Arbitrage

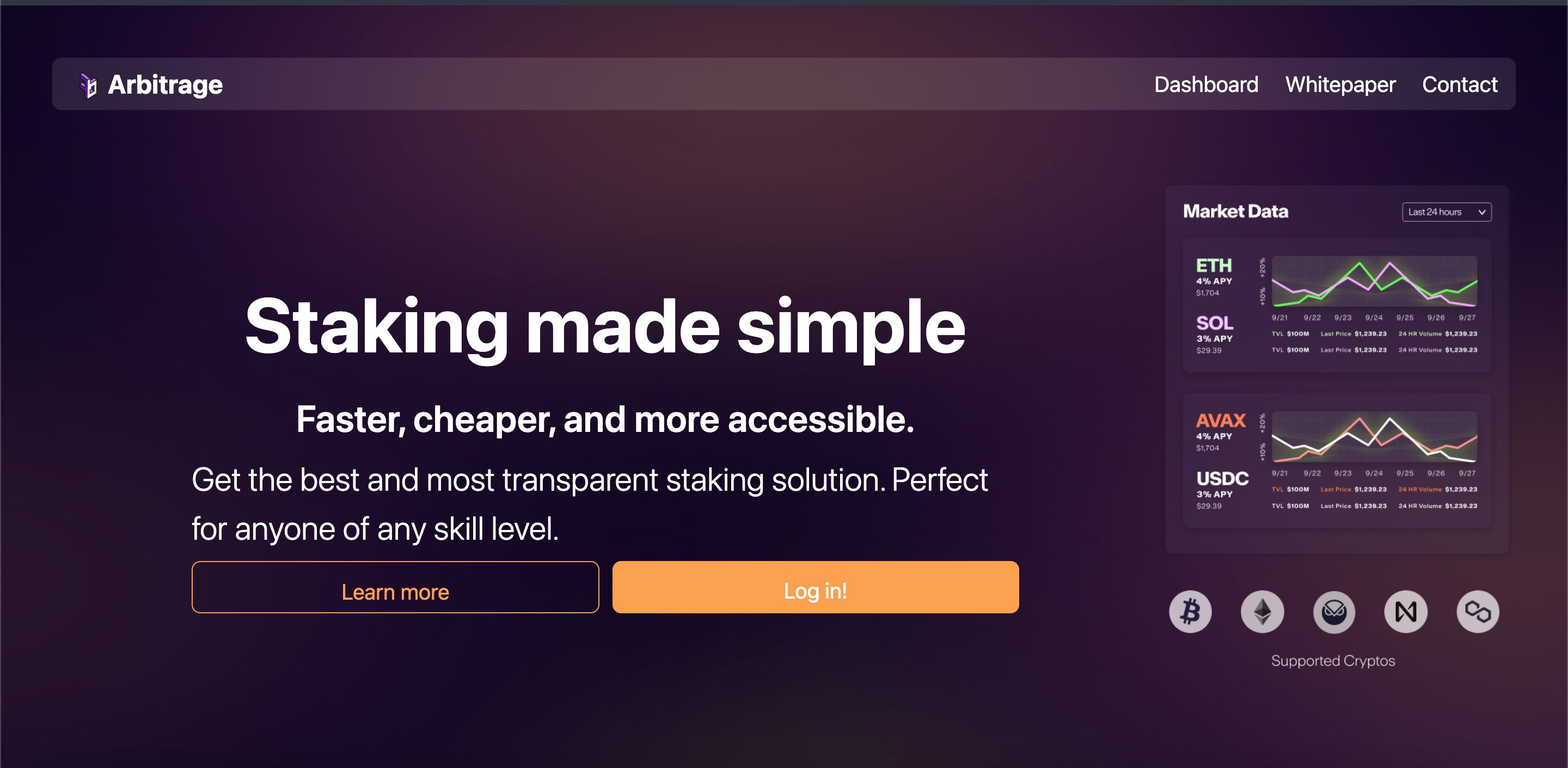

Arbitrage streamlines Web3 investing. Built with Rust for broader developer engagement, it provides clear visuals of your assets and the market. It's designed for easy navigation and comprehensive asset management in the Web3 space.

