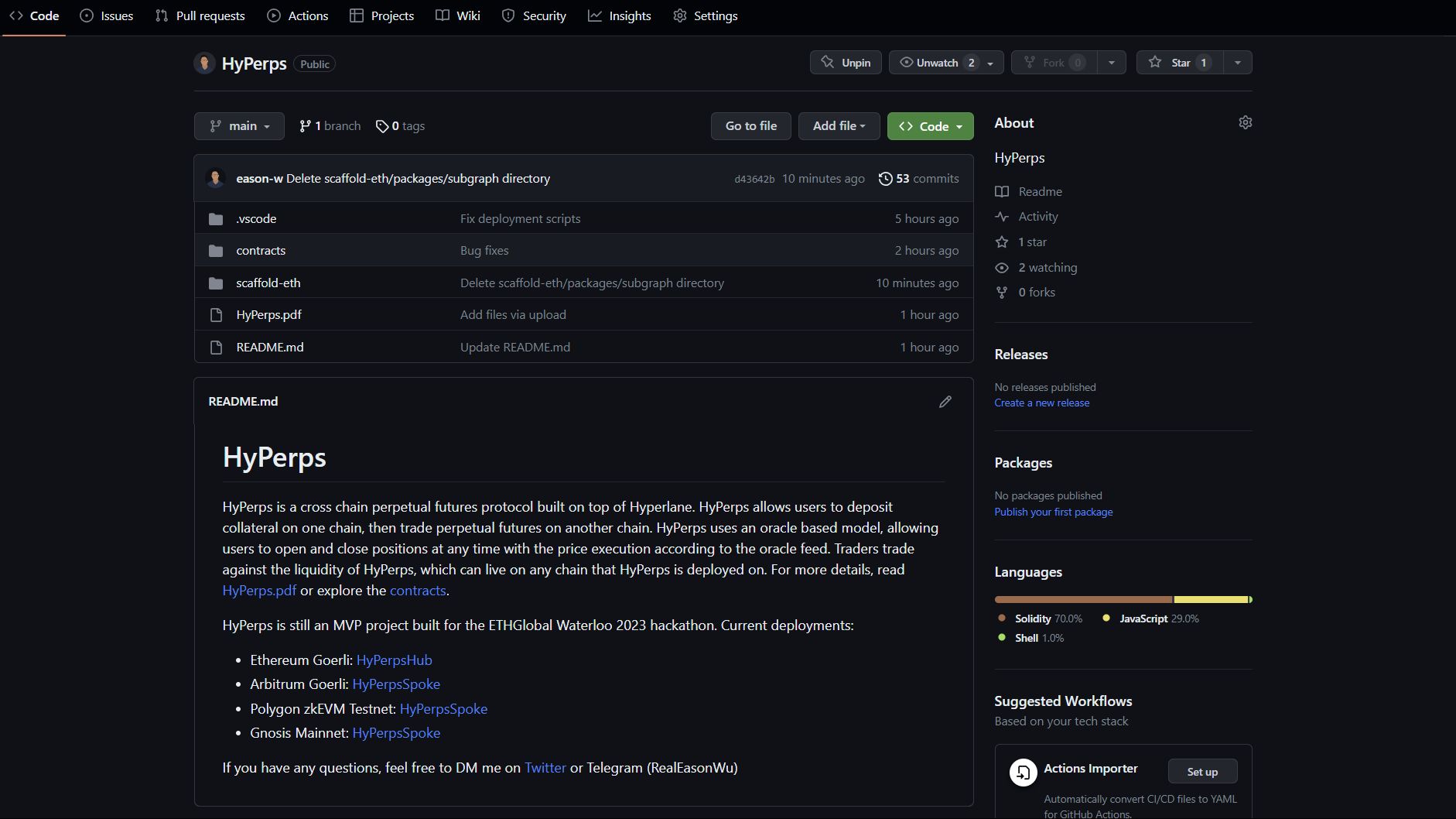

HyPerps

Cross chain perpetual futures protocol built on top of Hyperlane. Allows users to trade perps on one chain while the collateral and liquidity can be on another. Benefits include: lower gas fees, higher price latency, more liquidity, and access to more assets.

Project Description

HyPerps is a cross chain perpetual futures protocol built on top of Hyperlane. HyPerps uses an oracle based model, allowing users to open and close positions at any time with the price execution according to the oracle feed. Traders trade against the liquidity of HyPerps, which can live on any chain that HyPerps is deployed on, while the traders can also trade from any chain. HyPerps’ multichain approach means traders can choose to trade from the chain that suits their needs (ex. low gas fees, high latency), while having access to a wide range of asset types & liquidity.

