avobankless

Crypto Loans Without Collateral Is Now Possible with avobankless credit protocol

avobankless

Created At

Winner of

🥇 Superfluid — Best Overall Hack

🥈 Yearn — Best Use

🏊♂️ NFTPort — Pool Prize

Project Description

In DeFi, loans are over-collateralized.

This means that to get a loan, you have to deposit more than you want to borrow.

Why would anyone want to take over-collateralized loans?

So you need some kind of identity and credit verification system but this isn’t exactly decentralized and this kind of borrowing is not really helping to drive adoption from the masses.

However, DeFi lending solutions are emulating the same practices of traditional banking, preventing thousands of crypto users from accessing a loan due to lack of collateral.

That is why we built the 🥑 avobanklees protocol: Crypto Loans Without Collateral Is Now Possible.

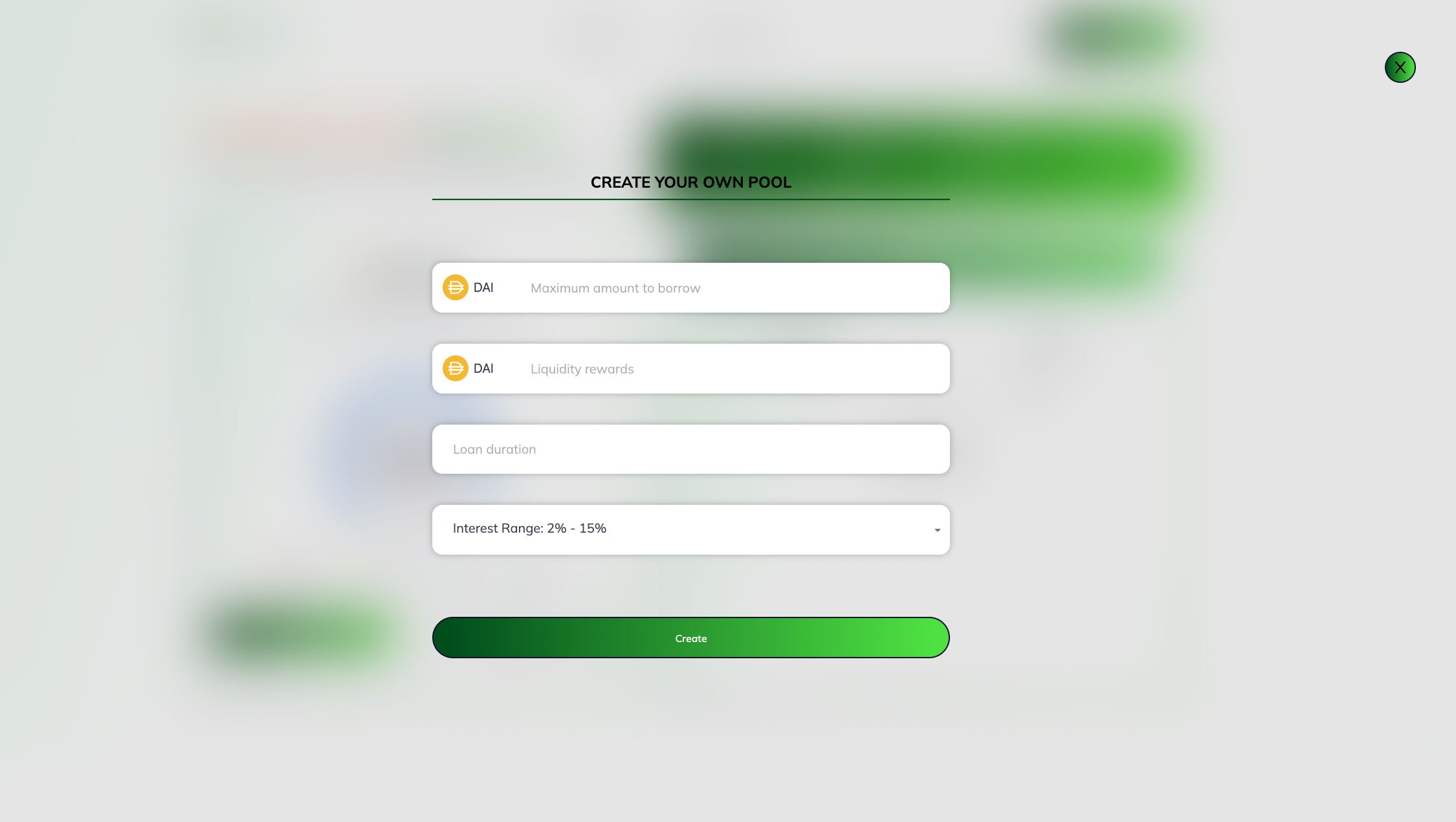

-Borrow anytime with competitive Lending Rates on a cryptocurrency line of credit in the form of a liquidity pool where you can withdraw at any time.

-Lend with AutoPay by leveraging superfluid's constant payment streams to automatically amortize loans with constant yields, always with liquidity.

-Create a non-fungible credit score to connect your DeFi on-chain history into a single composable asset and develop your borrower profile.

For this hackathon we have focused on building the first part of lend and borrowing the loan.

How it's Made

We use Superfluid for:

🥑Automatically amortize loans.

🥑Decrease volatility in the liquidity pool.

🥑Borrowers flexibility for short terms liquidity needs.

We use NFT Port for:

🥑Display NFT info to see lenders' positions.

(In the future we use for create the NFCS)

We use Yearn for:

🥑Liquidity that is not being used is deposited in yearn to earn extra yields.