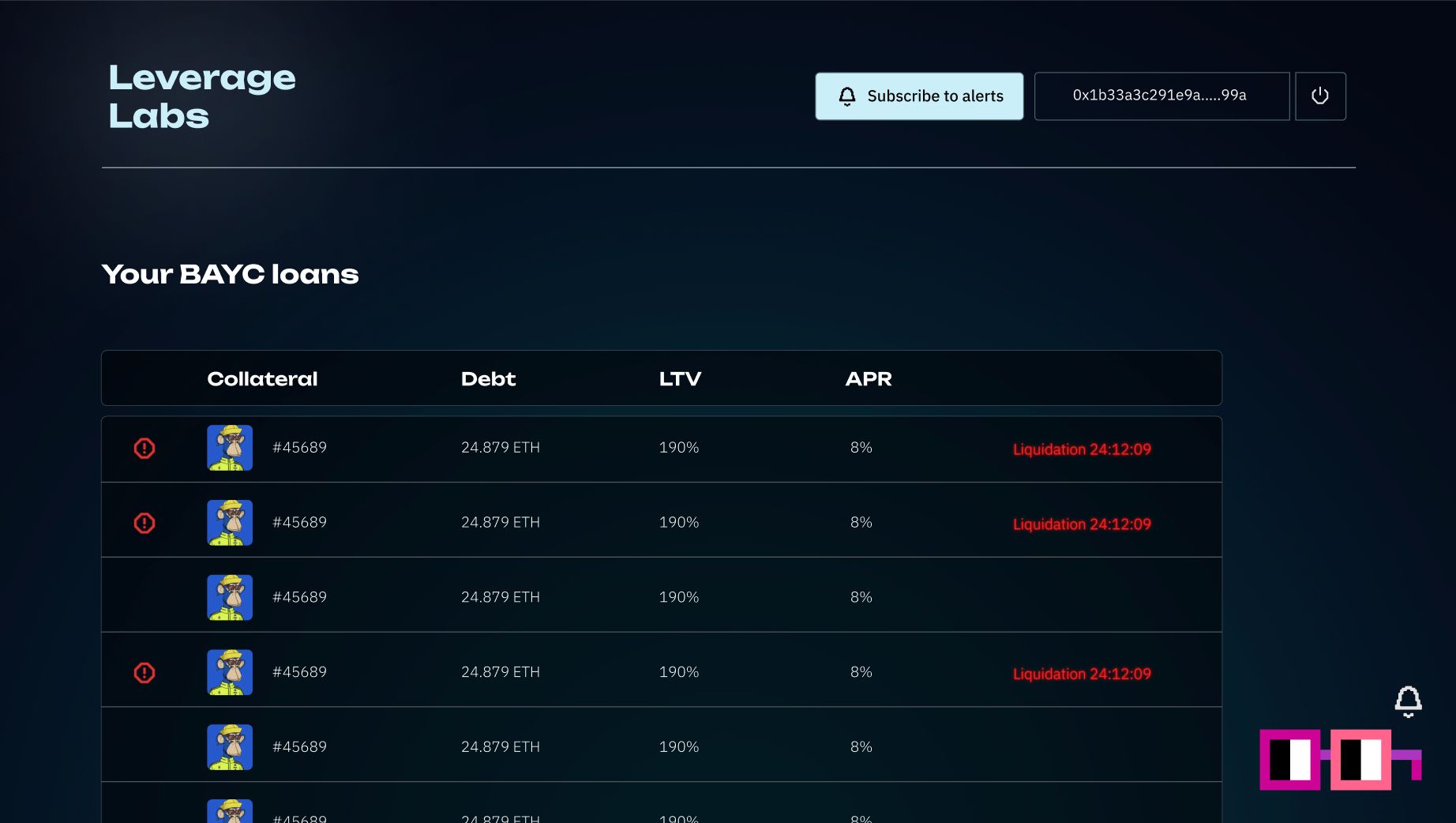

Leverage Labs

NFT leverage management tool, giving access to better loan terms and liquidation protection.

