NAL - Now Any Loans

Enhanced lending model where users vote to secure the protocol

NAL - Now Any Loans

Created At

Winner of

🔀 Polygon — Best use of zkEVM

🏊 UMA — Pool Prize

🏊 Push Protocol — Pool Prize

💸 MakerDAO — 🥈 Best use of sDAI

Project Description

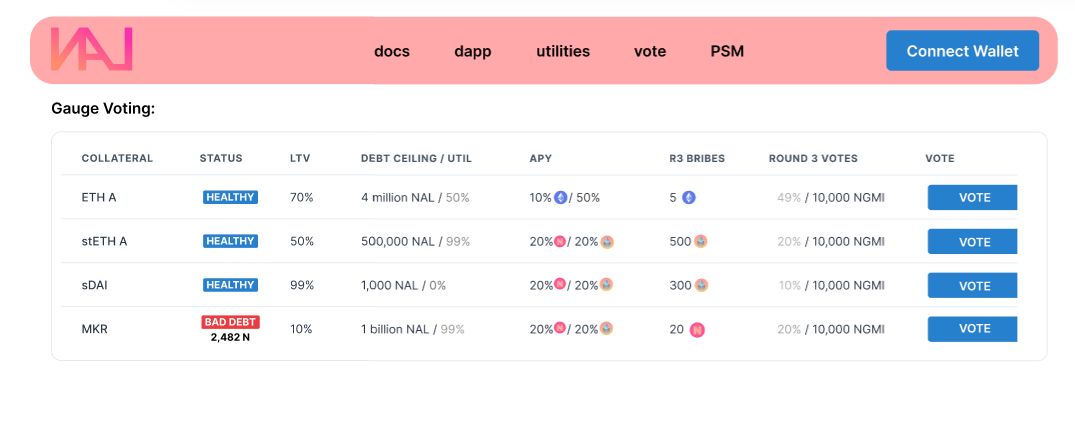

We introduce a lending market model where token holders have the power to vote on debt caps for various assets.

Each epoch (every week), users participate in voting and stake their tokens as a means of backing their decisions.

In traditional DeFi models, rapid asset depreciation can lead to significant shortfalls during liquidation events. In the case of a shortfall, our market automatically creates a Dutch auction to liquidate a portion of the locked voting tokens.

For instance, if a voter has supported an asset ($XYZ) which then undergoes a rapid depreciation, and the liquidator is unable to fully recover the debt, our model initiates a "slashing" process. The locked voting tokens of those who voted for $XYZ are partially sold to cover the remaining debt, ensuring the overall stability of the market.

This creates a system where voters are incentivized to make careful, informed decisions about debt caps, as their tokens are effectively insuring against the risk of asset price volatility. It’s a self-regulating system that promotes responsible governance and offers a novel solution to one of DeFi's most pressing issues.

How it's Made

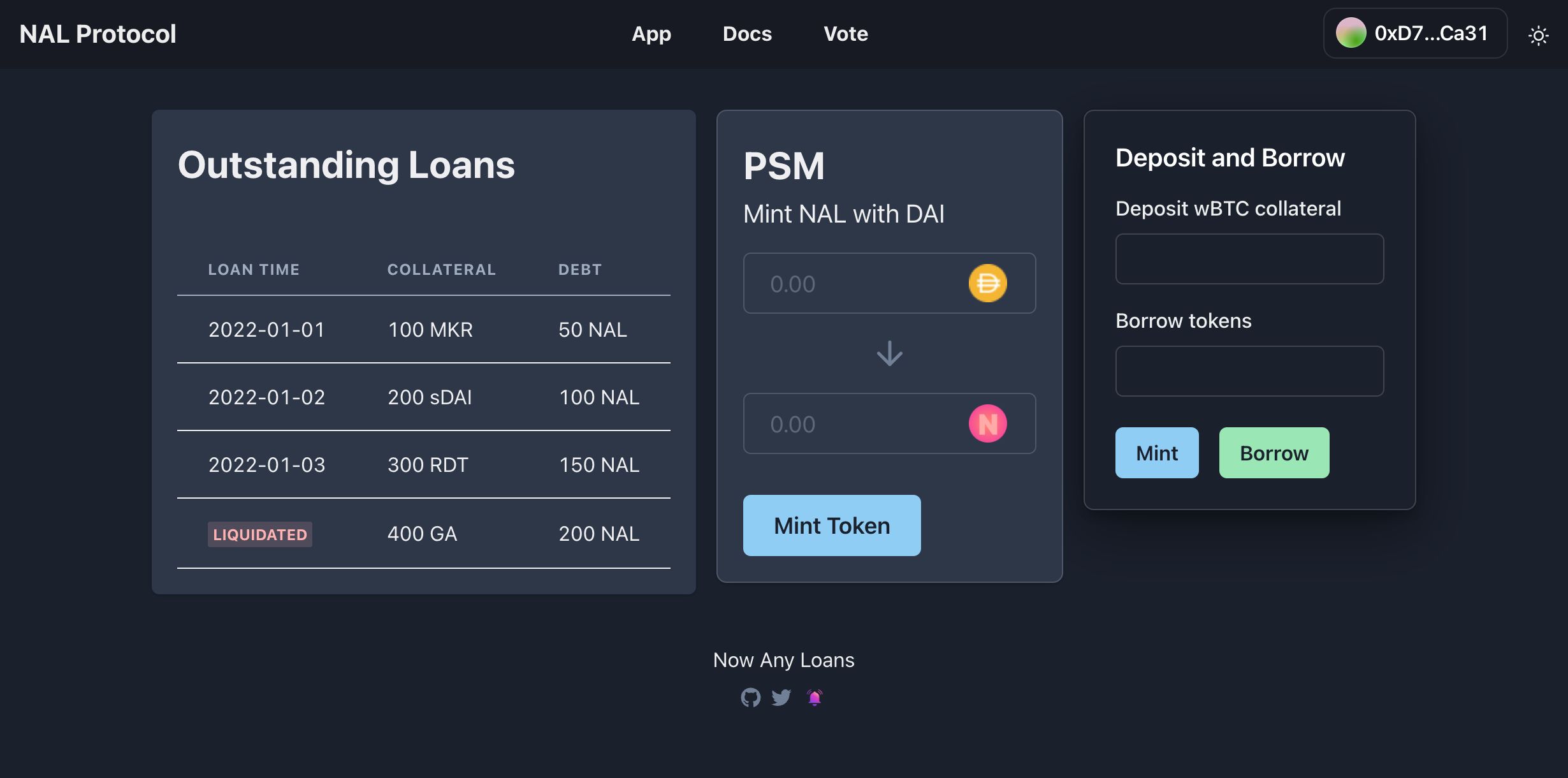

We used foundry and next-eth. We learned how to use Push, which allowed us to notify users in a liquidation. UMA allowed us to do optimistic validation of liquidations. We implemented the DAI conduit interface to allow us to mint NAL against DAI and earn yield by lending. Finally, we deployed on many EVM chains.