Flexergy

Our energy system must quickly decarbonize, yet the challenge to maintain the balance of supply and demand still remains. Our mission is to provide a decentralized marketplace for trading flexibility electricity services towards the transition to a smart, flexible power grid.

Project Description

New technologies are changing the way the electricity system works. As the electricity system relies more and more on renewables, and more and more energy use is electric (for example because of e-mobility and electric heat pumps for heating) the electricity system becomes more decentralized and interactive, having a bi-lateral flow of electricity (one from the power generation factories and the other from the small and medium scale renewable generators).

The bi-lateral flow of electricity drastically affects the delicate balance of electricity supply and demand, to the case where the network operator must rely on the demand-side to shift their energy patterns in order to maintain the balance of supply and demand.

Many electricity generators and consumers have the potential to reduce their demand for electricity during peak periods or, conversely, the ability to increase energy supply using existing, on-site power generation assets. Where there are known constraints on the electricity distribution network operators (DNOs) wish to enter into contracts with these consumers which will allow them to utilize this demand and generate flexibility in return for financial payment.

Hitting net-zero requires significant investment in low-carbon generation, demand-side

technologies (electric vehicles (EV), heat pumps, etc.) and electricity network capacity.

Flexible demand will have a significant impact on system capacities and operation.

Our mission is to provide a decentralised environment where the network operators can contract flexibility services from small and medium-scale electricity asset owners. Through this environment, a flexibility asset owner will have the ability to monetise its flexible power through a transparent, secure, and dynamic system.

