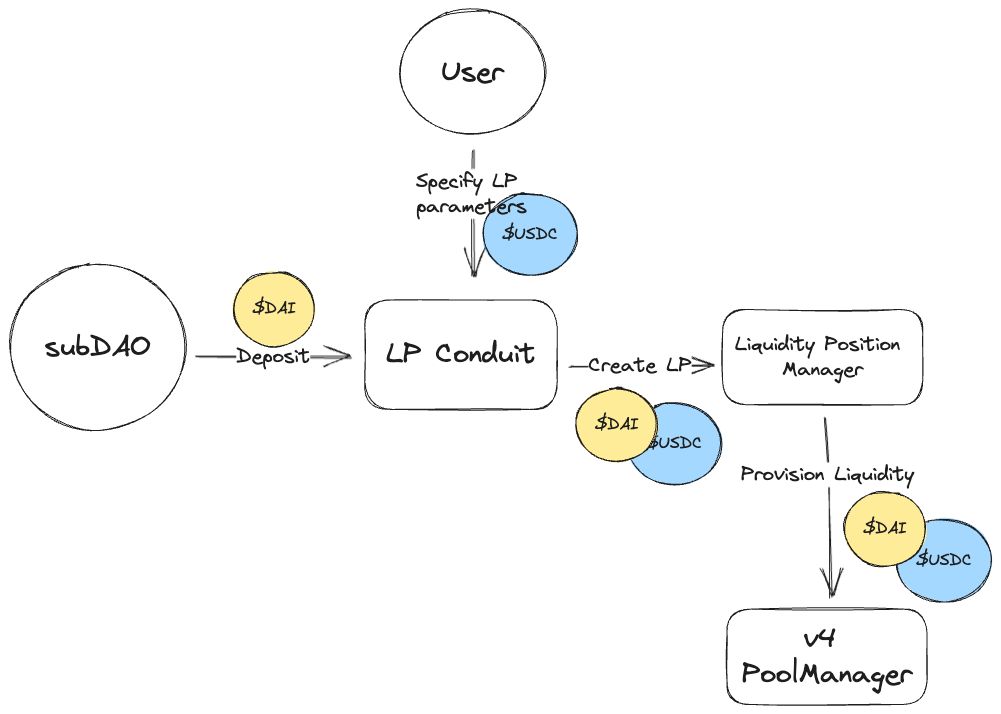

LP Conduit

Leveraged Uniswap LPs using Maker Conduits as a DAI credit facility

Project Description

With Maker Endgame and the formation of subDAOs, Maker Conduits offer a DAI credit facility for yield-generating strategies. This project uses Maker Conduits to enable leveraged LPs on the upcoming Uniswap v4.

As an example, users create concentrated LPs on Uniswap v4 by will providing tokens (i.e. ETH, or USDC) to be paired with "borrowed" DAI. The swap fee revenue can then be shared with the LPs and Maker (requires additional work).

How it's Made

The project currently is a suite of Solidity contracts and tests, built with Foundry. The tests showcase the end-to-end flow of funds from DAI allocation to LP creation. Tests also showcase how LPs are "owned" by the conduit and can be unwound to "clawback" the allocated DAI.

Note, Uniswap v4 does not have an official periphery router for LPing, so I used my own existing liquidity position manager.