Leverage Labs

Created At

Winner of

🕸 The Graph — 🥇 Best use of Subgraph or Substream

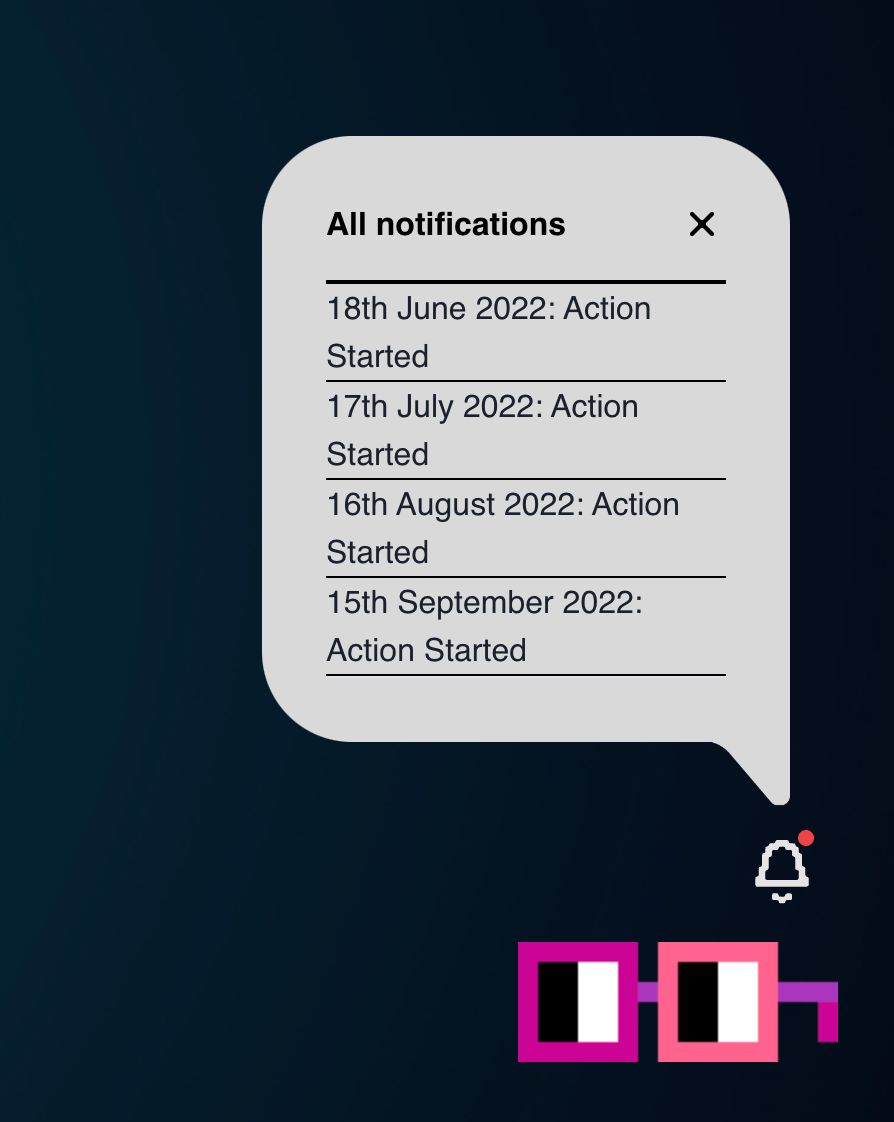

📬 WalletConnect — 🥇 Best use of Web3Inbox

Project Description

Each week $10M worth of loans get liquidated in the NFT markets, majority of which happen on Blur.io NFT marketplace, posing a major hurdle for user retention.

To address this issue we've built a React web app that keeps track of user's loans and sends out Wallet Connect Web3Inbox alerts in case any of the loans get close to getting liquidated.

