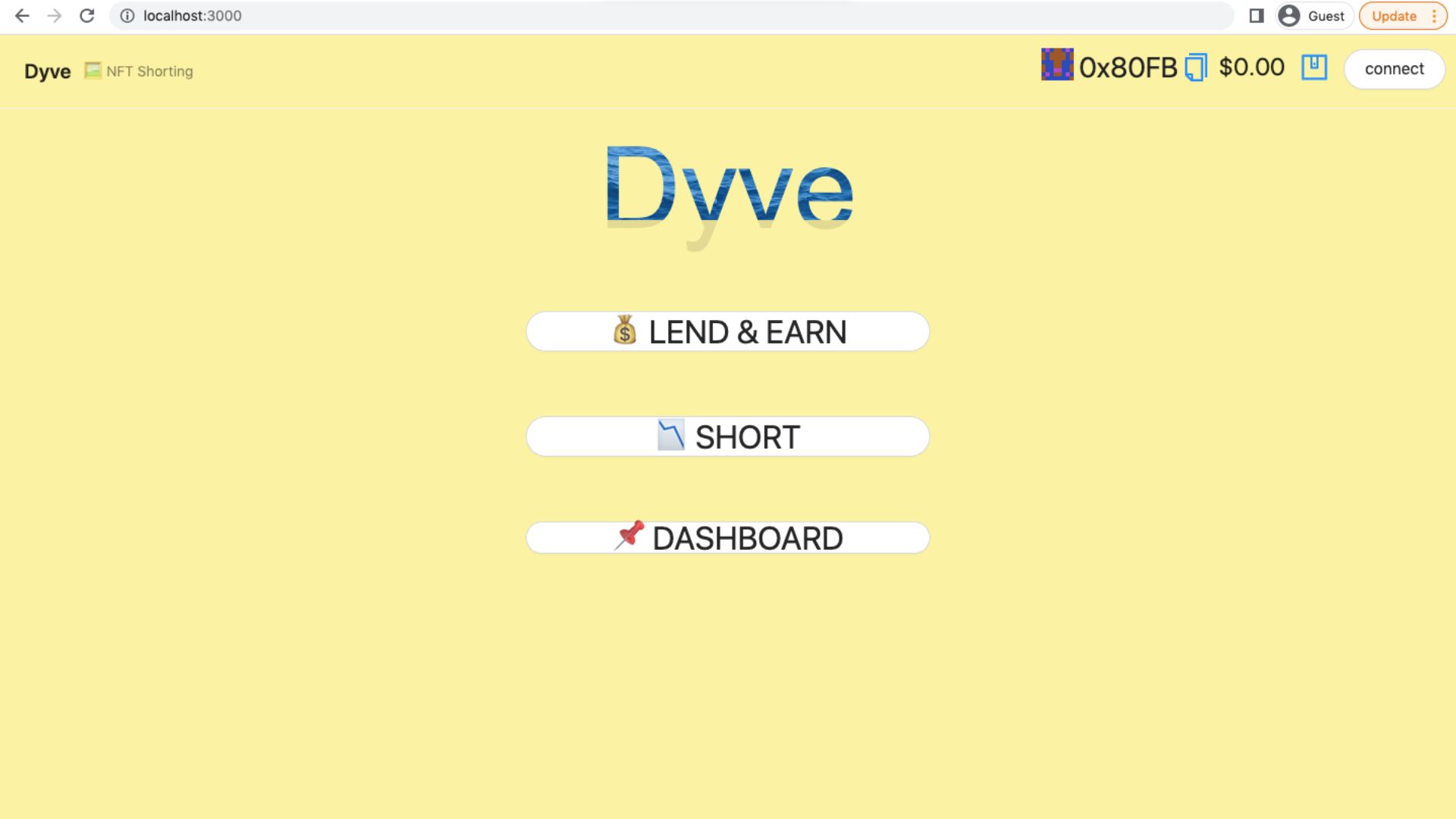

Dyve

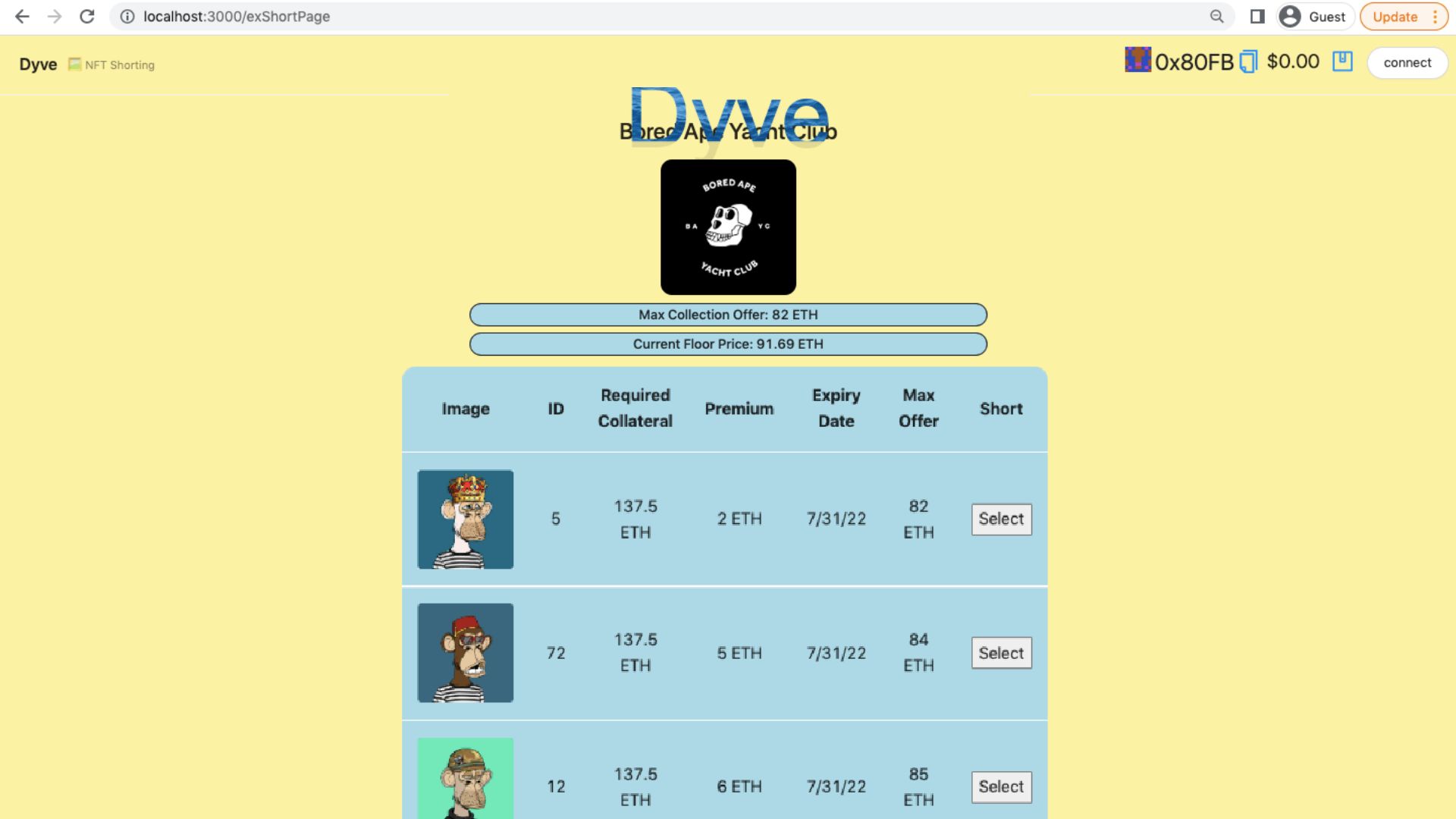

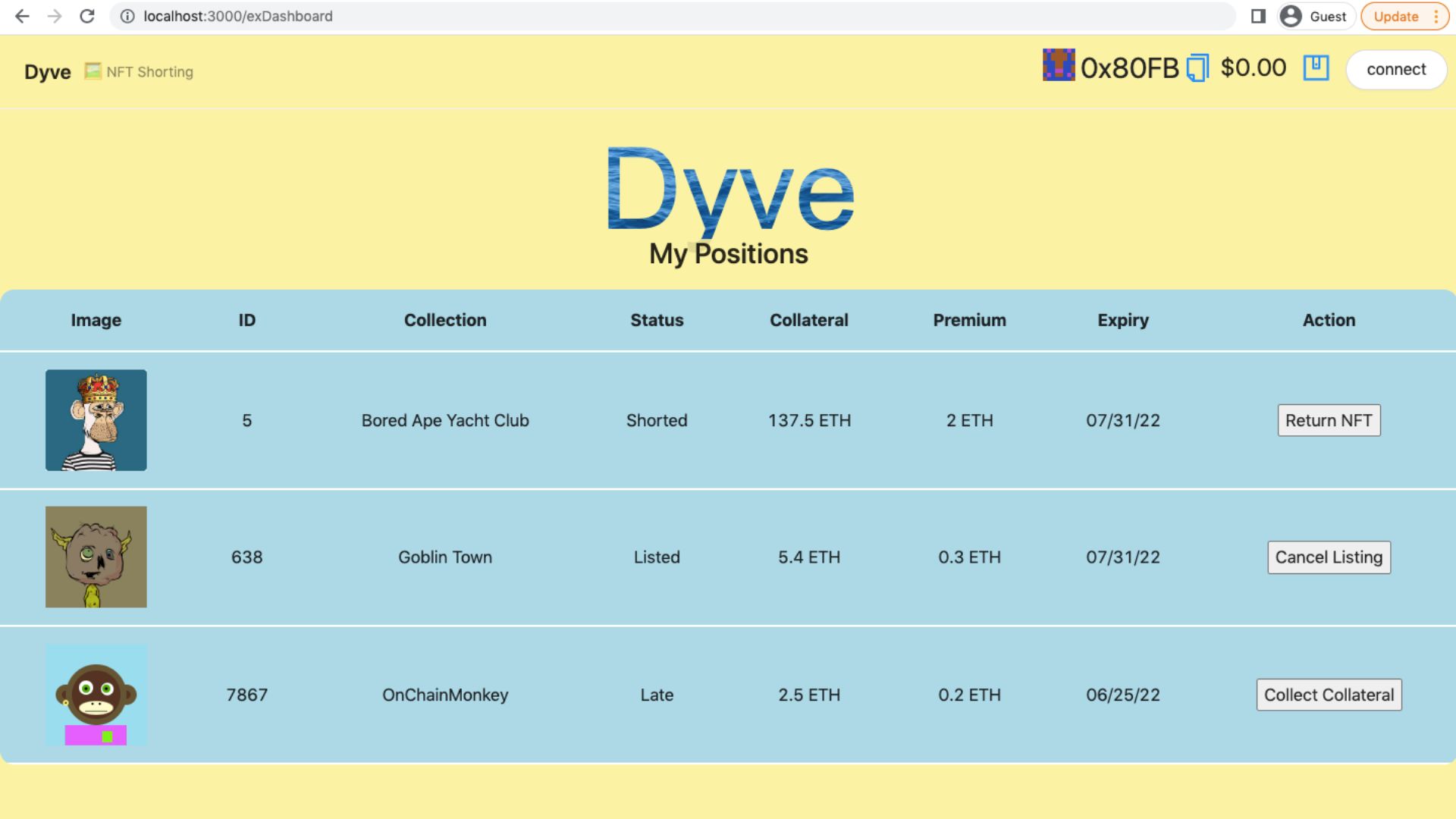

Dyve unlocks NFT shorting opportunities with a decentralized & trustless lending and borrowing platform. Hodlers receive premiums to list NFTs, borrowers pay for the ability to sell those NFTs promising to either return ANY NFT from the collection or forfeit posted collateral.

Dyve

Created At

Winner of

🚀 Optimism — Just Deploy!

🤑 Polygon — Best DeFi

🥇 Reservoir — Best Use

Project Description

The NFT market is only a half finished product. Dyve aims to be the other half! Dyve is a decentralized, trustless, permisionless, NFT lending and borrowing platform, creating sustainable yield generation for idle NFTs, and new NFT shorting functionality for borrowers.

