LSD (Liquid Streaming Derivatives)

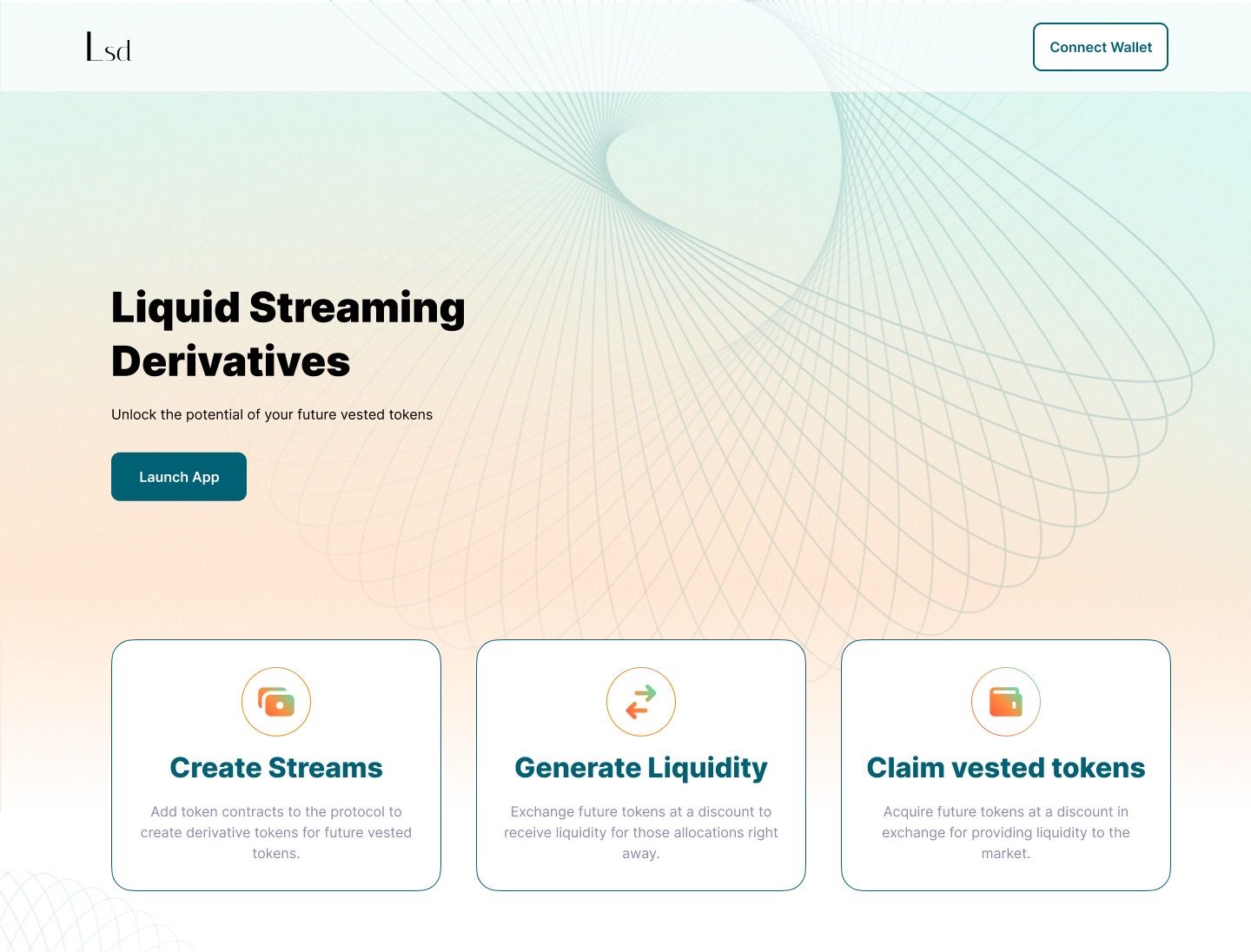

LSD (Liquid Streaming Derivatives) is an open source protocol to create non-custodial liquidity markets for token vesting. Get liquidity for future tokens now. Why wait?

LSD (Liquid Streaming Derivatives)

Created At

Winner of

🚀 Optimism — Just Deploy!

🏊♂️ Valist — Pool Prize

🏊♂️ SKALE — Pool Prize

🏊♂️ Superfluid — Pool Prize

Project Description

Investor token dumps suck. When a large portion of investors start selling tokens as soon as their vesting unlocks, this usually leads to a selling spree. As a result, price of the token plummets significantly, causing damage to both the project and the investors who are in for the long term.

