Banker Smith

xUSD is a cross-chain synthetic USD that offers capital efficiency with a 1:1 collateralization ratio without the risk of liquidation while providing a Web3 native yield. The protocol accepts ETH as collateral to back xUSD.

Banker Smith

Created At

Winner of

💸 Hyperlane — Best Use of Warp Routes

🏊 Scroll — Pool Prize

Project Description

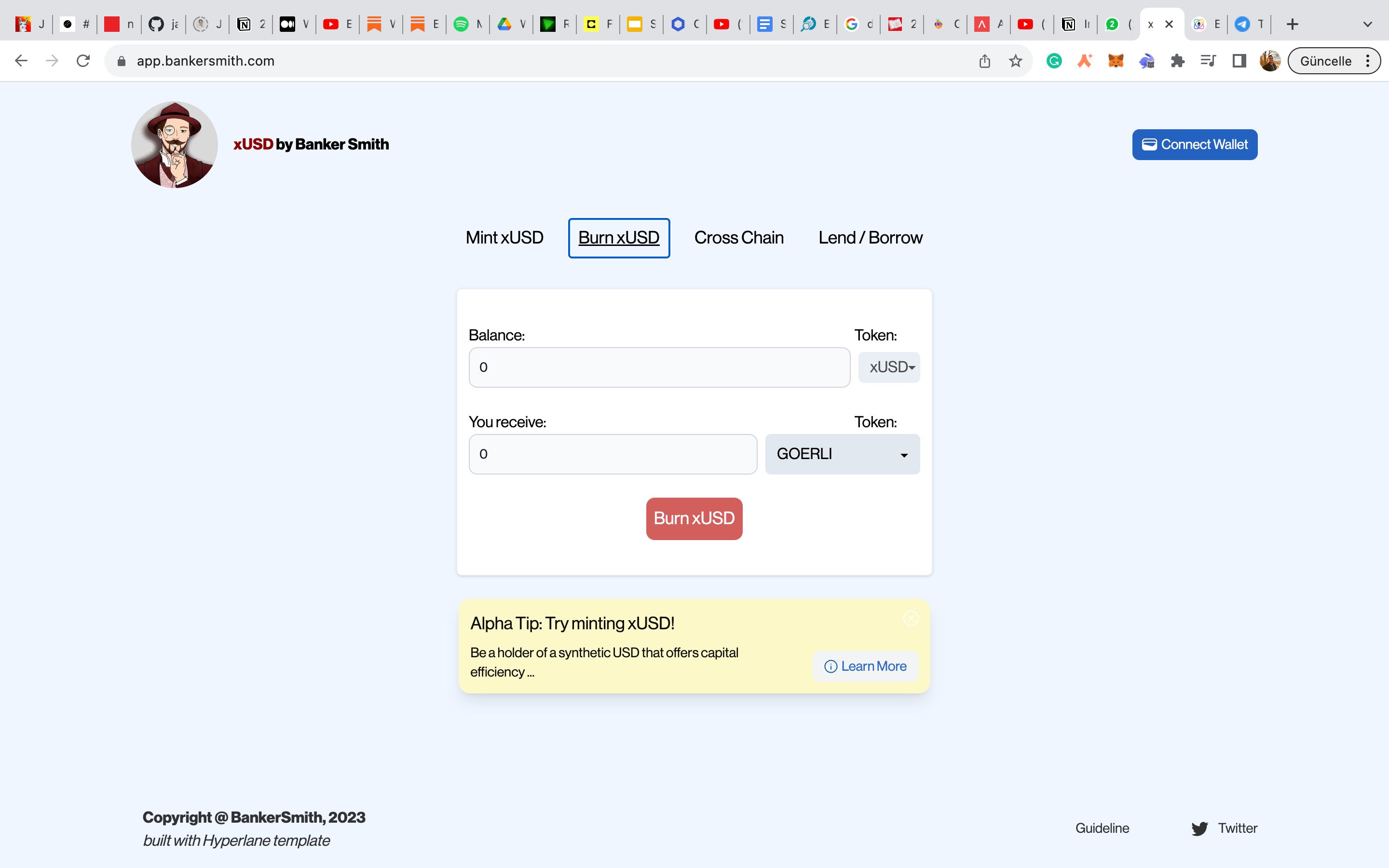

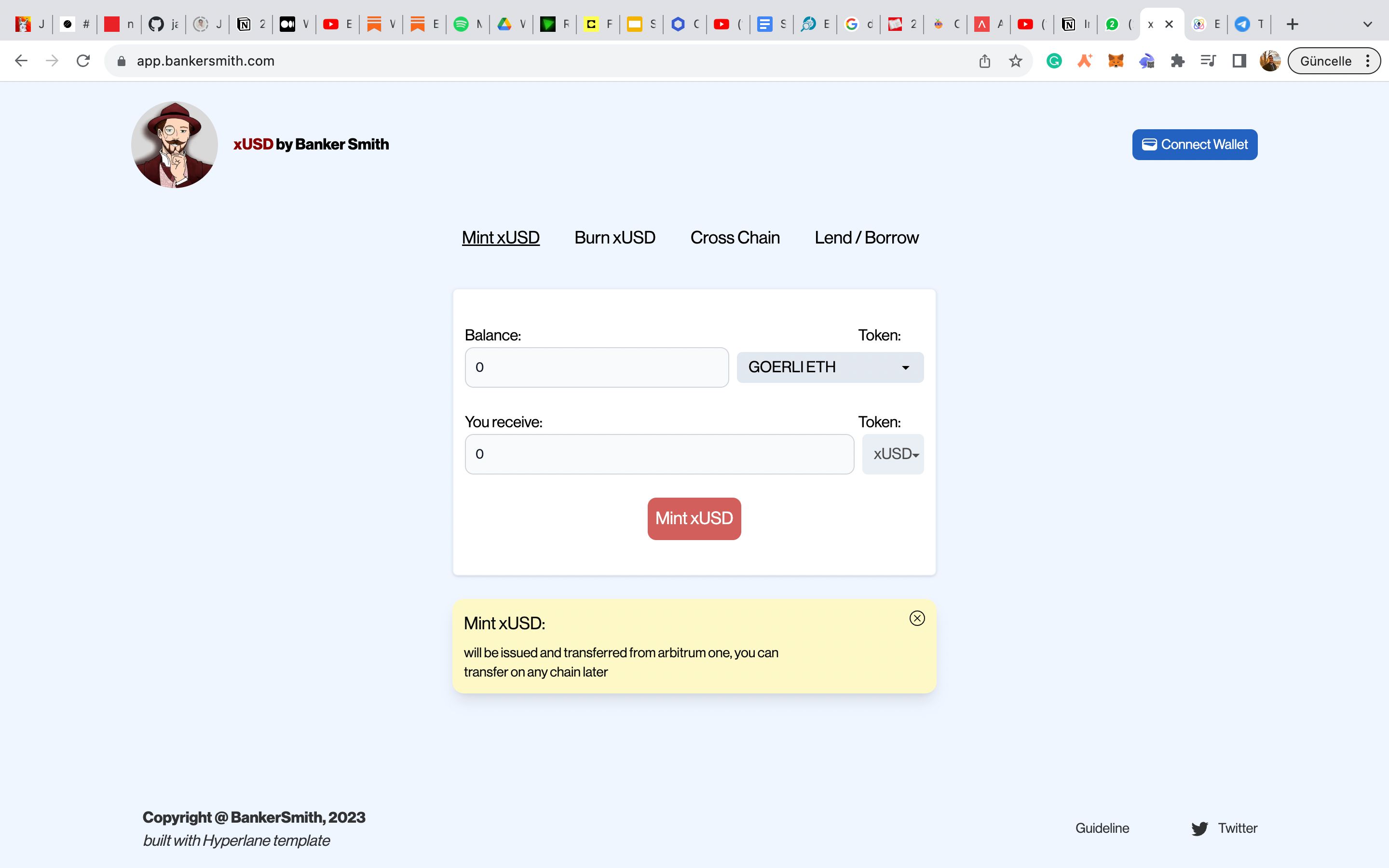

xUSD is a cross-chain synthetic USD that offers capital efficiency with a 1:1 collateralization ratio without the risk of liquidation while providing a Web3 native yield. The protocol accepts ETH as collateral to back xUSD.

ETH is used to open a short position to create a "spot long, derivative short" position. This position hedges the dollar value of the collateral so the price volatility doesn't impact the reserves.

xUSD will capture value by creating the first “Web3 native yield” for its users. xUSD will enjoy funding fee yield as a result of the short position that the protocol opens. This is going to be the first “Web3 native yield” that will attract institutions and businesses to the Web3 ecosystem.