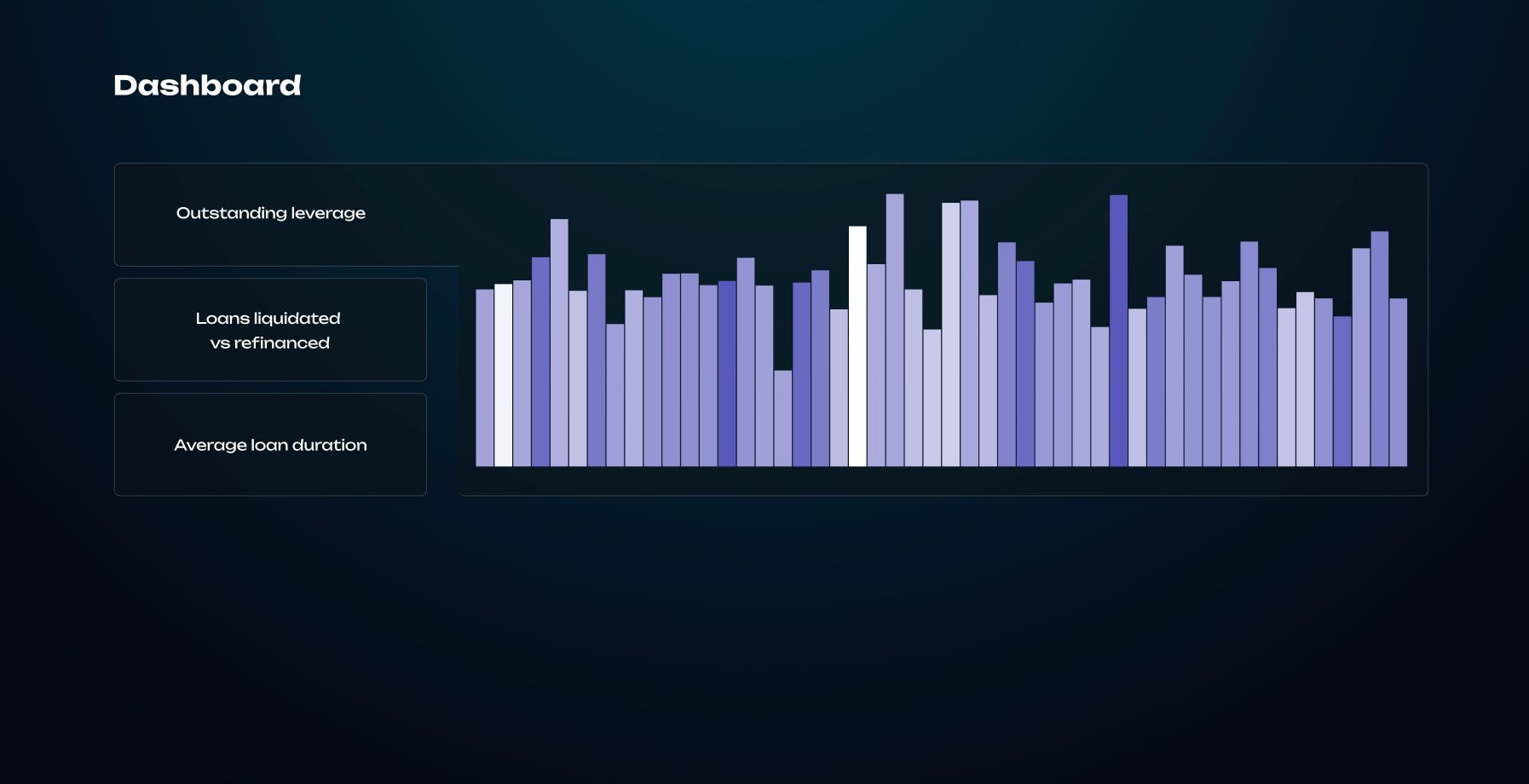

We have also added a section with useful NFT lending data for advanced users helping them make better trading decision. The data is served using The Graph protocol.

To give the app some character and to offer the users guidance, we have introduced the Noundvisor - a fun persona, inspired by Windows Clippy, serving the important alerts as well as useful advice.

The tool is (initially) focused on managing Bored Ape Yacht Club loans since it's the largest NFT lending market.

We will release the project in production after the hackathon, adding more valuable features, such as automatic refinancing, sourcing liquidity from other protocols and more.

How it's Made

Frontend: React; Backend: Javascript; On-chain data query: The Graph; Wallet connection & alerts: Wallet Connect + Web3Inbox; NFT gating access: Unlock Protocol; UI elements: NounsDAO

Did we do anything particularly hacky? We broke both Wallet Connect as well as The Graph, the teams are looking into it.