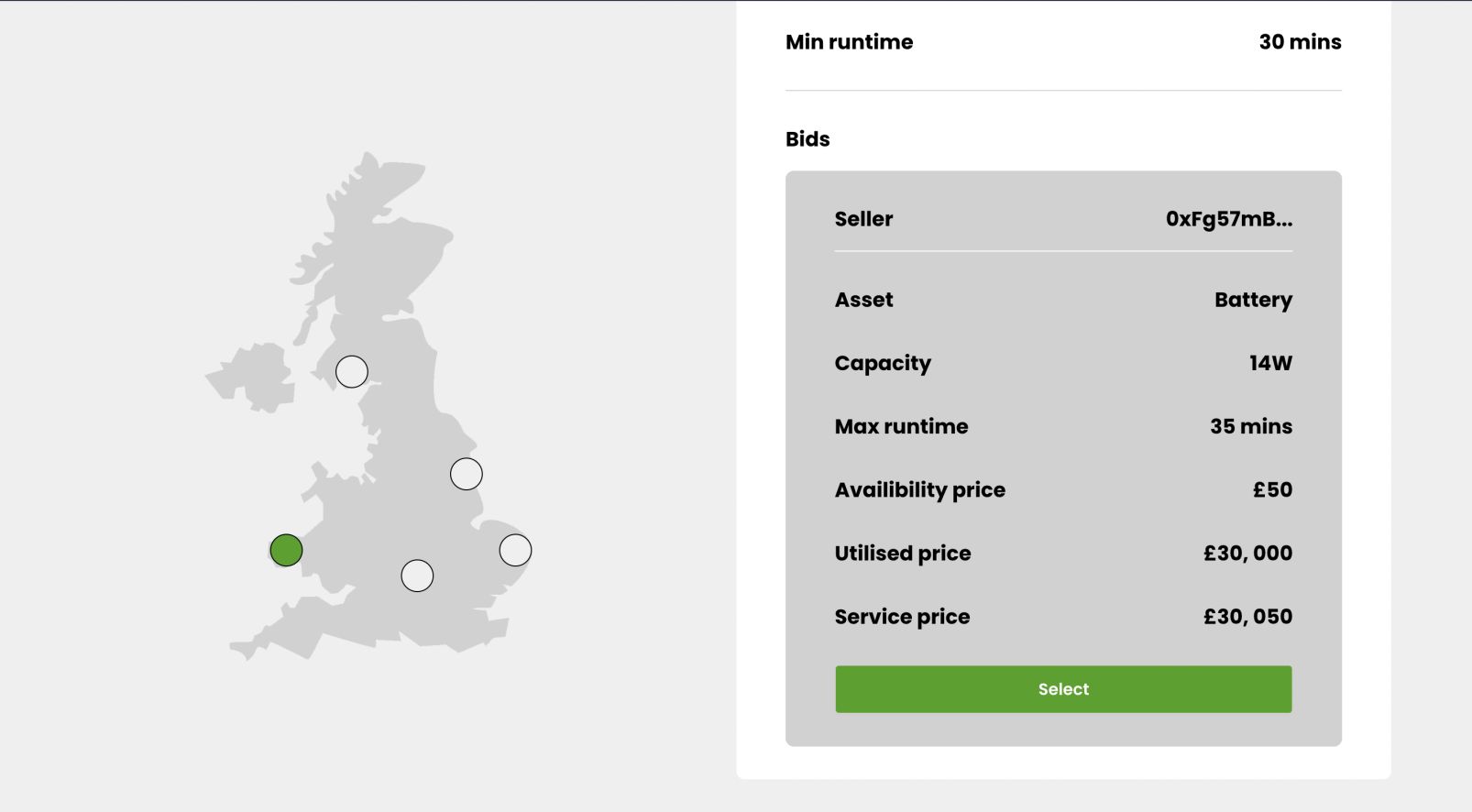

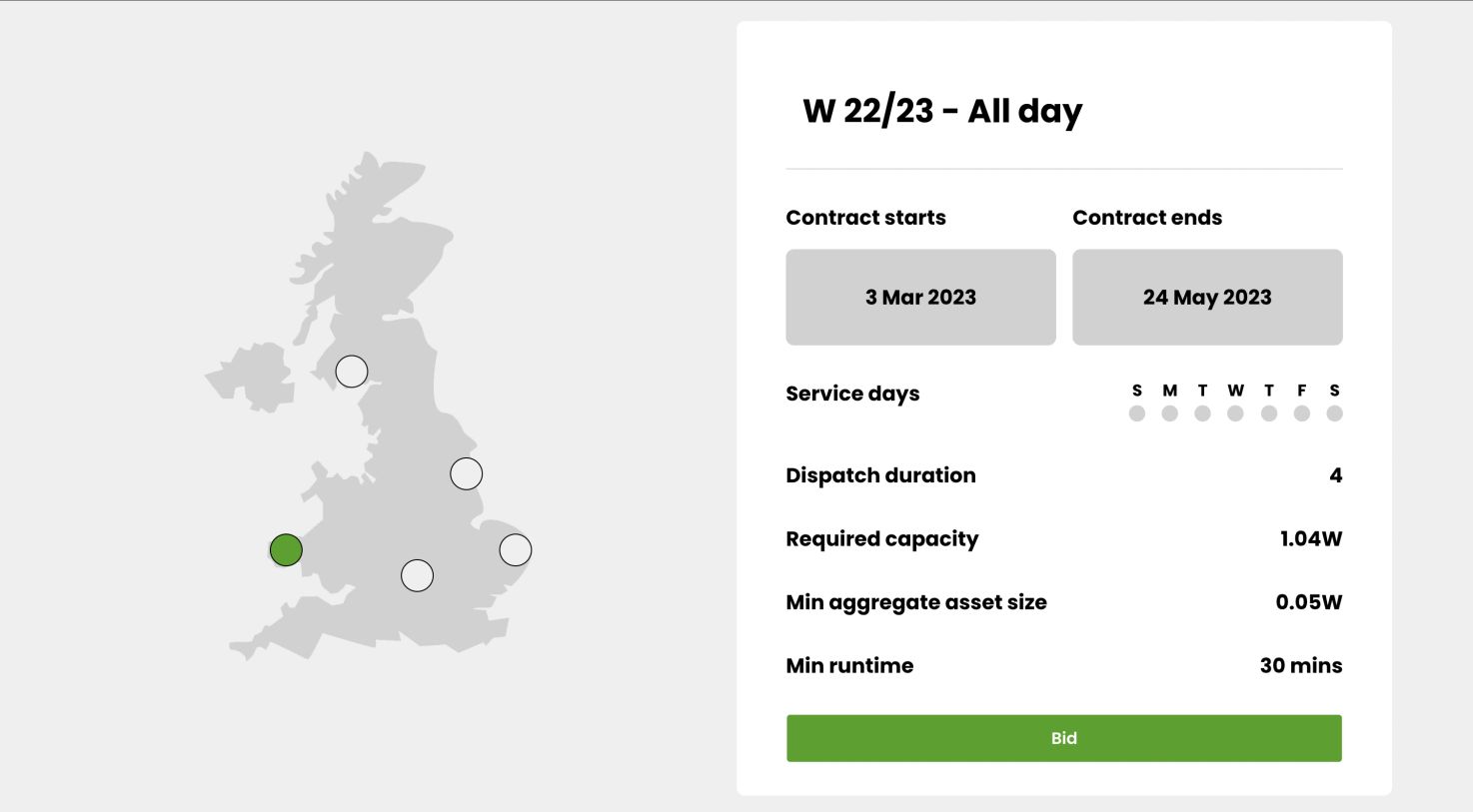

The network operator (DNO) is able to deploy competition smart contracts. These reflect a sub-network inside the grid where they are expecting to contract flexibility services. For each competition deployed, the DNO can then set up power service windows, which reflect exactly which flexibility service the DNO would wish to contract and metadata regarding the capacity required, days of operation, etc. On the other side, an asset owner (flexibility provider, FP). The FP registers their energy assets that have been mapped as NFTs (ERC-721). This mechanism is placed as the NFT stands for a unique representation of each flexibility asset. The NFT flexibility assets then bid for each service window opened by the DNO if they are whitelisted to be doing so (based on their geographical location). The DNO then manually has to select the winning bid.

The decentralised model of Flexergy incentifies higher revenues for the asset owners through yield farming. Both the network operator and asset owner are required to lock in a financial escrow (the network operator is locking in the funds used to pay for the flexible services, while the asset owner is locking in the funds that will be lost as penalties if it does not deliver). This mechanism increases the revenue of the asset owner by 2% - 5%.

Currently, the asset owner is required to provide a live data stream API from its flexibility asset back to the network operator to monitor the power delivery. Flexergy challenges this approach and provides the asset owner a layer of data protection through the use of IPFS and Zero-Knowledge Proofs. Through this mechanism, the asset owner will be able to prove its delivery to the network operator without having to publicly send any sensitive information regarding the asset energy profile on-chain.

All the architecture and functional design of the project are fully compliant with the UK Energy Regulation. Therefore, the project is legally allowed to go live at any point. All the metadata implemented has been carefully considered and agreed with UK’s top 5 DNOs (SSE, UKPN, SPEN, WPD, ELNW).

How it's Made

The whole project is utilising 3 main technologies, core solidity contracts that are the middle of everything, IPFS and Mina on the SmartMeter called zkMeter(RaspberryPI running ipfs node and computing proofs) and the frontend that displays it all. The solidity contracts take care of market betting and keep the progress of the whole flow. At the moment of the delivery, the zkMeter is submitting proof of a start of streaming and then when it delivers agreed flexibility. As we're taking the escrow from both parties, we want to capitalize on the capital and we're yield farming on Aave. A particularly hacky mix of different tech :)