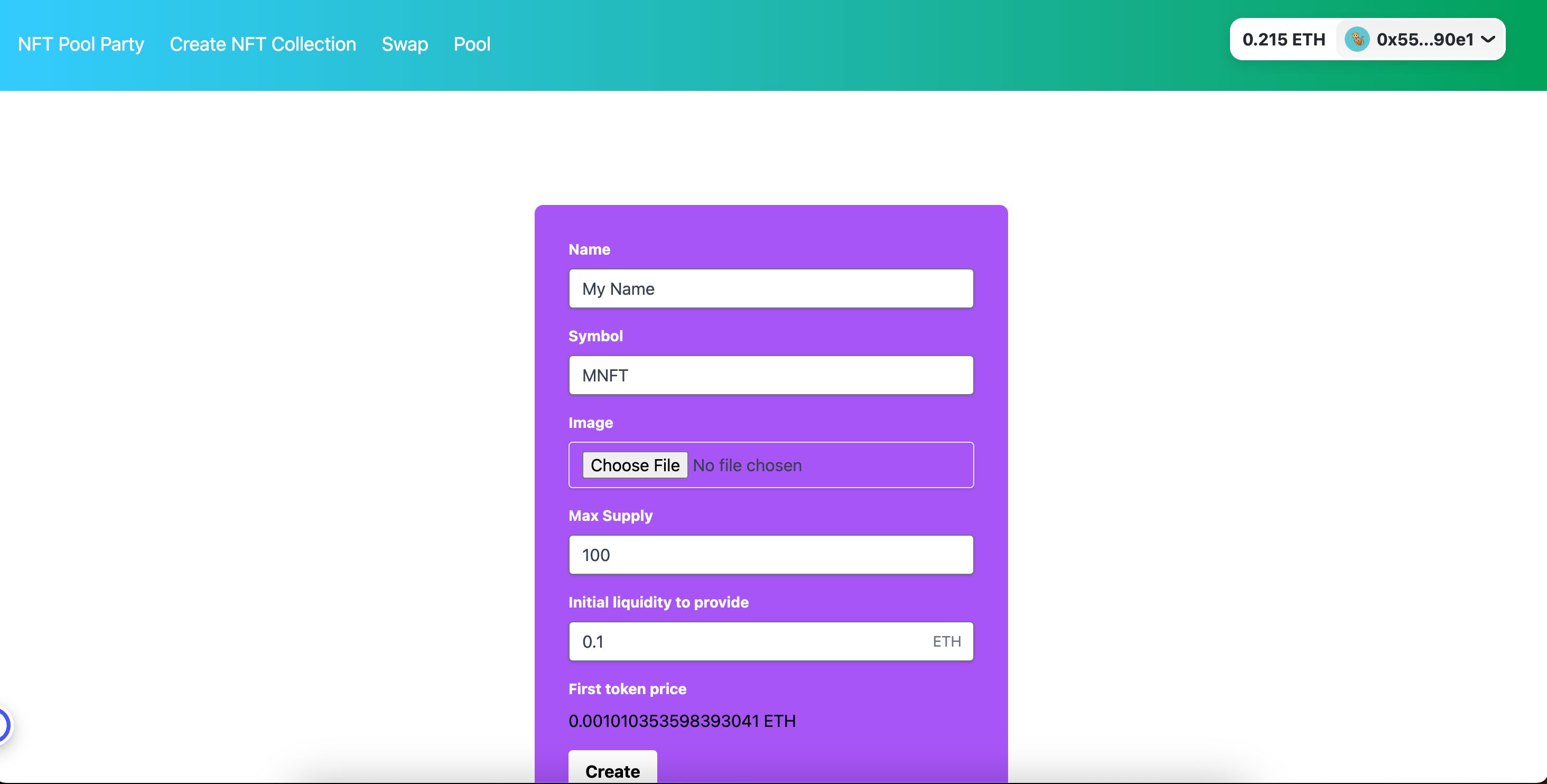

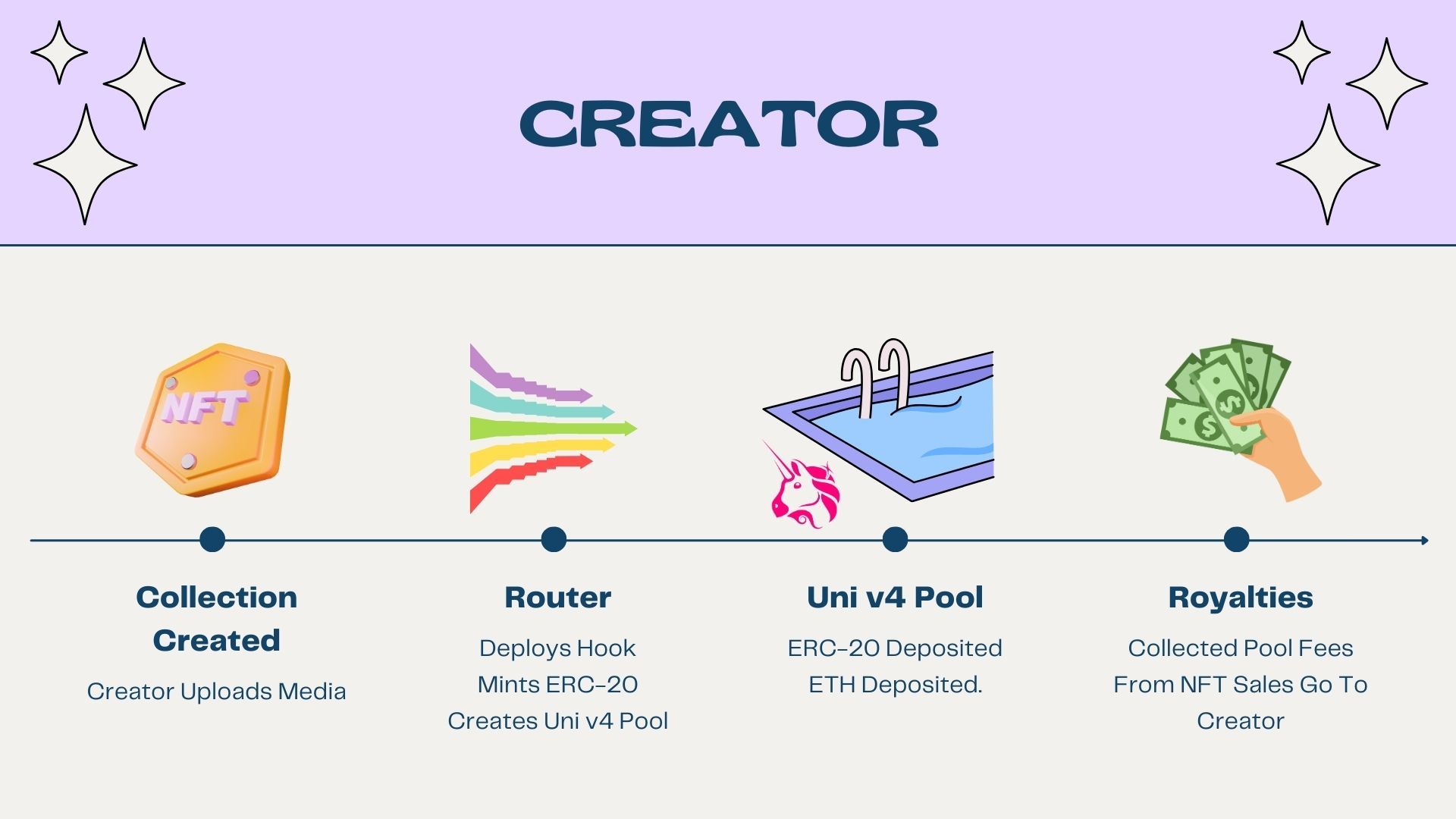

Creators interact with our custom router contract to deploy an NFT collection and initialize a Uniswap v4 pool of ETH to virtual ERC-20 tokens.