Being locked up also sucks. But if you’re an investor, you don’t want to be seen dumping and losing confidence in the token you’ve backed.

To avoid this, we’ve created LSD: Liquid Streaming Derivatives.

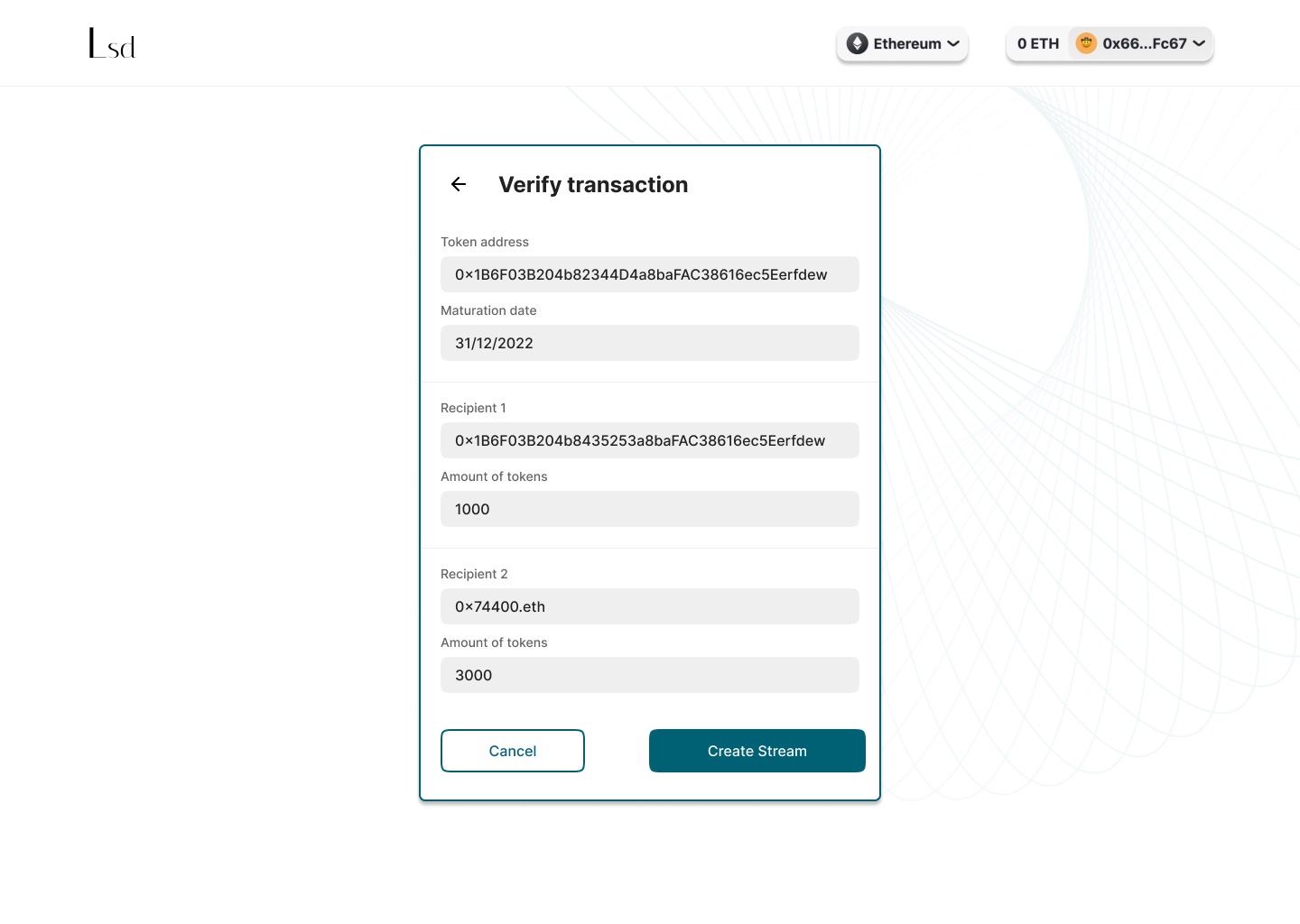

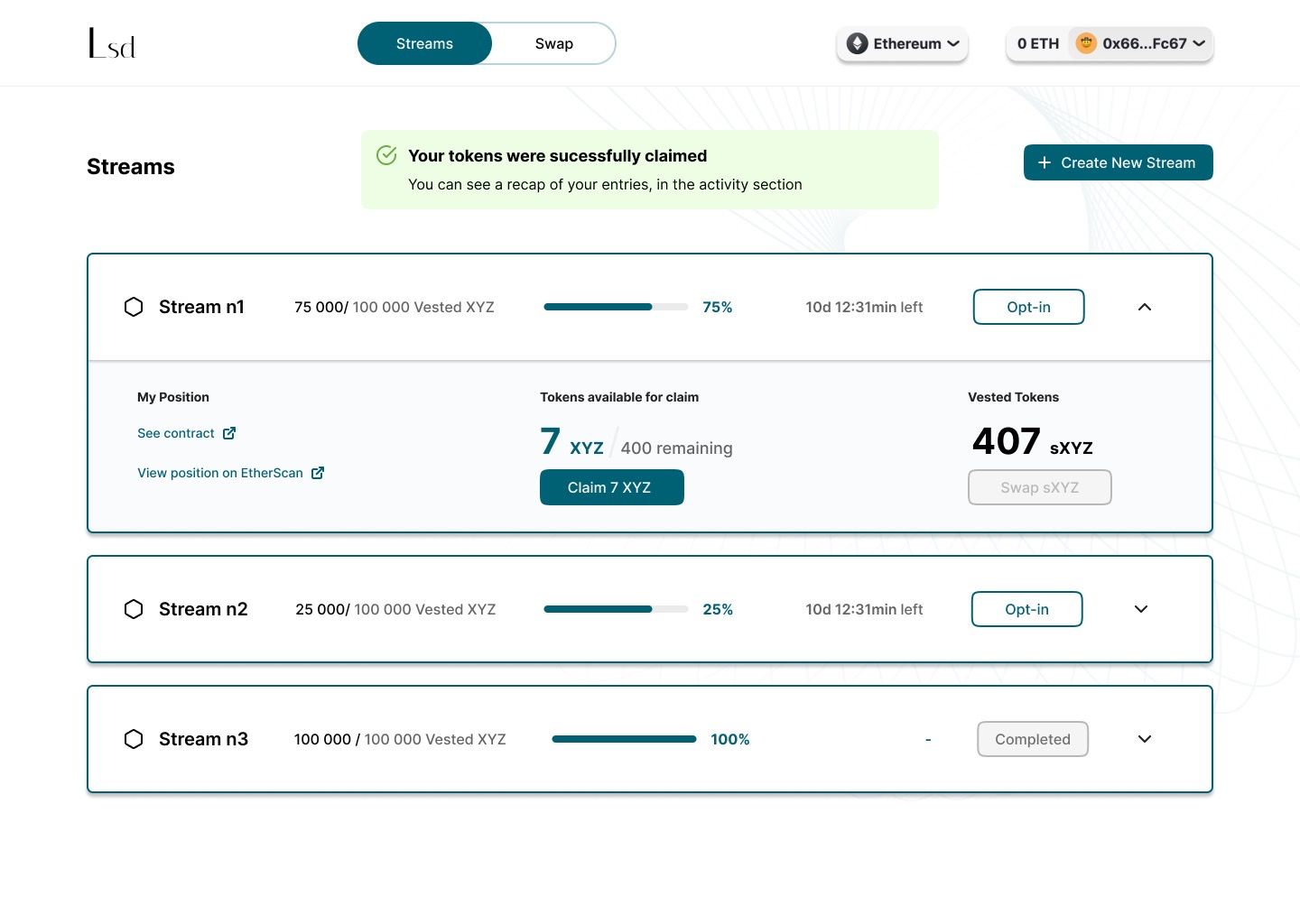

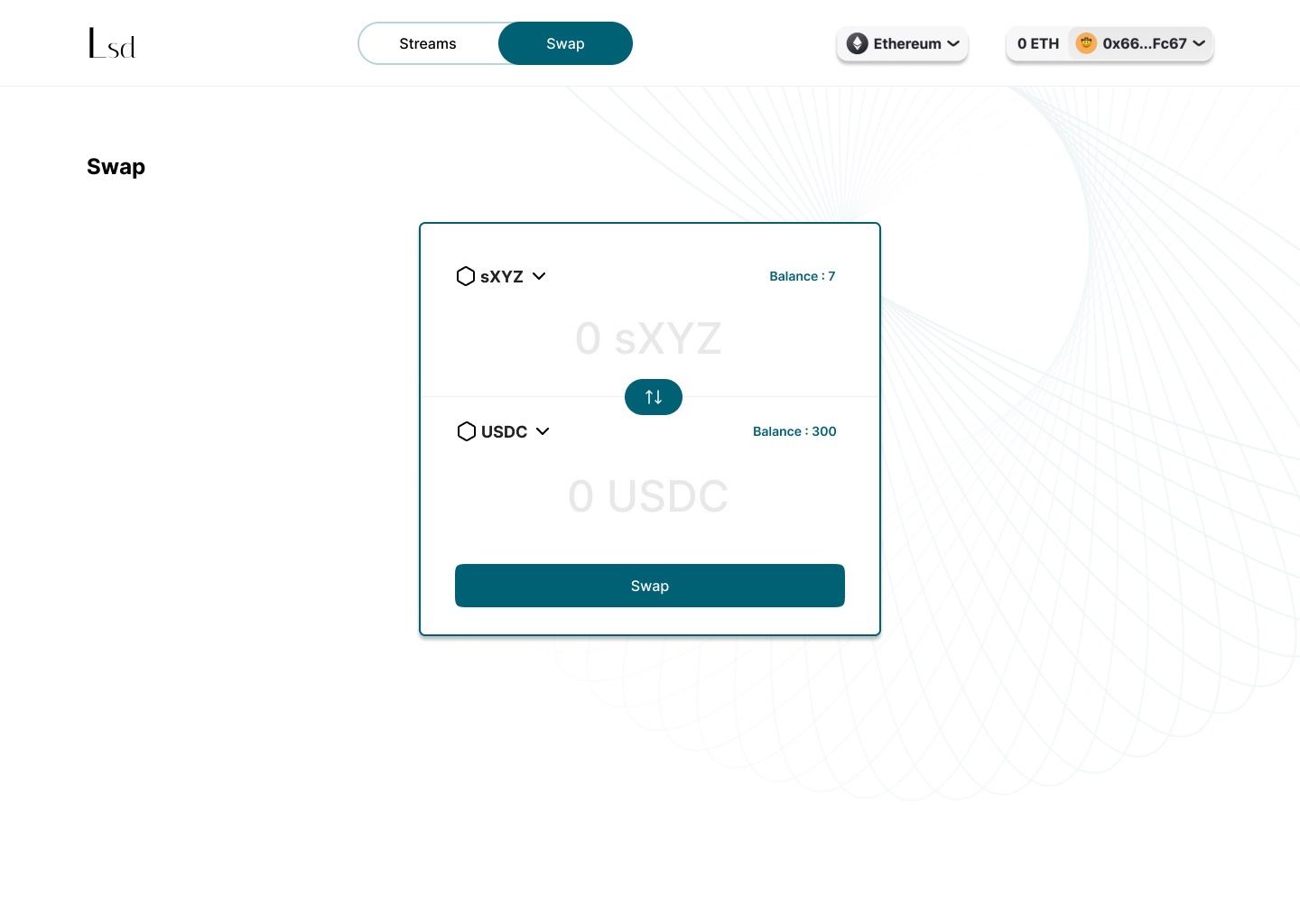

LSD is an open-source protocol to create non-custodial liquidity markets for vested tokens. Users can participate as Streamers, Recipients or Liquidity Providers. Streamers are token projects who add their token contracts to the protocol to create derivative tokens for their vested tokens. These derivative tokens help act as a protective barrier against potential price crashes, essentially forming a price dump moat around the project tokens. They also allow the token investors, who are the Recipients of these derivative tokens, exchange their vested tokens at a discount in order to receive liquidity for those allocations right away. Liquidity Providers acquire the vested token contracts at a discount in exchange for providing liquidity to the market.

How it's Made

Superfluid - Creating derivatives for a fixed income asset (token vesting) relied on the efficiency / simplicity of superfluid's auto-incrementing feature. Once these tokens were locked up and a stream was created, we could assume a derivative token would never be insolvent after the maturation of the fixed-income asset. Since there is a guarantee - the asset can safely be traded / borrowed against as a yield generation token if the strike price is less than the matured asset. We create a dTokens which is minted to the vest-or at time of creation and they may either wait the allocated time or trade these dTokens on the open market. SCOPE - We decided to scope this project to 1 maturation date per token. The reason is the added complexity when attempting to create a derivative token which represents more than one maturation date and in theory more than one pricing mechanism. The solution to this is to create fixed and variable maturation dates by changing the streams recipient to the LiquidityHub.sol for variable rates and then dStreaming contract for fixed rates.

