Aspan

Borderless USD savings accounts tailored to emerging market retail savers

Project Description

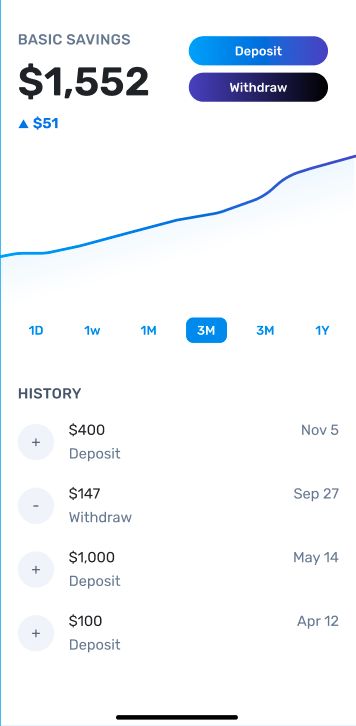

We are building borderless USD savings accounts on the blockchain. By reducing optionality and abstracting away technical concepts, we aim to bring web3 to retail savers globally, particularly in emerging markets. Deposits still earn interest from top DeFi platforms, but Aspan simplifies discovery, depositing, and withdrawing.

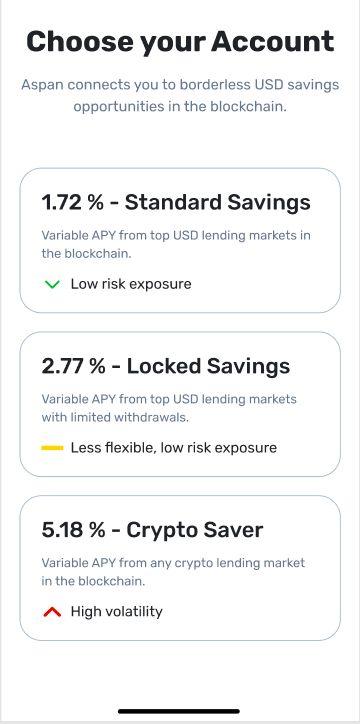

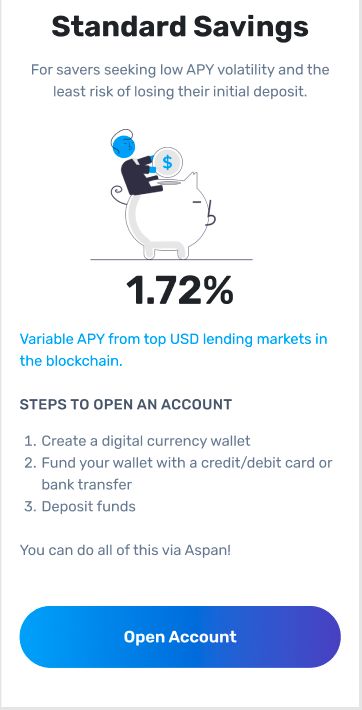

That all starts with a mobile-first application that revamps several common UX practices across DeFi. Today’s apps present users too much optionality, with each earnings opportunity defined by a plethora of token symbols, chains, and protocols. The few apps that offer a compelling mobile experience repeat these same mistakes as well as others, like having limited non-English content. Aspan was created to refocus DeFi’s value proposition. We will only offer a few savings accounts, with different earnings potentials and risks communicated in everyday financial terms. Explanatory content will be written with local audiences in mind, and user flows will be designed based on local fintech competitor approaches. Our central UX principle is to minimize cognitive load.

Admittedly, a creative design is not enough to overcome other complexities inherent to DeFi. These include creating an EOA wallet, storing private keys, deciding which blockchain tokens to own, and separating value from hype. Aspan’s technical design is crafted to handle these barriers.

Though our initial scope is savers in Central Asia, we consider this a lifting off point for a broader expansion that will encompass most emerging markets. Indeed, our approach is generalizable across many other DeFi services. Just like someone does not need to be a monetary policy wonk or FX pro to open a savings, checking, or investor account at a local bank, neither should an everyday DeFi user.

How it's Made

Web3 wallet creation and management, for example, will be as intuitive as creating an account on any web2 software. Aspan will integrate a third party, Magic Labs, that offers a widget to create an EOA with a simple email sign in. The EOA owner can also purchase crypto using a variety of emerging-market-compatible payment rails, export their private keys, and transact on gas-optimized chains like Polygon. We aim to offer Aspan users a security-minded yet flexible on-ramp to crypto ownership.

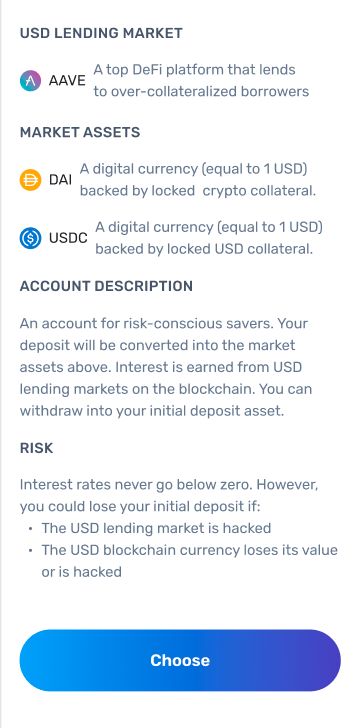

Aspan will also make depositing and withdrawing effortless. Users will deposit any flagship EVM-compatible asset and earn the highest interest rate across USD stablecoin supply markets. To do so, deposits are first sent to an Aspan smart contract which scans top DeFi lending platforms (i.e., Aave) for their top-performing USD stablecoin supply market. If a token swap is needed, the Aspan smart contract will leverage a DEX aggregator, 0x, to ensure the user’s deposit is swapped at the lowest rate. The deposit will then be routed to the corresponding Aave smart contract, the user’s deposit and swap details will be recorded, and the user will be issued an Aspan ER20 token that represents their ownership over their deposit. When it comes time to withdrawing, users simply connect their wallet, indicate how many Aspan tokens they want to redeem, and receive their original deposited asset. We want our users to focus on their savings potential, not the intermediary steps to navigate DEXs, L2s, gas fees, or Aave.

None of this is to say we are opting for simpler logistics to sidestep DeFi’s security concerns. As this is a savings product, we intend to connect users only to flagship DeFi lending protocols like Aave. Additionally, users will only be able to select a savings account in a highly capitalized and non-algorithmic USD stablecoin supply market. Cross-EVM compatibility is embedded to lessen gas fees, but only top networks like Polygon, Optimism, and Arbitrium are being considered. And every user will have ample risk warnings presented that ensure they comprehend the potential for underlying asset volatility and network exploits.