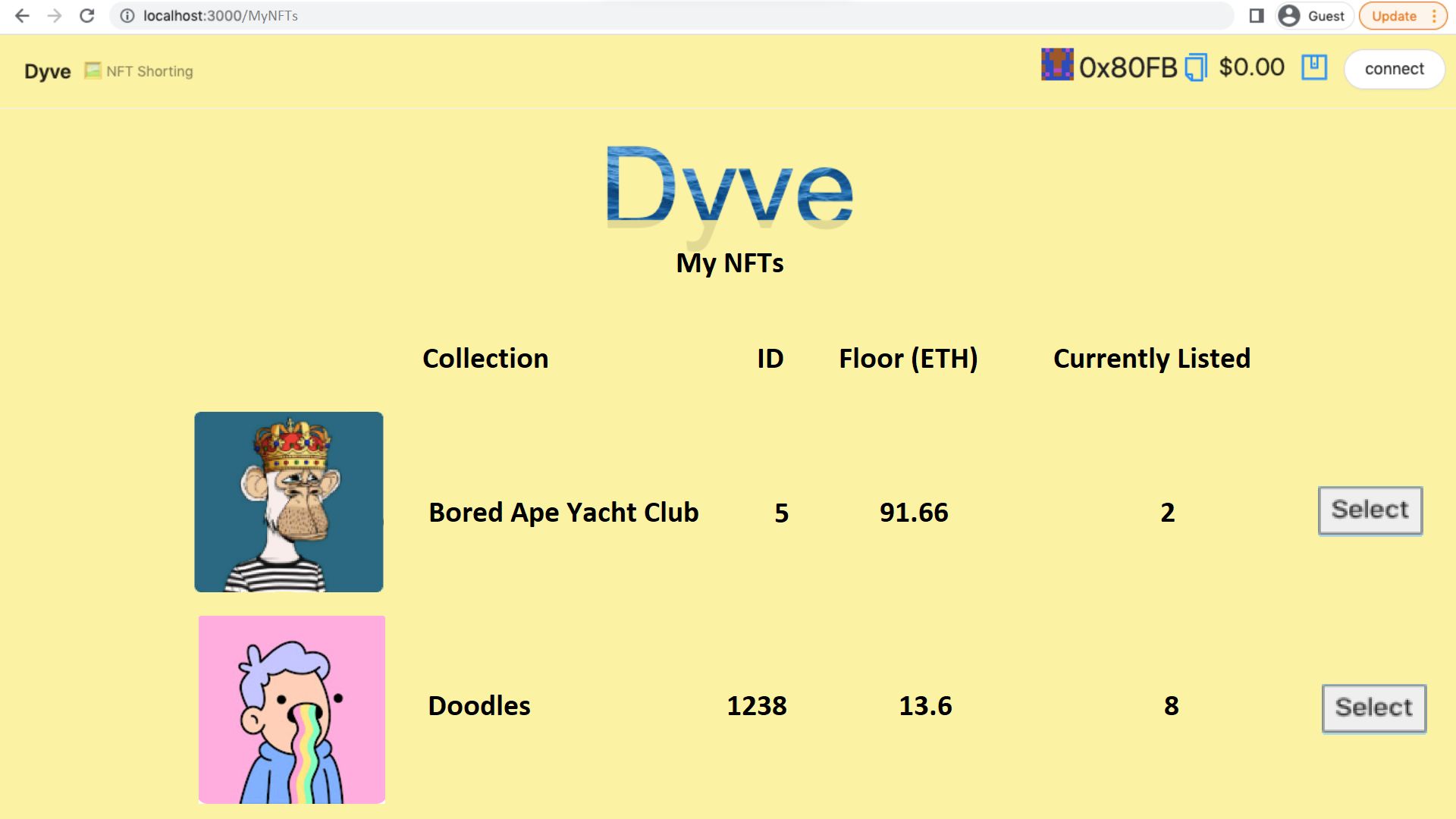

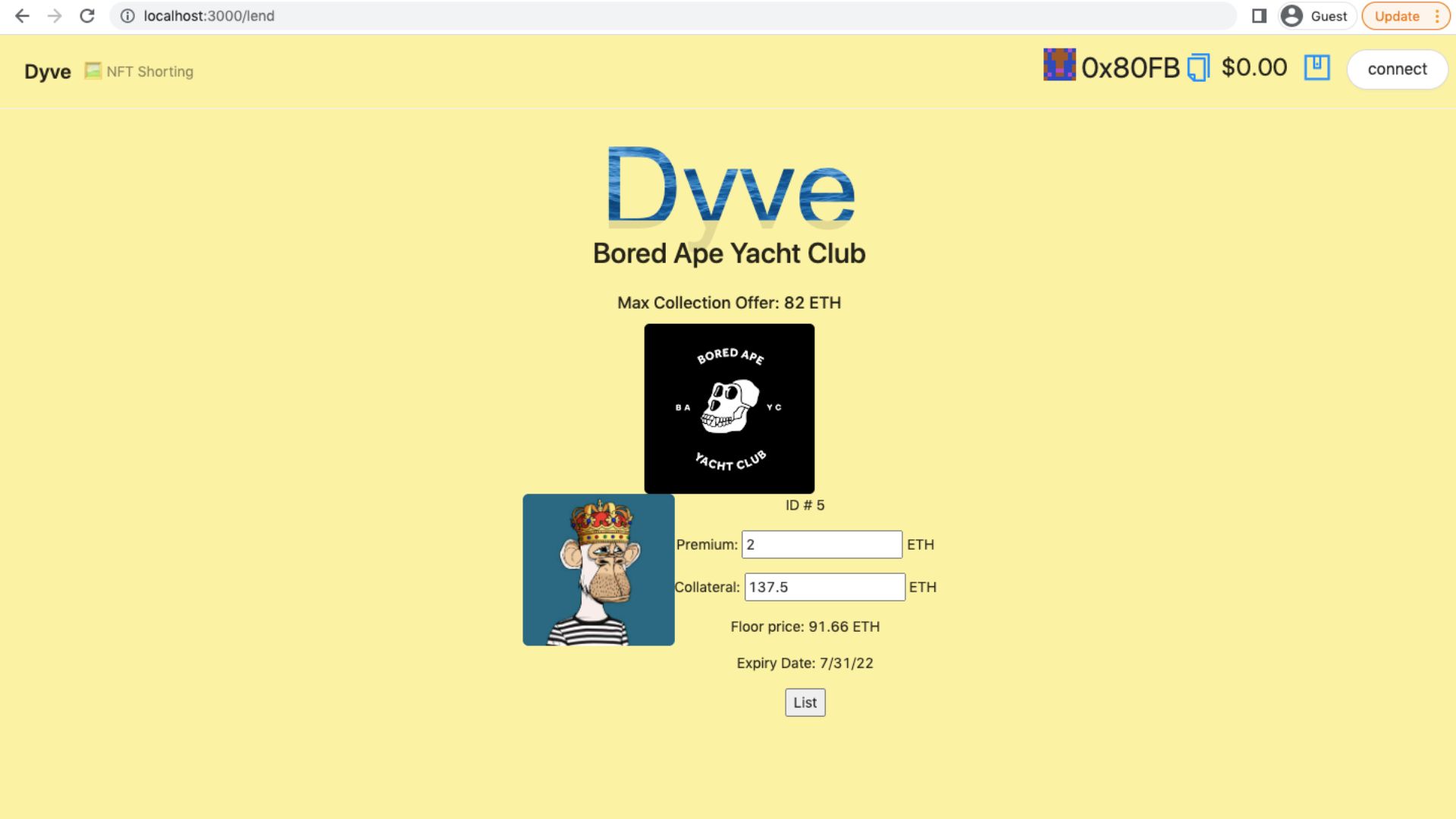

• Lenders are incentivized to provide their NFTs for a set length of time for a fee with the expectation of receiving ANY NFT back from the same collection. This opportunity is appropriate for thousands of NFTs in collection that don't have a material markup for rarity.