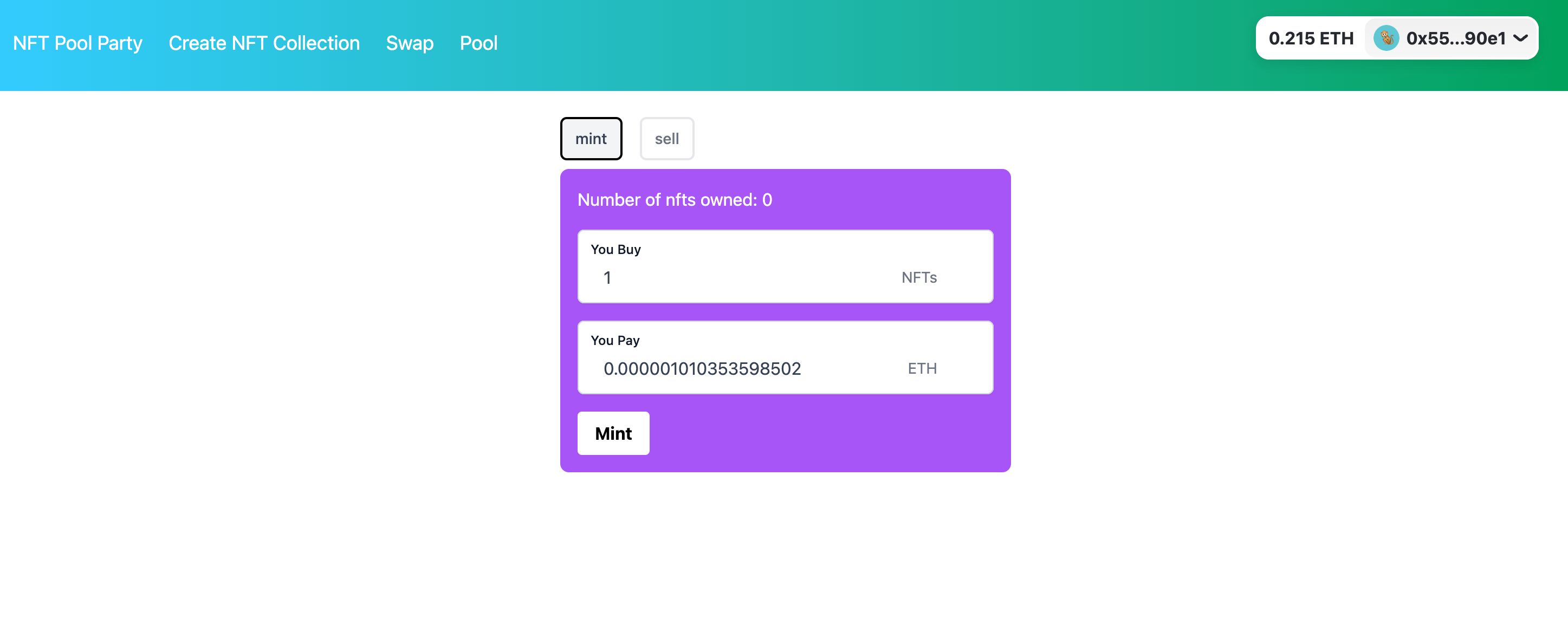

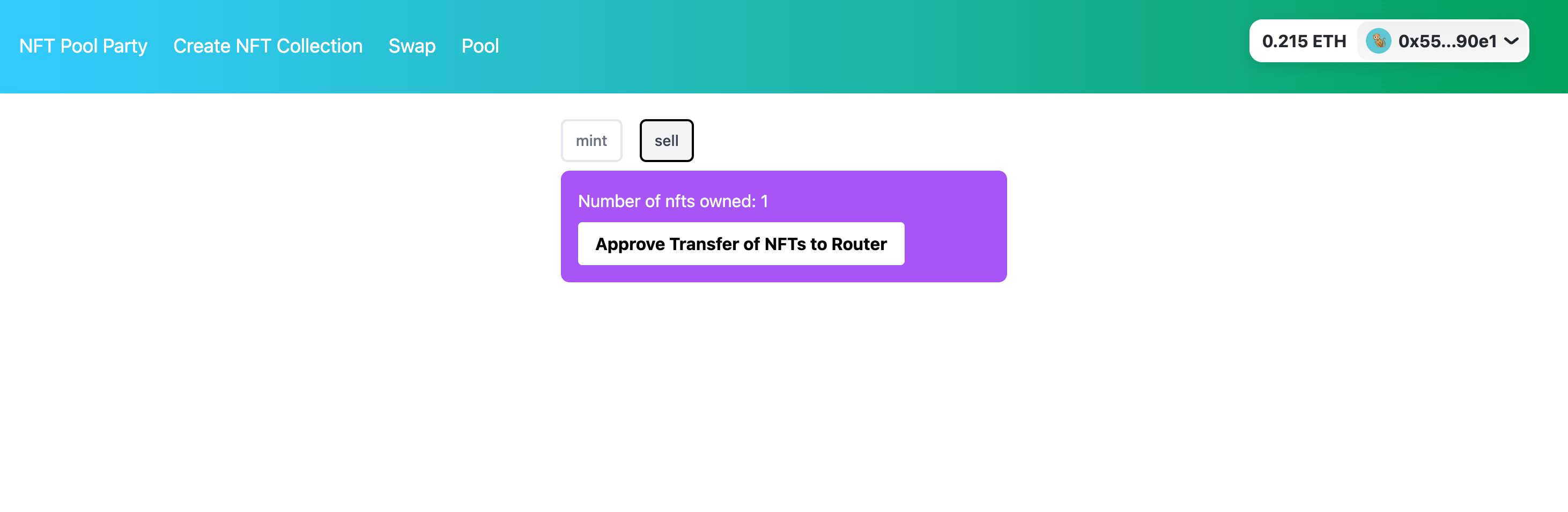

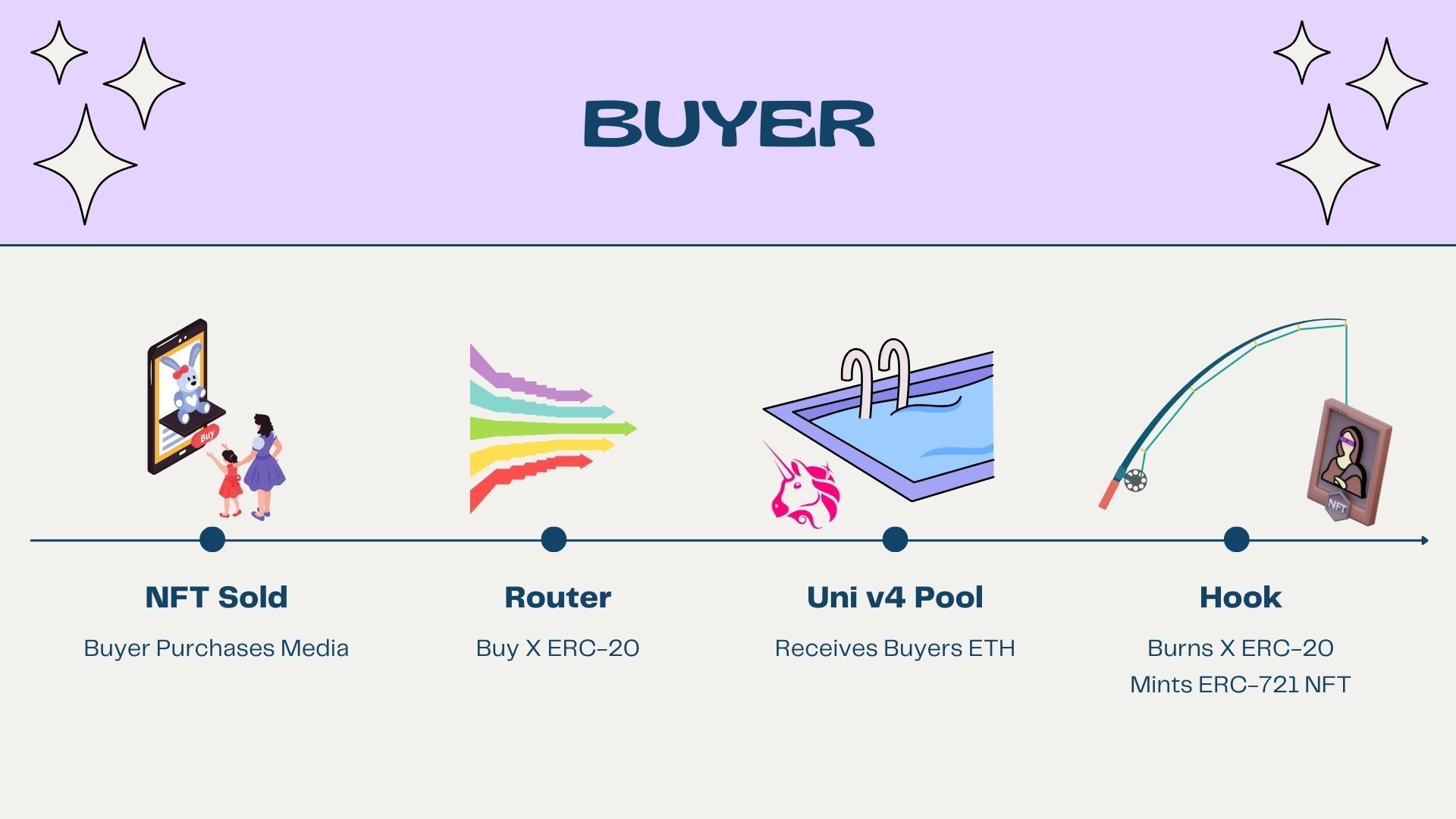

When a collector buys an NFT against the LP pool for the first time, virtual ERC-20 tokens in the LP pool are burned, & the NFT (ERC-721) is minted for the buyer, increasing the price of the remaining NFTs. Conversely, when an NFT is sold back to the LP pool, it is put in reserve, & an equivalent number of ERC-20 tokens are minted to the LP pool, decreasing the NFT price. This results in the price of the NFT correlating with the price of the resulting bonding curve. Essentially we're creating an AMM around the NFT price.

Because the creator has provided all of the initial liquidity to the liquidity pool, they collect royalties on every swap in the form of Uniswap liquidity pool swap fees.