0xY

Borrowing protocol offering put-protected term loans that protect against price liquidation and offer coupon payments to lenders

Project Description

0xY is an application that offers Put-Protected Term Loans. It solves two key problems with existing borrowing lending protocols:

-

Liquidation. Existing protocols liquidate borrowers whenever their collateral depreciates. While this may work for a DeFi native user who is familiar with actively managing their position, this is not a good fit for a long-term HODLer who wants to minimize the amount of effort required to manage their position. 0xY addresses this by offering borrowers the ability to purchase insurance in the form of put-options that compensate for collateral depreciation.

-

Repayment Ambiguity. Existing protocols offer borrower loans without a fixed maturity or repayment conditions. This has the effect of increasing risk over time for lenders. 0xY instead offers borrowers the option to pay coupons in exchange for a lower interest rate. This has the effect of decreasing the risk over the term of the loan. Furthermore, it creates cash-flow thru the lending pools which can be borrowed by other borrowers.

How it's Made

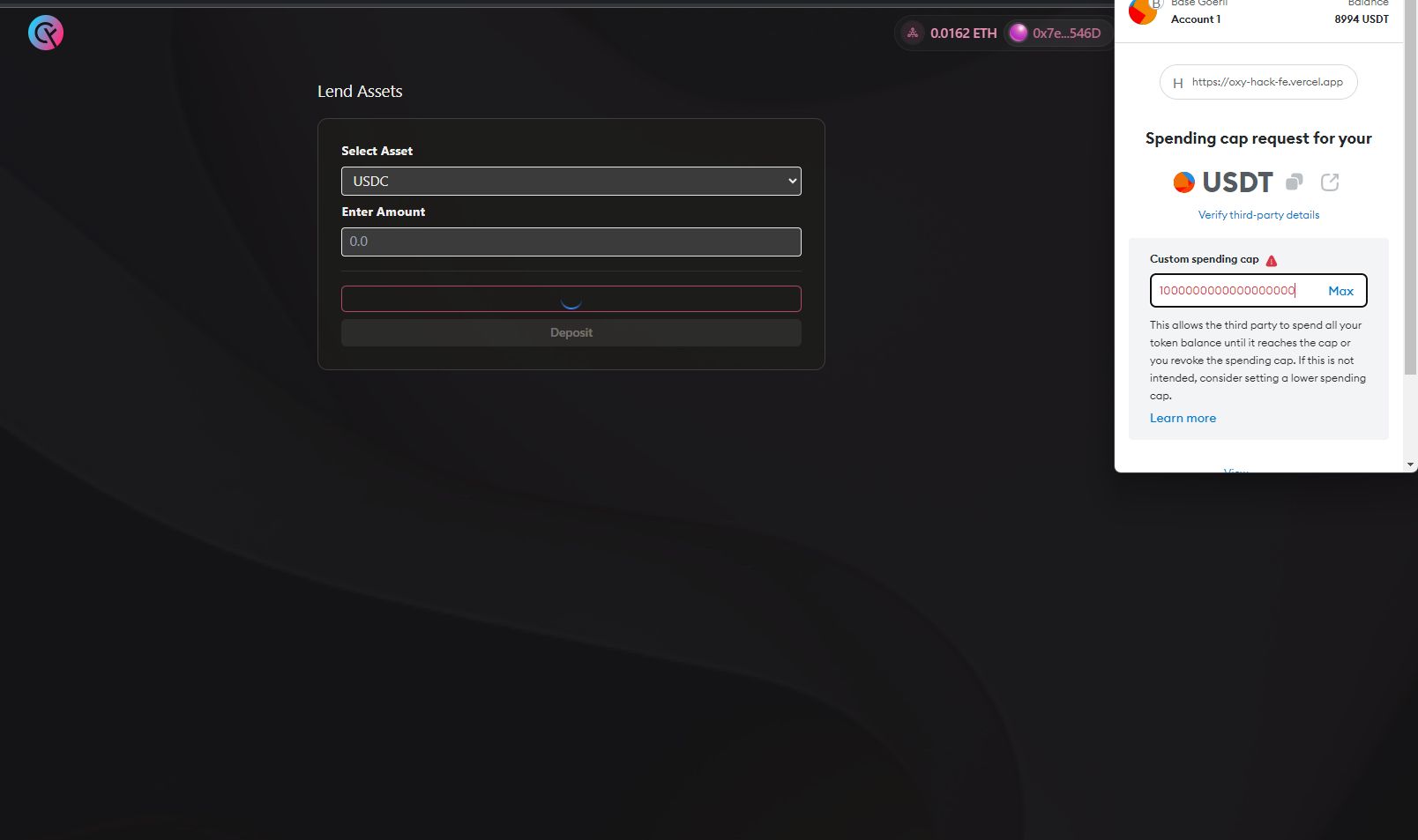

For the smart contracts, they were built and tested using the Foundry framework. We tested using forge, anvil, and cast. We made use of the ButtonToken contracts, as well as Chainlink price-feed oracles in order to keep track of dollar value of collateral. We also implemented Open-Zeppelin templates for standard tokens such as ERC20 and ERC1155. Finally, we used Uniswap V4 hook templates for building a custom liquidity pool.