The mechanism behind xUSD gives it a clear edge against its competitors in the ecosystem, both fiat-backed and crypto-backed. While xUSD is superior against fiat-backed stablecoins in terms of disconnection from the banking system and censorship resistance, it is better positioned against crypto-backed stablecoins in terms of capital efficiency, scalability, and non-liquidation.

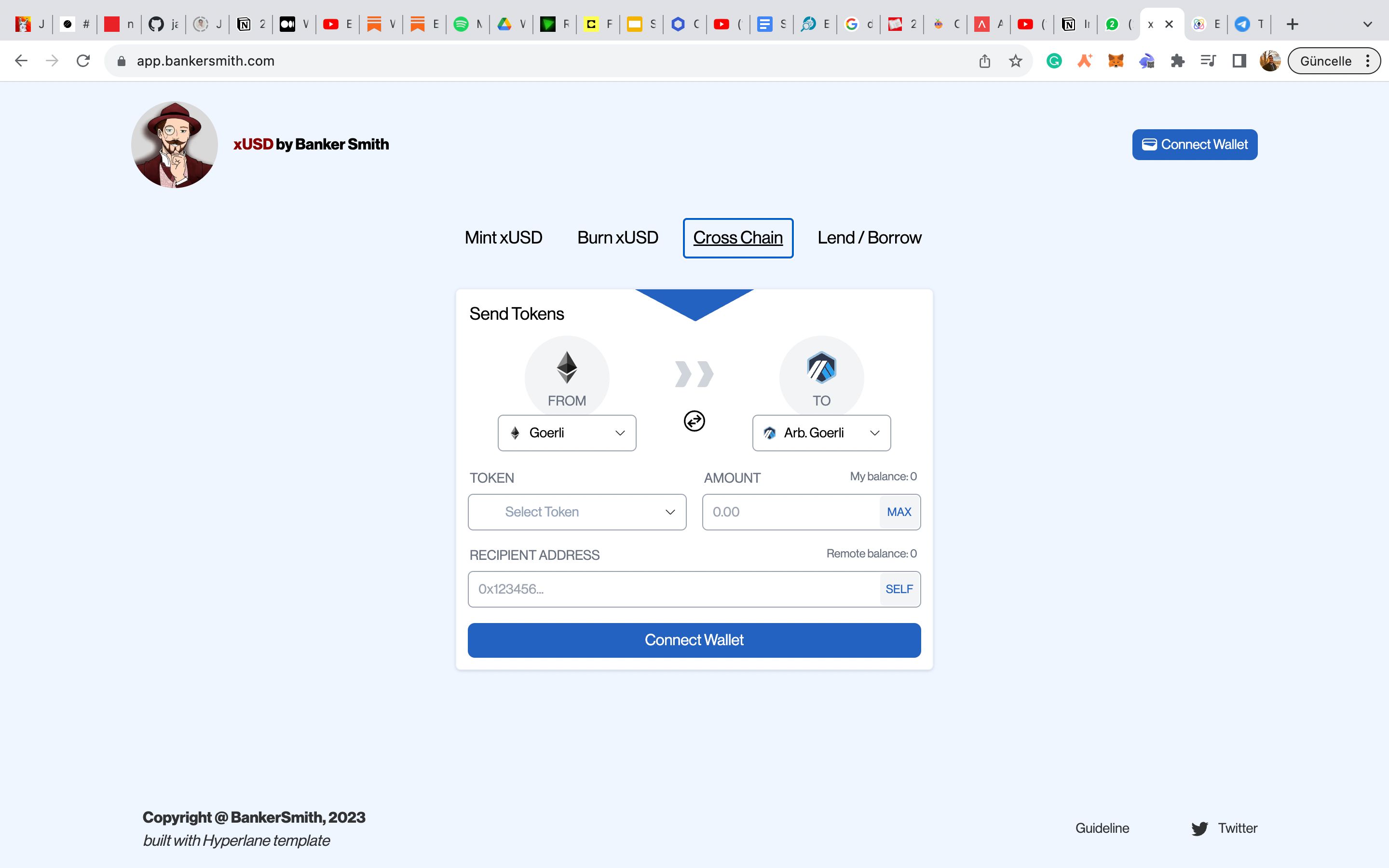

How it's Made

In our project, we've mainly used Hyperlane and its products. We created a delta-neutral synthetic stablecoin, using Binance API and Hyperlane's template UI, combined with a mint burn system for our stablecoin. xUSD was deployed to several chains, including Ethereum, Arbitrum, Mantle, Scroll, and zkEVM testnet.