Kuala Bond

Kuala Bond is designed to simplify cross chain value transfers through the use of bonds

Project Description

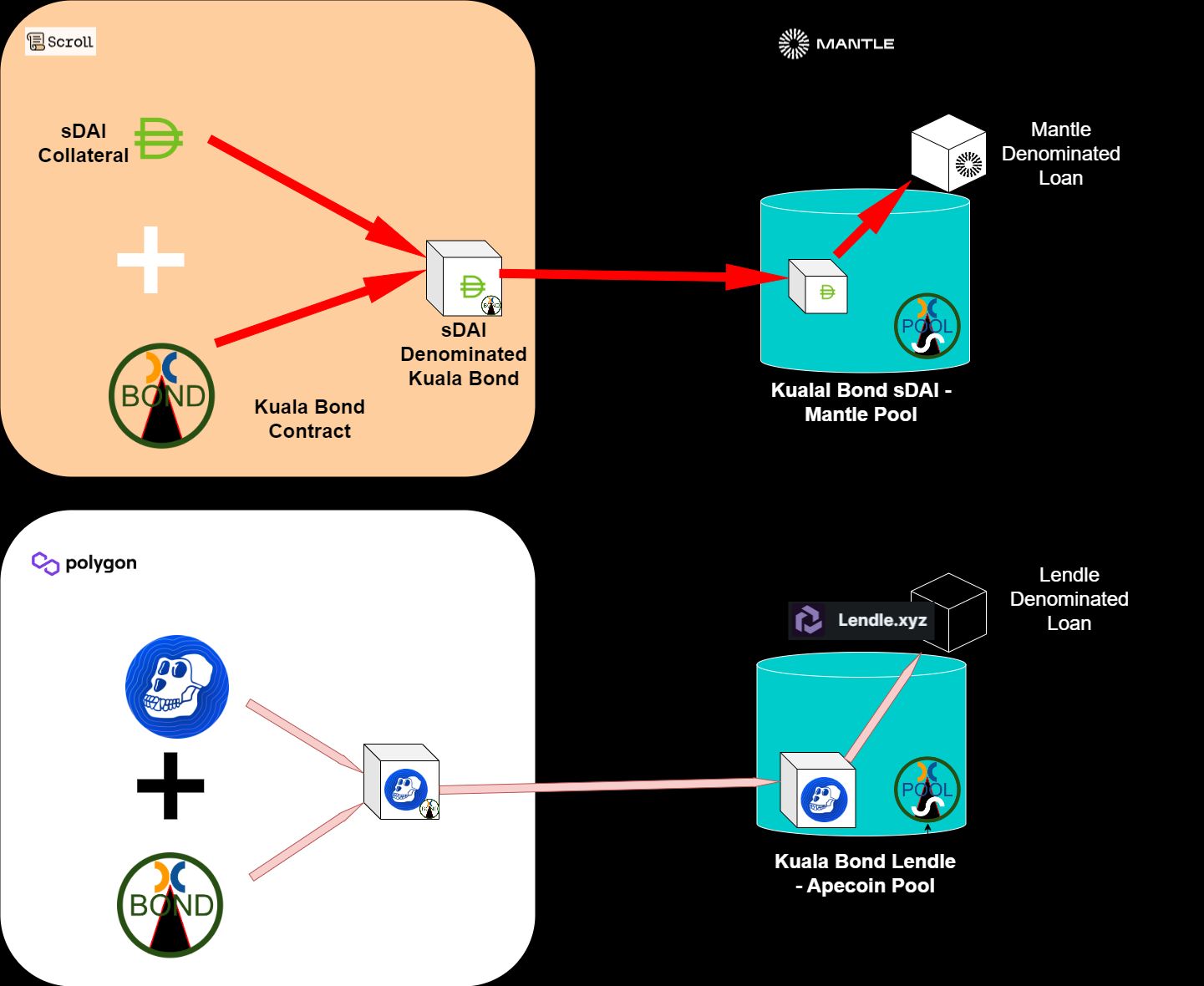

The Kuala Bond project has been created to innovate cross chain liquidity and collateral. The current issue with DeFi is that it's precarious to move funds cross chain because your project might not be supported on a foreign chain along with other risks such as those associated with bridging raw capital. Kuala Bond seeks to solve this by inverting the bond model whereby users "bond" their capital on their home chain and then explore foreign chains using bonds based on their home chain capital. This creates an amazing opportunity for both bond issuers and new chains in that it reduces the attack vectors associated with large raw capital movements and for projects on a foreign chain support for Kuala Bonds such as the APE COIN Kuala Bond opens up access to the APE Community with a model for accessing other communities as well. The Kuala Bond infrastructructure supported by Axelar cross chain mechanics enables users on the Scroll blockchain to in the first instance expose their DeFi profit making opportunities to the APE COIN community creating greater opportunities for the cocreation of value.

