Coffin Finance

Cof.fin is a decentralized finance (DeFi) platform that enables users to maximize their yield from liquidity mining through automated leveraged yield farming on Uniswap V3 and Aave

Coffin Finance

Created At

Winner of

🌍 Uniswap Foundation — Best Ecosystem Hack

🥈 Aave Grants DAO — Best Use of Aave/GHO

🏊 The Graph — Pool Prize

🏊 Scroll — Deploy a Smart Contract

Project Description

Cof.fin's yield farming platform has the potential to not only generate high returns for investors but also increase the utility and adoption of GHO tokens, creating a positive feedback loop that benefits both investors and the broader DeFi ecosystem. By enabling users to deposit and withdraw GHO tokens for yield farming, Cof.fin creates a new use case for the tokens beyond simply holding them for speculative purposes. This can help to drive demand for GHO tokens and increase their overall value, while also providing users with a way to earn passive income on their investments.

Overall, Cof.fin's yield farming platform has the potential to not only address the low yield returns for GHO token holders but also increase the adoption and utility of GHO tokens in the broader DeFi ecosystem.

How it's Made

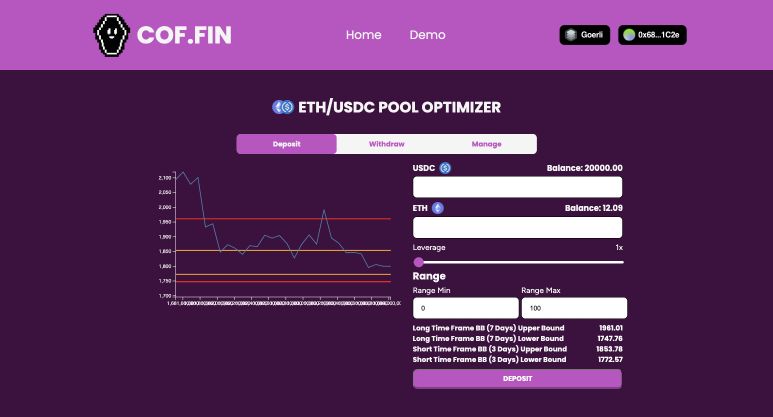

Cof.fin is built on top of two key DeFi protocols: Uniswap V3 and AAVE.

Uniswap V3 is a decentralized exchange that allows users to swap tokens and provide liquidity to earn fees. Unlike previous versions of Uniswap, Uniswap V3 offers concentrated liquidity, meaning that liquidity providers can specify a price range for their liquidity, allowing for greater capital efficiency and higher returns.

Cof.fin leverages Uniswap V3 by enabling users to invest in concentrated liquidity pools and earn fees from trading activity. By providing liquidity in these pools, users can earn a portion of the trading fees generated, while also benefiting from the capital appreciation of the underlying assets.

AAVE, on the other hand, is a decentralized lending platform that allows users to borrow and lend cryptocurrencies. Users can deposit their cryptocurrencies as collateral and borrow other cryptocurrencies in return. AAVE uses an algorithmic interest rate model to determine interest rates, ensuring that rates remain stable and transparent.

Cof.fin utilizes AAVE's lending platform to enable users to borrow funds and invest them in Uniswap V3 pools. By leveraging their positions, users can increase their potential returns and take advantage of market volatility.

By combining the power of Uniswap V3 and AAVE, Cof.fin offers users a powerful platform for leveraged yield farming and DeFi investing. With our user-friendly interface and optimized algorithms, you can easily manage your portfolio and maximize your returns.