Leveraged sDAI

The vault leverages the DAI Savings Vault from Spark through GHO. To optimize for scalability and revenues we use Yarn V3 Vault standard in combination with Paladin's Dullahan protocol to have max discounted GHO. The protocol offer cheap leverage on mainnet using flash-loans.

Project Description

The project allows you leverage the popular DAI Savings Rate module to get even higher yield with low risk of liquidation. The protocol offers a Yearn vault that allows anyone to deposit and instantly amplify its yield. We offer the most competitive leverage rate using GHO thanks to Paladin's Dullahan.

How it's Made

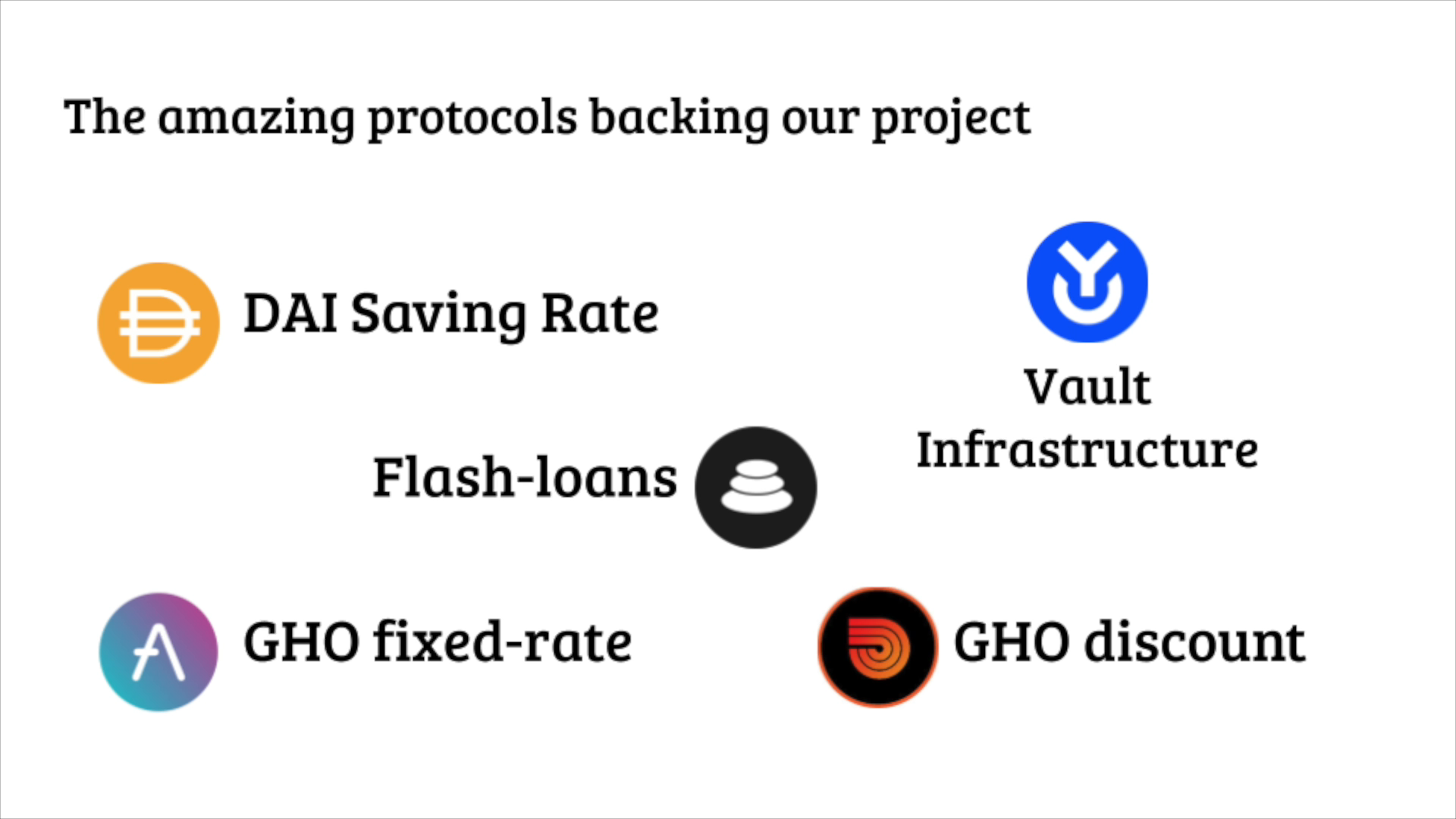

Tech stack: The Strategy is written in solidity and has been properly tested with foundry (everything can be found on the repository). We are true believers of the DeFi lego principle and that's our implementation leverages 5 different actors in the ecosystem:

- AAVE to borrow GHO

- MakerDAO and Spark for DAI and the Saving Rate

- Paladin's Dullahan to offer competitive leverage rates

- Yearn V3 for their amazing work on vaults and potentially their newly release veYFI gauges

- Balancer to get free flashloans and optimize our leverage process

- Uniswap to sell the borrowed amount during the leverage/deleverage operations.

Why Yearn Vault: Yearn's V3 offers some nice vault contract that already implement most of the ERC4626 logic. The other advantage with Yearn V3 is that we don't even need to maintain a frontend since vaults will automatically appear on the official Yearn page (even though a demo frontend was built for the hackathon). Furthermore Yearn V3 has just released veYFI allowing the protocol to incentivise vaults, we're planning to use this to bootstrap liquidity in the future making the vault automations (deleverage if GHO depegs) self sustainable with protocol fees.

Why did we use GHO to leverage? As of now GHO interested rate on borrow is fixed and quite low, making it the ideal token to leverage up the position knowing that AAVE will always add new measures to guarantee the peg of its stable-coin. This is not the case for other "cheaper" stable-coins like MAI that while offer extremely competitive rates (0%) never manage to stay on peg since their only use is degenerate leveraging.

Why Paladin's Dullahan: GHO's borrow rate is the biggest bottleneck in amplifying yield, this is where the Paladin's Dullahan vault comes into play: it allows us to borrow GHO with a discount by using the stkAAVE discounting power rented by independent stakers wanting to squeeze some additional yield on their AAVE. Thanks to this rented discount the vault can offer up to 30% cheaper borrow rates on GHO making it the most competitive sDAI leverage strategy based on AAVE.

Gas optimisations: Since the vault is built on Ethereum leveraging up and down the position can be very expensive. That's why we use Balancer's flash-loans to make this as cheap as possible and allowing to leverage and deleverage with just a single swap. We chose Balancer specifically because they don't charge money for their flash-loans unlike AAVE.

For the future: If AAVE enables e-mode for GHO (most likely when they will restore its peg) the yield can be further amplified up to 30%. The code is already compatible with different loan-to-values. You can check this form the numerical simulations shown in our chart in the pictures section.

Demo frontend available here: https://github.com/Loris-EPFL/sdai-front (Screenshots available in the README)