How it's Made

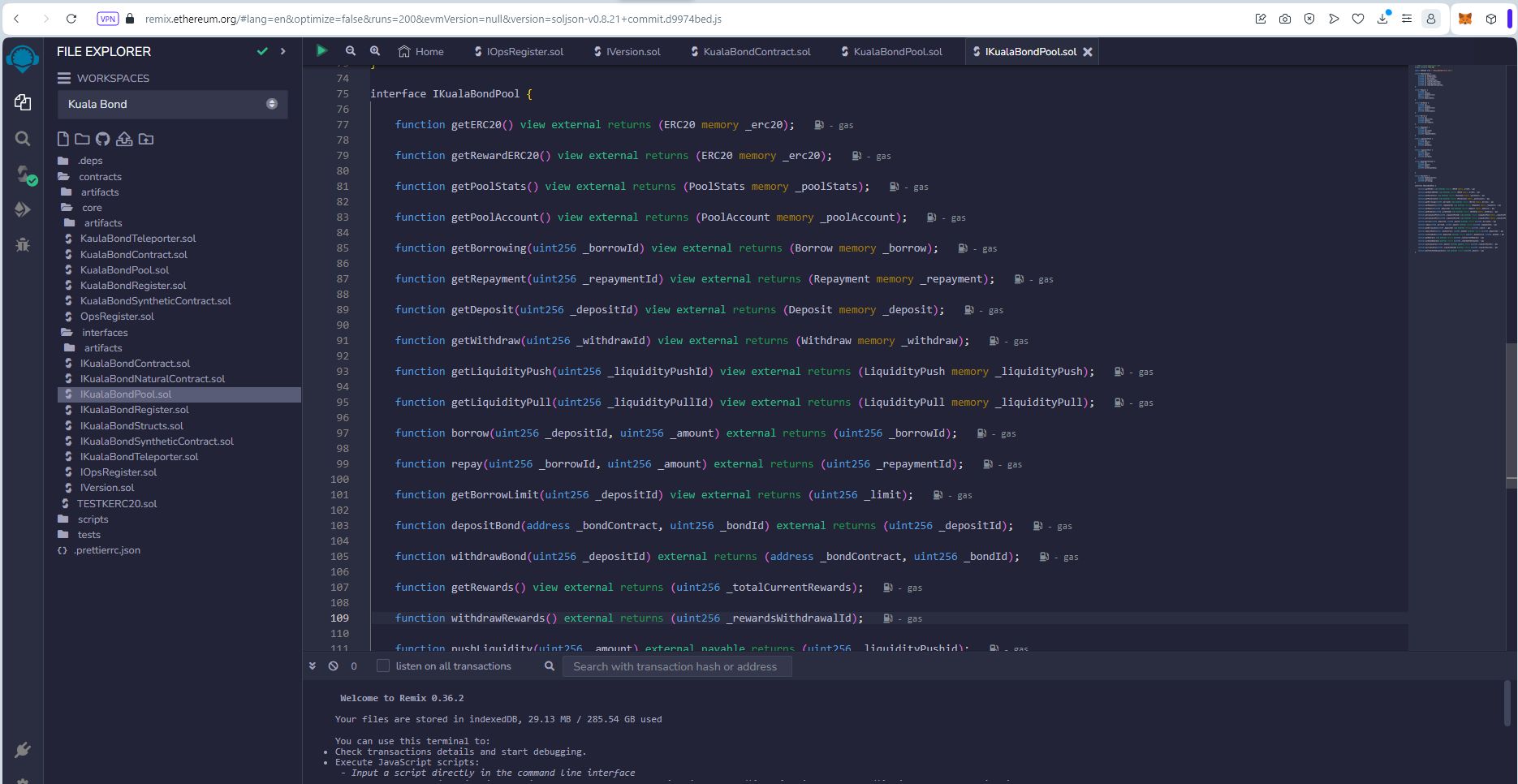

The Kuala Bond project has been built using APE COIN. Users from the APE COIN Community will be able to create Kuala Bonds which can then be transmitted to the SCROLL L2 network, where they can be used in the Scroll network hosted Kuala Bond Pools. Transmission between the native Goerli Testnet and Scroll Testnet is achieved through use of the Axelar Protocol where the project has implemented a separate transmission and receiving contracts tied together by a vault architecture.. The Kuala Bond Pool is tied to the APE COIN bond where bonds are allowed to borrow from liquidity deposits of Kuala Bond Token.