Lime

Active Hooks Manager with Offchain Pricing Mechanism / Bringing institutional grade profitability to onchain liquidity

Lime

Created At

Winner of

🥉 1inch — Open Track

🌍 Flashbots — Best Ecosystem project

💡 Uniswap Foundation — Most Innovative

Project Description

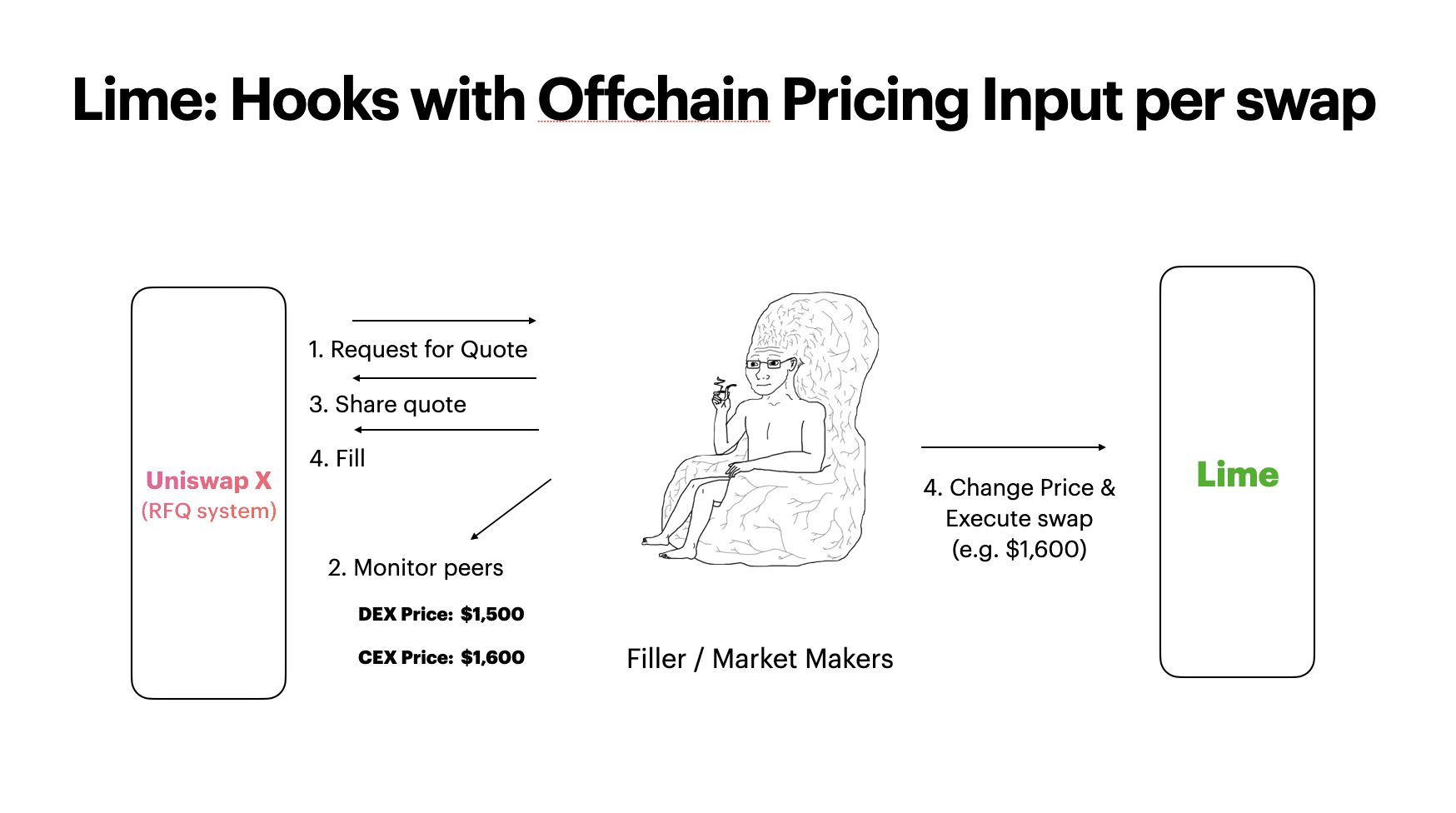

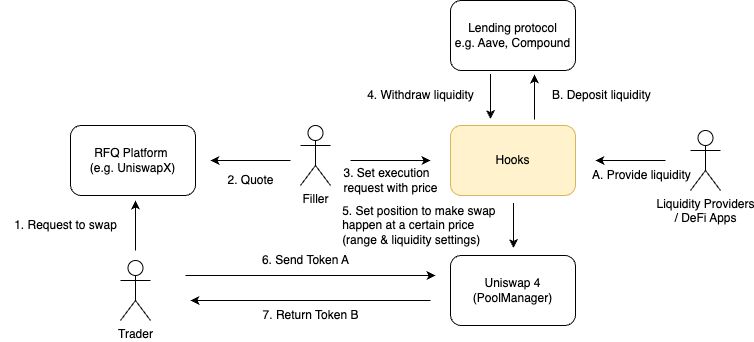

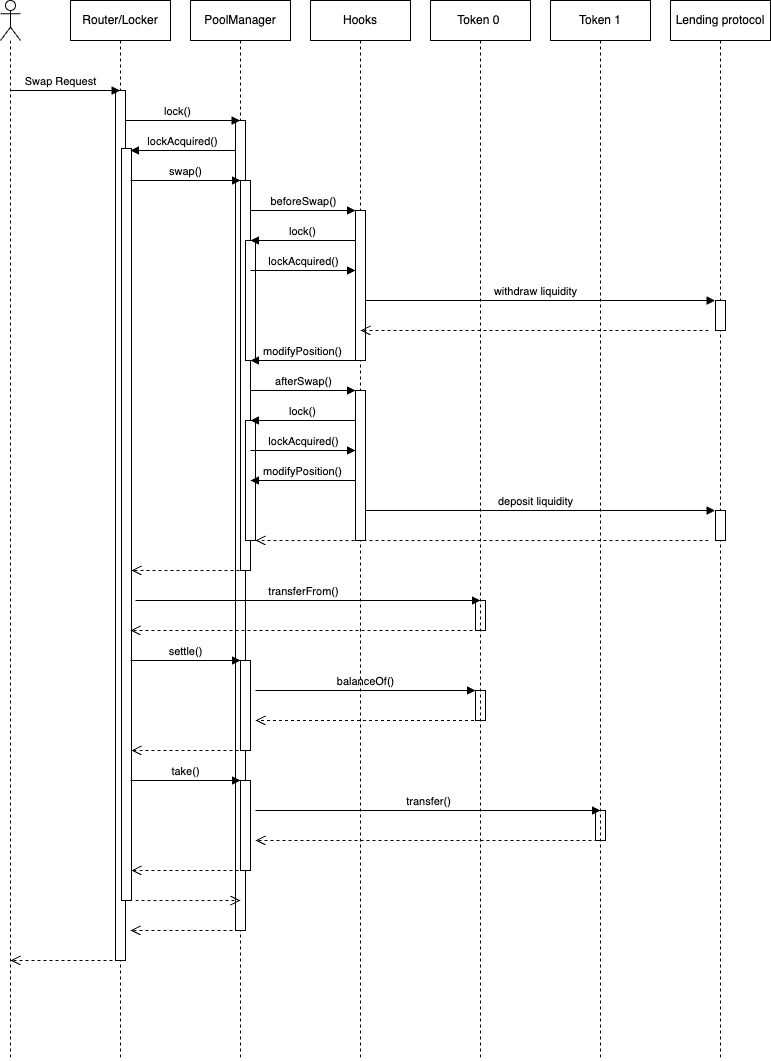

Lime is an active hook manager which allows fillers or market makers to set price and fill Intent / RFQ based swap requests. This system is intended to be used through UniswapX, 1inch, CowSwap, and other RFQ / Intent based systems.

Offchain entities are usually more competitive in terms of pricing and taking orders as they can collect more information and more nimble. On the other hand, Onchain liquidity is vulnerable to toxic flows, or MEV exploits which is usually arbitrage between onchain <> offchain price (e,g. Binance and Uniswap).

Lime allows onchain liquidity to be lend out to fillers or market makers, and they can set a competitive price vs offchain entities, and settle swaps with that funds. All related parties will benefit from this mechanims

- Onchain LPs will no longer suffer from toxic liquidity, arbitrageurs, MEV

- Traders will benefit from increased liquidity from onchain/offchain

- Market makers can easily access to capital

Not only Lime bridges offchain and onchain environments, but mix advantages of both worlds;

- From offchain: better pricing and execution

- From onchain: trust-minimalized control over liquidity and composability of deposit token.

In the future, there should be this kind of system.

How it's Made

This project used several technology and borrowed ideas from follows;

- Uniswap V4 Hooks and X: Out protocol is built and assume these

- Flashbots: I have borrowed the idea of anti MEV cencepts mostly from them

- Aave/Compound: I assume a lending protocol like Aave or Compound to be integrated.

This project can be extended and further developed as a fully fledged Hooks manager, which I guess a formal successor of liquidity managers for Uniswap V3 and most technologies used there will be used in Lime as well.