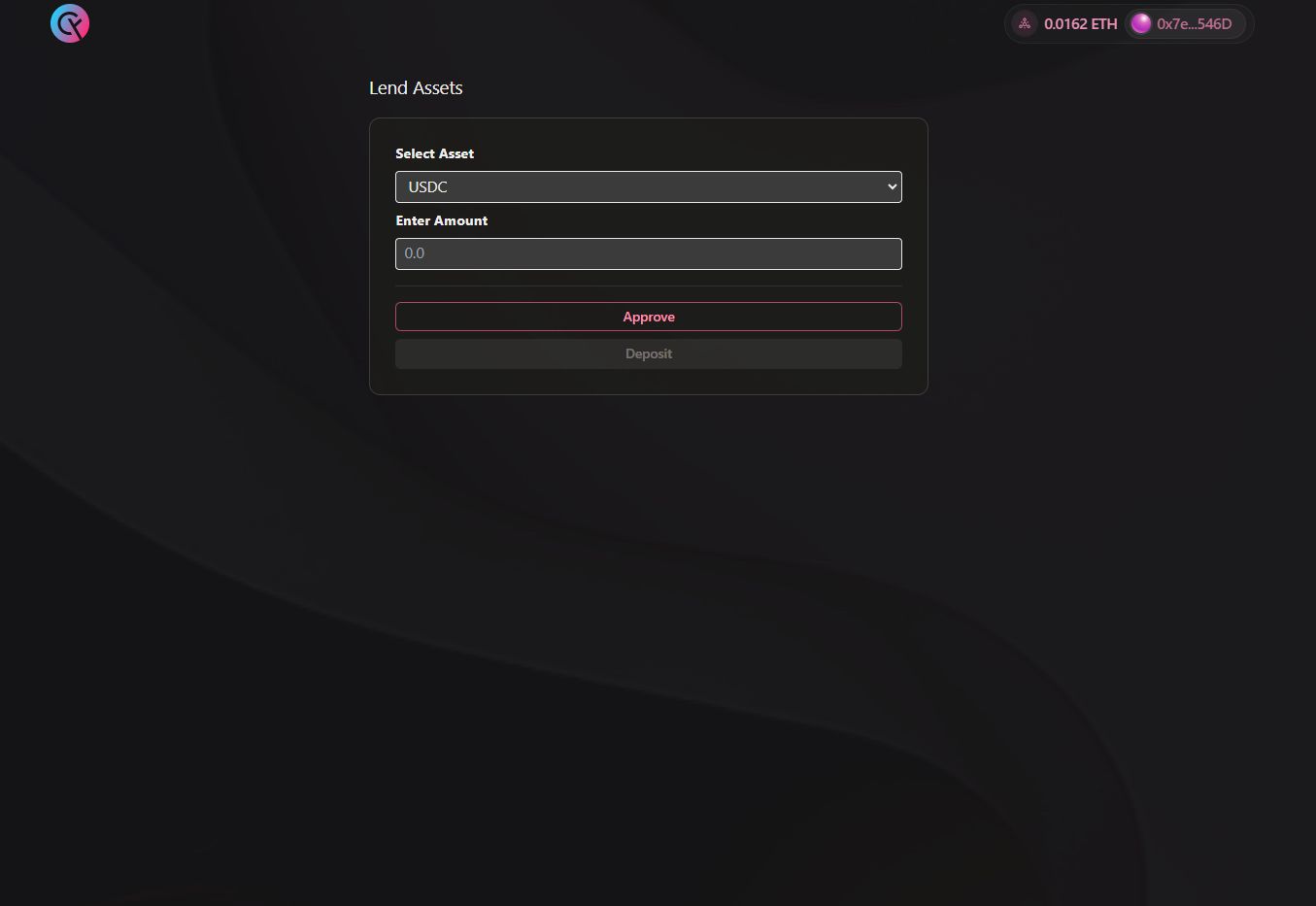

The front end is built using nextjs, wagmi for the interfacing with the smart contracts. We used WalletConnect to allow users to use a variety of wallets as well as accessing user's wallet addresses and displaying balances. For styling we used tailwind and Radix UI for some good primitives.