UI: The UI provides the fixed-income creator(company/DAO) the ability to seamlessly create vesting contracts and provide its derivative token to investors. Core technologies include:

- ReactJS with Typescript via create-react-app

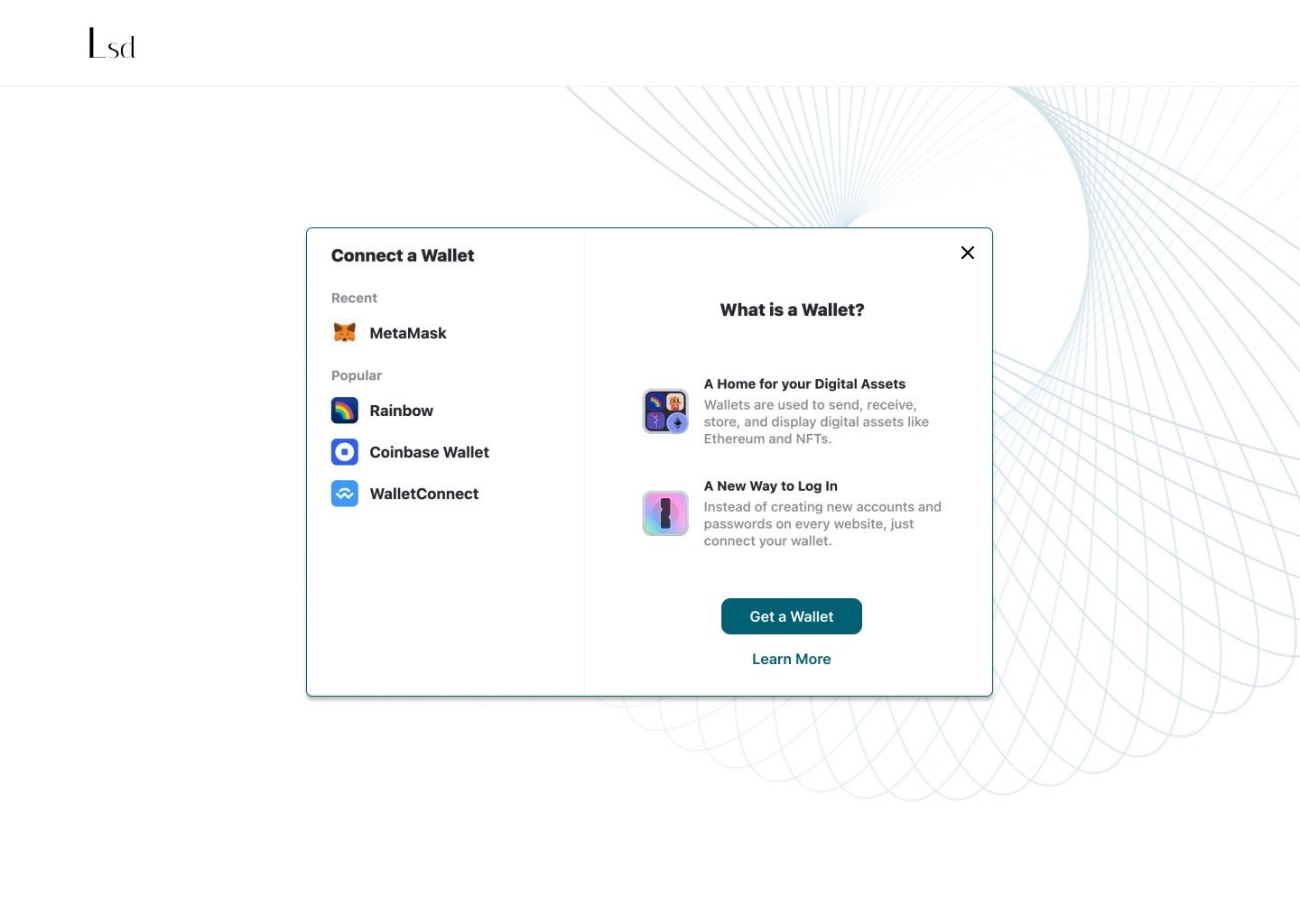

- RainbowKit for simple and clean wallet integrations

- Github Actions for building the React app and

- sending to Pinata for pinning the app to IPFS

- updating Cloudflare DNS for setting _dnslink, for friendly IPFS urls

Design (UI/UX): Figma

Blockchains: Polygon - Mainnet Optimism - Mainnet Skale Network - Testnet

Other Web3 Technologies Used: Wallet Connect - Wallet integration SuperFluid - Streaming future tokens