How it's Made

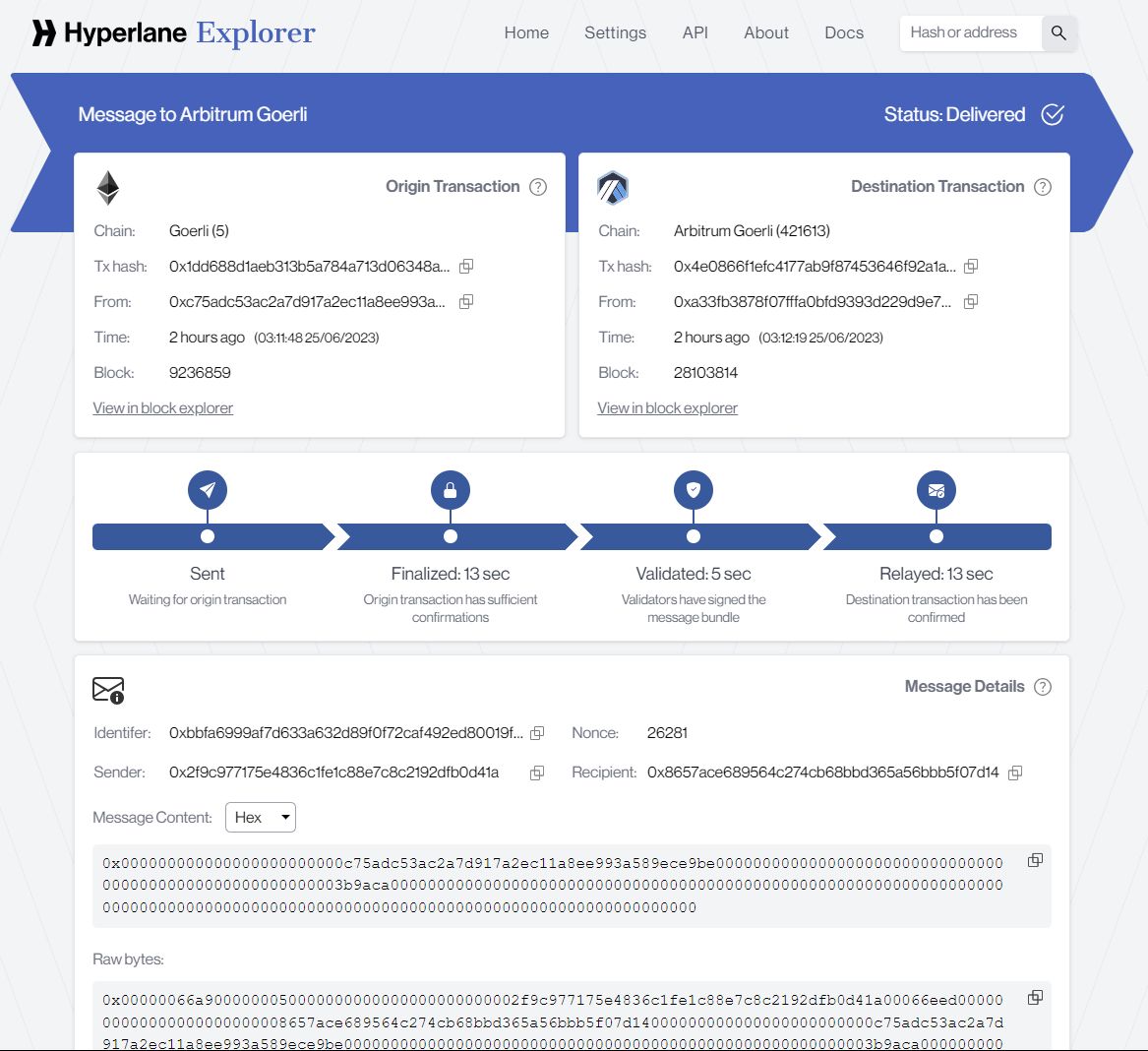

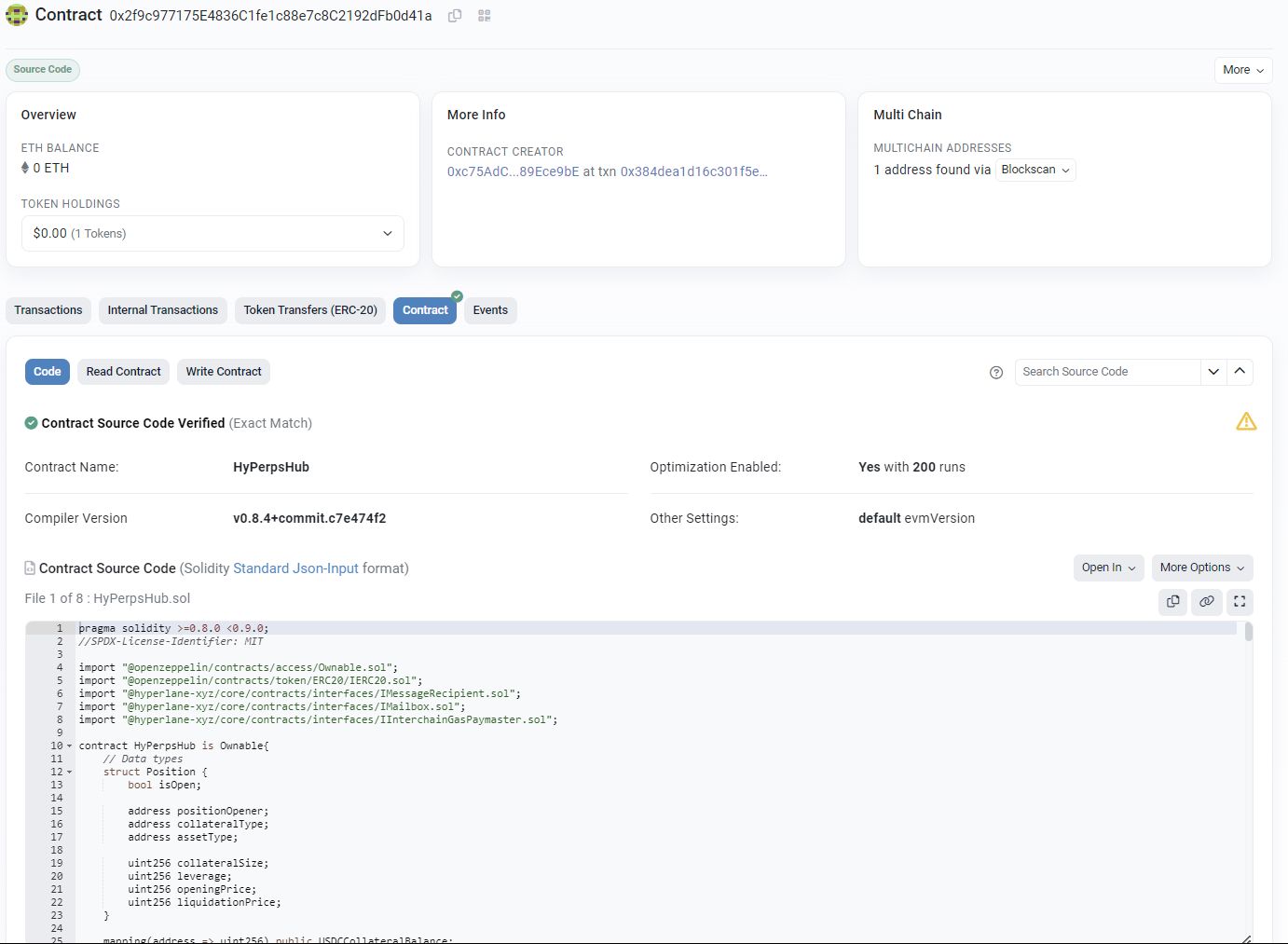

Hyperlane is the backbone technology underlying HyPerps, allowing for arbitrary messages to be sent across multiple chains. For HyPerps, Hyperlane was implemented to disperse messages to other chains when collateral was deposited on a particular chain. This allows this collateral to be used on chains other than the initial one. After a user executes and closes a perps position, this message is also propagated to the host chain that contains the user’s collateral, updating it to match the state of all chains. Other core technologies used are the chains that host HyPerps, notably Gnosis and Polygon zkEVM. Both of these chains were the best suited to act as the trading layer for HyPerps, with extremely low gas fees and fast block times. Quicknode was also used for a fast RPC when deploying the contracts. Hardhat and Scaffold Eth were also essential tools for this project, providing a strong framework to help me in the hack.