Project Description

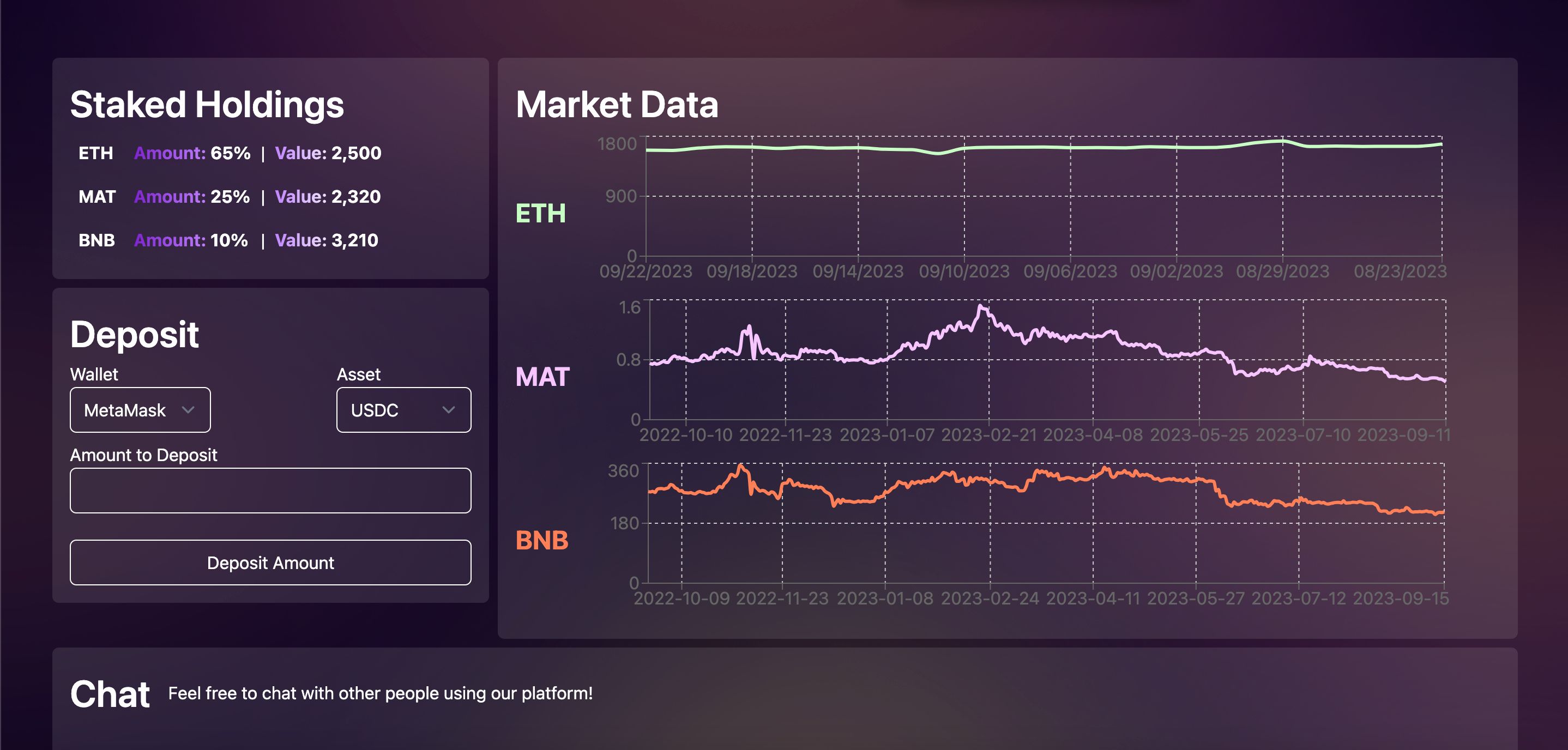

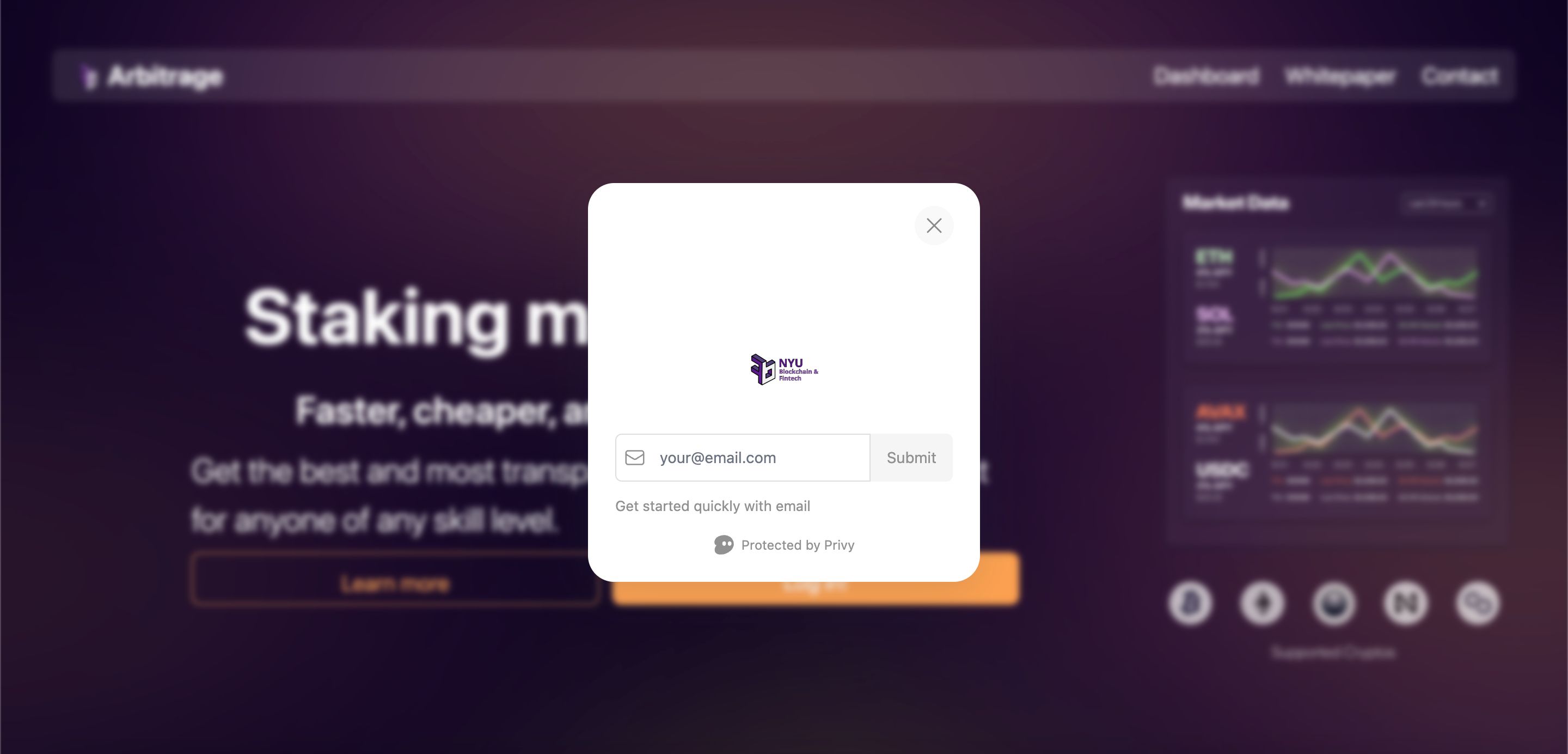

Our goal in this journey was to open Web3 investing to Web2 investors by solving common issues they face from entering the space. TerraUSD and Tornado Cash are just a few protocols which cast a dark shadow over the microeconomy, touted for its transparency, despite the fact that most protocols are collateralized! While roughly 20k developers know solidity, millions know Rust, and by simply changing our logic to Rust using the Arbitrum Stylus SDK, we’ve allowed millions of investors and traders to read and understand our bare-bones smart contracts. Even with understanding of smart contracts, many Web2 investors–and investors in general–run into another issue: lack of information. The solution to this lies in Vaults: a simple yet powerful idea. After pivoting from lending protocols and their distribution, we found that while vaults have so much potential, they are lacking in current traction. We first attempted to transpile the Beefy Crypto vault, but ultimately created our own mutual fund weight on risk-adjusted and volatility-adjusted returns using our financial proficiency. We introduced Web3 to a familiar Web2 experience–the Bloomberg terminal experience–which any trader (and our colleagues at NYU Stern) know inside and out. In our one-stop shop dApp, users can easily stake their money into their vaults, watch the distribution and see the live progress of the exchanges their funds get exposed to. Furthermore, we tooled XMTP's P2P interaction into a global community group chat to talk about markets live. For easy integration into crypto wallets, we used Privy and some fantastic APIs to attract more Web2 investors. Layered with account abstraction, we used Biconomy for an ease of use. Oh, and we forgot to mention: by building on Rust an the Arbitrum One chain (notably, an optimistic rollup), we save traders their incredibly valuable time and money via more efficient transactions. While we did not achieve our intended theoretical goal, we found it better to pursue the best solution in practice given our path. We proved not only to ourselves, but to the world, that transparency is king: having truly transparent smart contracts, highly informed investors, and accessible investing is no longer a myth, but instead can be a reality.

How it's Made

At a high level, this project is a CRUD dApp with Web3 access. The centerpiece of this dApp lies in the Rust smart contract, and compiling it onto the EVM via Arbitrum’s Stylus SDK. From the ground up: we used Privy’s quickstart materials to craftily build an effective and aesthetically pleasing login, while adding utility and support for embedded wallets by using React Hooks. We quickly and efficientnly introduced Biconomy's account abstraction above the wallets. Right after the user logs in with Privy, they’re sent to the main UI, where they can do a number of thing: they can interact with the smart contract on the goerli chain by transferring money in, or they can watch the current market rates by using the 1inch network (NOTE: the 1inch network’s API did crash the morning of, so for showcasing purposes we used dummy data but the backend is all fully visible). We innovatively used the XMTP SDK to create a “global” group chat across any and all members of the dApp by abstracting the routing, and utilizing Privy’s user REST APIs. When one person sends a message, each person online receives the message individually, not in one combined group chat setting. Overall, we efficiently used multiple technologies to build our dApp, creatively understanding and bringing out the best in each product.