Correlatzia 🔀

DeFi doesn't look sexy anymore? Stop trading on price and gear up to become a correlation swaps master! Pick two assets, select the expected correlation after 30 days, decide the maximum notional amount you'd like to sell and offer it on the market 💱

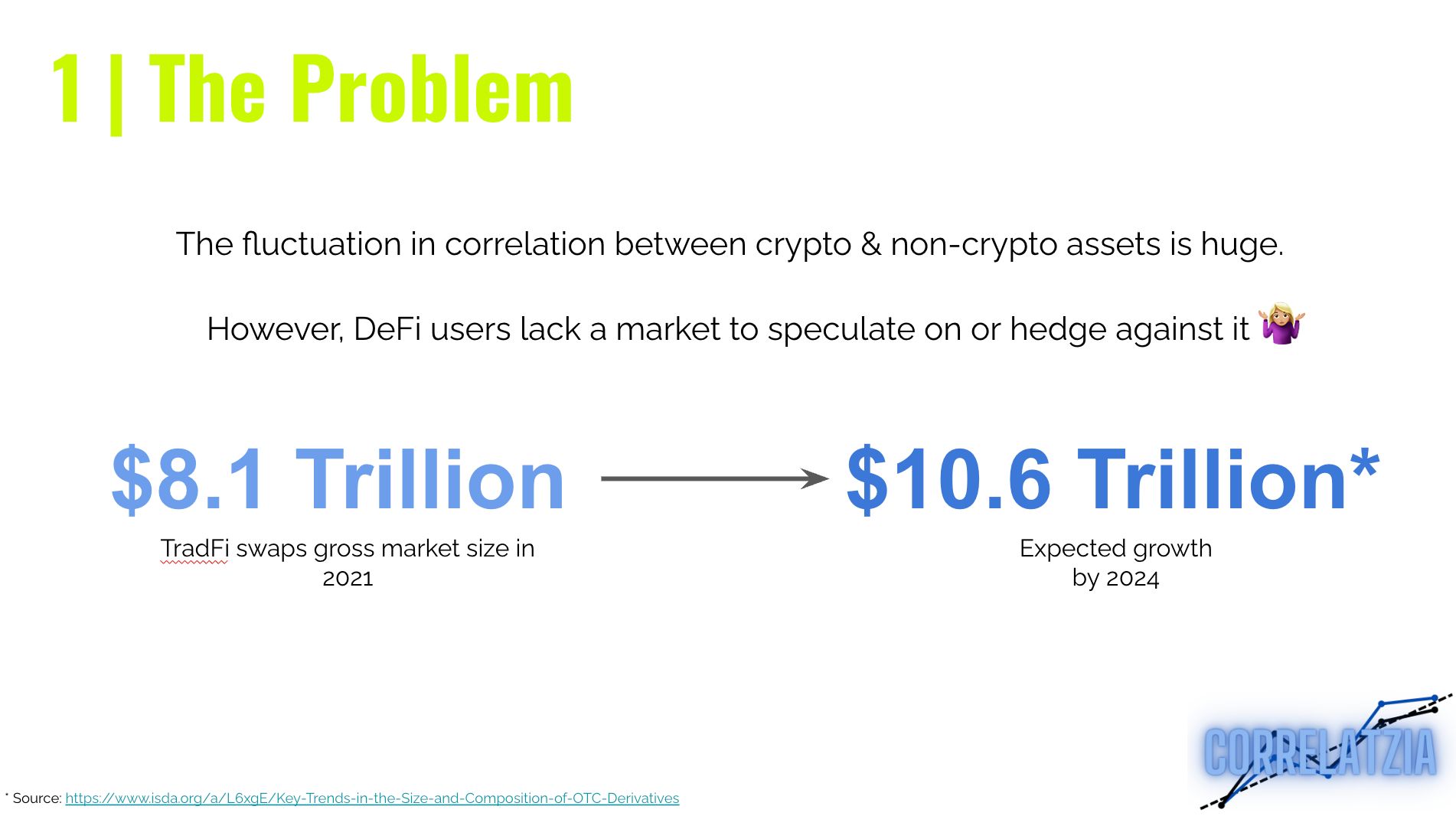

Project Description

In TradFi, a correlation swap is an OTC derivative that allows one side to speculate on or hedge risks associated with the observed average correlation between the two or more assets like commodities, exchange rates, interest rates, or stock indexes. Boring! 🥱

Correlatzia is a dApp allowing you to pick two ERC-20 tokens, set a fixed correlation, lock USDC/USDT/DAI as collateral and offer DeFi Correlation Swaps up to the amount corresponding to your collateral. Wait, what? Okay, let us break it down in an example!

Alice is a YugaLabs fan who'd like to speculate on correlation. She comes across Correlatzia, where:

- She decides to bet on the correlation between ApeCoin and WBTC.

- She calculates that the historical correlation was 0.91 (lately). But she's aware that a big alpha from YugaLabs related to BTC is coming. Therefore she decides to offer a Swap with a fixed correlation of 0.91 (betting that ApeCoin and BTC will have an even stronger correlation in the future).

- Alice decides on a $10,000 notional, meaning she's locking such equivalent in stablecoins as collateral and that amount will be the base for payoff calculation. (Now, the only Swap maturity period is 30 days, we'll add more options in the future).

Now, Bob sees the Swap offer from Alice and believes that ApeCoin & WBTC correlation will weaken, since he's bearish on ApeCoin and bullish on the latter. Therefore he locks $5,000 worth of collateral in stablecoins and buys half of the available order (with $5,000 notional). The third player, John, is also sceptical about the correlation to strengthen. Therefore he locks $3,000 worth of stablecoins and buys part of the available order (with $3,000 notional). The remaining $2,000 of Alice's order has not been filled and won't be considered in payoffs.

The maturity date comes and the strike correlation over the 30-day period is calculated at 0.94, which means Alice was right, long live ApeCoin & BTC together! I. Alice's payout is the amount filled $10,000 - $2,000 = $8,000 is the realized notional. The correlation difference is (0.94 - 0.91) = 0.03, which gives us $8,000 * 0.03 = $240 payout to Alice. II. The reverse logic applies to Bob & John and they lose $5,000 * 0.03 = $150 and $3,000 * 0.03 = $90 respectively.

Resources:

- TradFi Correlation Swap: https://finpricing.com/lib/EqCorrelationSwap.html

- Correlation between BTC/ETH: https://www.macroaxis.com/invest/market/BTC.CC--compareProfile--ETH.CC

- Presentation: https://docs.google.com/presentation/d/1IhMDr7Ez4GND3zVTcCtIYwRvkHSMBrKJ4Vq1fxFzObM/edit?usp=sharing

- Video: https://www.loom.com/share/22e66abd2e7946c8b6b531b76f080bb0?sid=e4f08919-730c-4ddf-9a08-de1a28bbc23e

How it's Made

We deployed our contacts on Scroll, utilising WalletConnect as the wallet and ApeCoin as the primary asset for correlation Swaps. In the current version, users can pick any two ERC-20 tokens to create a correlation swap. The collateral a user needs to deploy in the contract is 30% of the maximum possible payout from the swap.