Dcollaborate

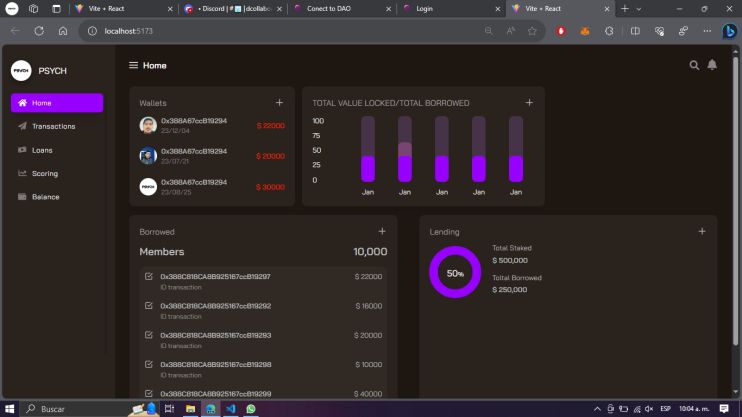

Dcollaborate: A Dapp that promotes collaboration among DAOs and its members through a Reputation Score. It offers competitive collateralized loan, enables multisig for impactful alliances, and provides 5% Yield Farming on unused collateral funds, enhancing collaborative DeFi.

Project Description

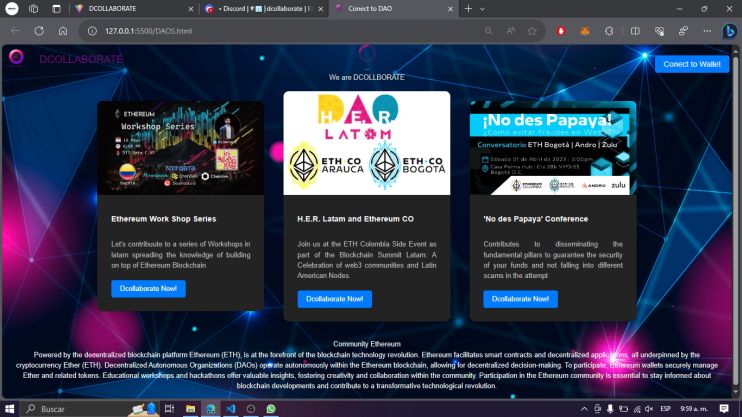

We are a DAPP that encourages collaboration between DAOs and their most active members with the best reputation. We created a global pool between DAOs to offer:

- Collateralized loans with the best collateral rate vs. loaned funds in the market for its members with the best reputation;

- The option to create a multi-signature between DAOs to create alliances for different activities, workshops and/or events.

- 5% Yield Farming on unused funds in collateral to allied DAOs

The base of our DAPP lies on an algorithm that generates a scoring of allied DAOs and its members to ensure that the most reputable members of a DAO have access to favorable interest rates and more attractive lending conditions which can encourage greater participation and collaboration. Likewise, by highlighting trusted DAOs and members, the project can promote the creation of stronger and more collaborative alliances. This increases the probability of success in joint activities, workshops and events as well as can help measure and manage the risks associated with financial operations between DAOs and their members.

How it's Made

We will use the scroll network in order to take advantage of the ZK SNARK protocol, and thus, increase TPS and reduce transaction costs; The aim is to combine both layer 2 solutions and DeFi protocols that offer cutting-edge staking, borrowing and yield farming models, integrating swap tools offered by uniswap to have the availability of different tokens with which to interact safely and efficiently with the borow, staking and yield models granted by Spark and in this way, consolidate solutions such as sDAI, Sparklend and conduits to expand the spectrum of collaboration between decentralized organizations in the way in which investments are projected using innovative strategies in different market sectors, according to the level of risk and need.

Dcollaborate will implement sismo connect to improve login, preserve privacy and allow users to selectively disclose their personal data, likewise each user will be able to generate zero knowleage tests from their data sources such as Ethereum wallets, Twitter, github and telegram. In the near future, it is planned to implement a specific data group for users who wish to request a loan from the DAO, in order to be able to measure their reputation through platforms such as “Praise” and for this to serve as an item to take into account when granting a loan.

In addition, it is planned to have a hybrid approach for information extraction where it is contemplated to use Subgraphs to extract information from DAOS creation protocols such as Aragon where the voting history, proposals launched, approved and participation rate of each member of the group can be seen; Also, with the subgraphs tool, extensive traceability of the flow of transactions can be made at the personal level of each member in terms of behavior with the interaction of decentralized finance protocols, in order to make a projection of the risk that is assumed to help the member of the DAO with a percentage of the colateralization of the loans