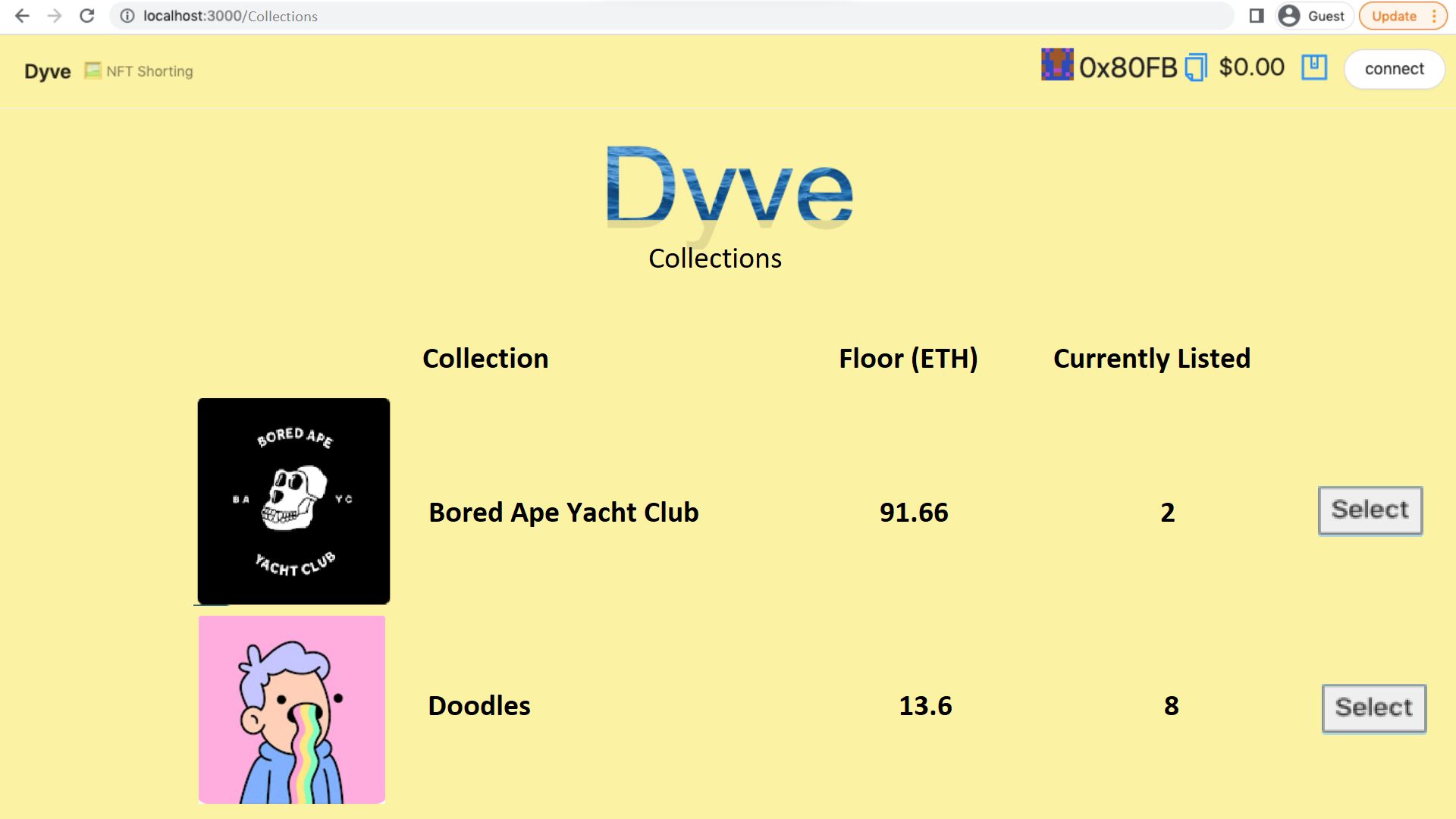

• Borrowers pay a fee and post collateral to borrow an NFT for a set time period, seamlessly selling it (often immediately via a collection), promising to either return any NFT from the same collection before contract expiry, otherwise they forfeit their collateral.

Dyve aims to scale to serve the $23 Billion NFT market, balancing "Up only" with "Down sometimes", enabling brand new capital efficient trading strategies, efficient NFT price discovery, NFT market making, and improved market liquidity.

How it's Made

To build the project we used Solidity for smart contract, React for our frontend. We used the eth-scaffold library to create our code. The Reservior api was used to get floor price of an NFT and sell NFTs to create a short position.

We are proud that we were able to unlock a brand new defi NFT primitive, which we feel will materially advance the NFT ecosystem, doing so without the need for an underlying oracle thereby making our initial design free from manipulation or attacks.